Richard Beddard: this FTSE 100 stock goes straight into my top 10

9th December 2022 11:00

by Richard Beddard from interactive investor

It’s the first time he’s looked at this £5 billion company, but Richard is so impressed – and a bit alarmed – that he’s almost given it a perfect score.

Here is something you might not appreciate if you do not buy used cars. Auto Trader Group (LSE:AUTO) a car marketplace, is where most of us in the UK go to find them online.

Here is another thing. The company is selling a lot more than advertising.

Auto Trader measures its dominance by comparing the time we spend on its properties compared to a list of competitors that includes Gumtree Motors, Pistonheads, Motors.co.uk, eBay Motors and CarGurus.

- Find out about: Transferring a Stocks & Shares ISA | Share prices today | Top UK shares

About 75% of all the minutes spent on classified sites are spent on Auto Trader properties. Other destinations, like retailer and manufacturer websites, barely get a look-in compared to the advertisers.

Network effect

Auto Trader is loved too. There are detractors in the reviews on app stores, but for many people who like motors, the app’s appeal goes way beyond finding a car to buy.

This review is from Google Play: I love this app. Probably too much. I search for cars I have no hope of owning, just because... The search perimeter options, technical data, insurance info, buyers guides etc. are far better than its competitors and that app itself [is] more responsive, and forgiving than others I've tried. A trusted name, and utterly indispensable if you're buying a new car, I'd imagine!

The company need not have been this successful.

Auto Trader started life in the 1970s as a classified advertisement magazine published in regional editions throughout the UK. It migrated online 15 or so years ago and in its most recent financial year the company earned £433 million in revenue.

By contrast, a Google Search for the even more venerable Exchange & Mart, returns the site first, and then the question, presumably frequently searched, “Does Exchange & Mart still exist?”

Auto Trader’s customers are not car buyers, they are sellers, mostly second-hand car dealers, although new car dealerships, individuals and manufacturers list on the site too.

- 10 great shares with profit margins to survive recession

- 10 FTSE 100 shares with the strongest momentum

It has grown by focusing on the needs of retailers, first by cultivating an audience of car buyers and potential car buyers.

The more buyers that visit the website, the more valuable the site is to sellers and the more cars are listed, which in turn increases the appeal to buyers, a network effect.

Auto Trader makes money from this activity by charging retailers a subscription to advertise and, increasingly, by developing and acquiring products and services that make it easier for retailers to sell cars.

For example, retailers can use its logistics marketplace to sort out delivery.

The jewel in its crown, though, is data. Auto Trader has such an omnipotent view of the UK second-hand market that the Office for National Statistics (ONS) uses its data to calculate the Consumer Price Index (CPI).

Of more significant commercial benefit perhaps, advertisers subscribe to data packages so they can price their vehicles more effectively and automate the listing process by populating advertisements swiftly with vehicle specifications.

Near-perfect numbers

Auto Trader’s last full-year of results were for the year ending in March 2022, when it experienced a strong rebound after the pandemic disrupted motor retailing.

That year, the year to March 2021, Auto Trader helped its customers stay in business by extending credit terms and giving them free advertising while their showrooms were closed.

Even so, it remained highly profitable and cash generative.

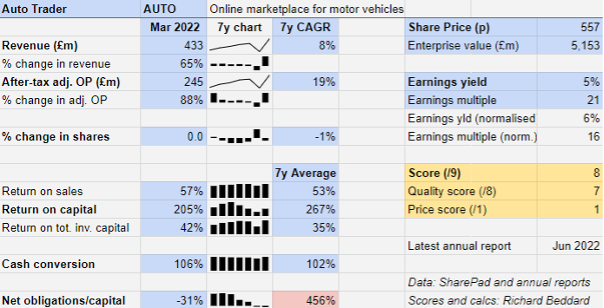

Average returns on capital are prodigious, and most years Auto Trader earns even more in cash terms than it does in profit. Revenue has grown at a compound annual growth rate (CAGR) of 8% since the company floated in 2015, and profit has grown twice as fast.

It finished the year with net cash, but that changed in June when Auto Trader acquired vehicle leasing marketplace Autorama.

At the end of the first half of the current financial year in September 2022, Auto Trader reported £57 million of net debt.

This is not alarming. The company’s intention is to return to a net cash position, which it should be able to do easily. In five of the last six years, it has earned over £200 million in free cash. Even during 2021 it earned £150 million.

Despite the cost-of-living crisis and new car sales at an historic low due to a shortage of supply, Auto Trader is trading well.

Revenue increased 11% in the half-year to September, compared to the same period in 2021, and operating profit increased by the same amount (excluding loss-making Autorama from both calculations).

Like most businesses, Auto Trader has three profit levers it can pull on: volume, price, and product.

While the volume of listings is flat and likely to remain so due to the short supply of new cars and the uncertain economic times, Auto Trader is confident it can continue to keep prices rising in line with costs, while it is busy adding new products to sell.

