Richard Beddard: a friendly company in better health than ever

23rd June 2023 14:31

by Richard Beddard from interactive investor

Financial strength means this business does very well during recessions, relatively speaking; one reason it’s a good long-term investment, says our columnist.

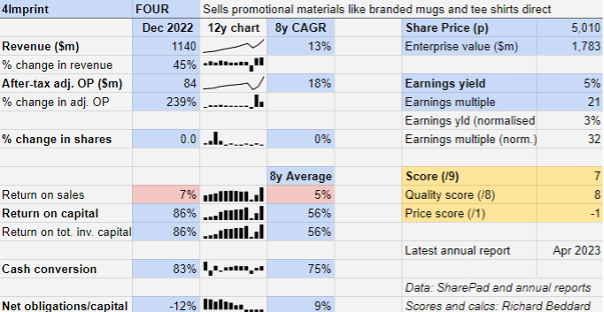

If you want a good example of a high-quality business you could have picked up cheaply in the pandemic, you need to look no further than 4imprint Group (LSE:FOUR). The question is, now the business is more profitable than it was before the pandemic, is it still good value?

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Money from freebies

4imprint sells promotional goods directly to businesses and organisations. These are branded freebies handed out at workplaces, training events, fundraisers and trade shows. Workplaces and events spent much of the pandemic in lockdown, hence the promotional goods industry struggled, but it is business as usual again now.

4imprint sources the goods from customisers, businesses that import blank clothing, stationery, bags, coffee cups and usb drives and print, embroider and emboss, logos and messages on them.

4imprint is a marketing and order processing machine that uses what it describes as mature and scalable IT to take and process orders for goods that are usually shipped directly from customiser to customer.

- Richard Beddard: my savage derating of this popular FTSE 100 share

- Stockwatch: kicking the tyres of a classic value investment

It earns 2% of revenue in the UK and Ireland, and 98% from the home of promotional goods, the US (and Canada).

More than a recovery

Commendably, 4imprint did not lay anybody off during the pandemic, enabling it to stage a partial recovery as demand began to return in 2021. In the year to December 2022 revenue blew past its pre-pandemic high of $861 million and also the $1 billion mark.

This year, 4imprint reported a step change in marketing productivity due to TV advertising. The company generated $8.86 for every $1 spent on marketing compared to $6.17 in 2021, the previous best.

Since marketing is 4imprint’s single biggest cost category, this drove profit margins up to an unprecedented 7%, and return on capital up to a record 86% despite cost increases in other categories.

So far in 2023 things are going well. 4imprint reported “substantial further progress” at the AGM earlier this month. Orders were up 22% over the first four months of the year, but the impact of the pandemic was still abating in the comparative period in 2022. 4imprint traded much more strongly for the rest of the year, so beating last year will become more difficult as the year progresses.

The performance of the US economy will have a say in the results for 2023, as it always does, but shortages and cost inflation are moderating and the business appears to be in better health than ever.

Scaling up

Traditionally, distributors of promotional goods relied on field salespeople, but 4imprint was an early adopter of direct marketing. Starting in 1987, it sent customers a catalogue from which they would order over a toll-free telephone number.

In 2004, the mailings developed into “Blue Boxes”, which include catalogues and samples, and the company was early to embrace the Internet too.

Today, the famous Blue Boxes (you can find “unboxings” on YouTube) are yielding to advertising, a trend accelerated by the pandemic, when the cost of TV adverts fell.

This latest evolution in the business model is not just a response to low advertising rates. Now 4imprint is a $1 billion turnover business, its scale gives it opportunities to invest in things it previously may not have been able to afford.

Advertising campaigns are expensive, but unlike smaller rivals 4imprint can spread the cost over large volumes of sales.

The shift in emphasis towards advertising was behind the high profit margin in 2022, and a third promotional channel gives 4imprint the ability to adjust its marketing spend between direct marketing, TV advertising and Google search, depending on which is most cost effective.

As a relatively big business, it can also invest in its own brands. The promise here is higher margins because 4imprint says its own brands do not cost much more than blanks to source but only sell for a bit less than famous brands such as Nike and Cahart, which 4imprint also supplies.

- Should you bookmark this small-cap with record growth?

- Stockwatch: the very real threat of a ‘balance sheet recession’

Own brands may also dovetail with another marketing trend; higher quality, sustainably sourced, less throwaway freebies.

Sales of promotional goods depend on the marketing budgets of customers, which in turn fluctuate with the economy. We cannot expect unremitting growth, but relatively speaking 4imprint does very well during recessions.

This is probably because of its financial strength, which is in turn a result of its profitability. Falling demand and rising costs hurt 4imprint, but it has more fat to burn, and in lean times it gambols ahead of competitors.

Recessions can be uncomfortable, but they are less uncomfortable than for financially constrained rivals, who emerge from them more slowly because they are drained of resources.

During the pandemic though, 4imprint kept all of its staff on and switched its marketing budget to TV advertising when there was no one in the offices to receive Blue Boxes.