Recession proof?

It is difficult to get a feel for how Auto Trader would trade through a bad recession because during the last major downturn, the 2007 crisis, it was a different business.

We probably do not have to be as concerned as we would be, though, were we to invest in its customers, car dealers.

Unlike dealers, Auto Trader does not stock cars. If demand is low, cars sit on forecourts for longer. They depreciate more, which reduces their selling prices, and cuts into dealers’ profits.

- Share Sleuth: why this share keeps its place in the portfolio

- Is this the top investment idea for 2023?

Auto Trader mostly lists used cars, which may also dampen the impact of recession on the company’s profitability because cars are a necessity for many of us. Although we may buy cheaper and older cars when money is tight, we still buy them, which is why the data shows that used car sales are less volatile than new car registrations.

One more reason to be cheerful: Auto Trader earns most of its money from monthly subscriptions. Customers not only subscribe to advertising packages, they subscribe to participate in the logistics platform, and they subscribe to data packages, for example.

Subscriptions may also dampen the impact of recession on profitability, although the pandemic showed how Auto Trader can be compelled to reduce prices, or even waive them, in extreme situations.

Disruption in the market

A more distant threat, perhaps, is disruption to the marketplace as Electric Vehicles (EVs) become more popular. This is likely to have two big impacts.

The first is a shift from car ownership to “usership” because of the high purchase cost of EVs.

We are more likely to lease cars in future, which partly explains Auto Trader’s interest in Autorama (it is also interested because it is growing the new car side of its business).

Autorama, which trades as Vanorama and mostly aggregates van lease deals, is a bit of a millstone. It is not expected to break-even until at least 2025, partly because new car and commercial vehicle sales are at a historic low.

Leasing is only one form of usership, and Auto Trader may have to contend with others, like ride sharing, should they take off.

The second impact of EVs is, potentially, a diminished role for car dealers, Auto Trader’s best customers.

Insurgent EV brands like Tesla, Polestar and VW ID sell directly to the consumer online and, sometimes, through their own showrooms.

Some of them also sell through dealers as agents, which means the dealer takes a commission, but the car is supplied by the manufacturer.

This is an opportunity for manufacturers to enjoy a closer relationship with the end-customer, and perhaps earn a higher profit margin by cutting out the middleman.

That said, if manufacturers take more of an interest in selling direct, perhaps Auto Trader can become a more important sales channel for them.

Pulling the product lever

Auto Trader’s strategy is to keep pulling the product lever until it can offer retailers and car buyers everything they need to sell or buy a car online.

This strategy comes in two new initiatives, at various stages of being rolled out.

The first, Auto Trader Connect, integrates Auto Trader’s data with dealers’ stockholding systems so they can price and update the specifications of their stock once, and advertise it through all their sales channels including Auto Trader.

The valuation module tells dealers how much cars they are sourcing are worth too, a product finance and insurance companies are also buying to help them forecast future vehicle values and price insurance.

The second initiative, currently in trials, makes it easier for us to buy cars on the platform by providing a guaranteed part-exchange price, allowing us to reserve a vehicle, and finance the purchase.

It may be, though, that this “Deal Builder” journey exposes a conflict of interest between Auto Trader’s audience, car buyers, and its customers, dealers, who might normally offer part-exchange and finance.

For example, the car buyer is initially offered the dealer’s first choice of lender, and only if the buyer is ineligible for a loan will they be presented with another choice through a broker.

Allowing the dealer to choose the first choice lender increases the complexity of the product and might not provide the best deal for the buyer, but it seems to be a compromise Auto Trader will make to get dealers to adopt it.

Scoring Auto Trader

I like AutoTrader. It is a dominant business but still inventive.

Although it has made a few tiny acquisitions and a somewhat more substantial one in Autorama, its growth has almost entirely been self-generated.

It routinely polls employees, a high proportion of which say they are proud to work there, and the reviews on recruitment sites tend to support the verdict of internal surveys.

Its reports and presentations are very informative not just about the company, but as you might expect, motor retailing in general.

Does the business make good money? [2]

+ High returns on capital

+ High profit margin

+ Excellent cash conversion

What could stop it growing profitably? [2]

+ Recession resistant

+ Highly competitive

? Disruption in the marketplace

How does its strategy address the risks? [1]

+ Adding products for dealers

? Adding products for consumers

? Acquisition of Autorama

Will we all benefit? [2]

+ Good place to work

+ Communicates well

? Executive remuneration

Is the share price low relative to profit? [1]

+ Yes. A share price of 557p values the enterprise at just over £5 billion, about 16 times normalised profit.

A score of 8 out of 9 indicates Auto Trader is a good long-term investment.

It is ranked 8 out of 40 stocks in my Decision Engine.

Frankly, I am a bit alarmed that it has gone straight in at number eight. This is the first time I have scored AutoTrader, my enthusiasm may have been aroused by the novelty of the opportunity as well as its apparent quality.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.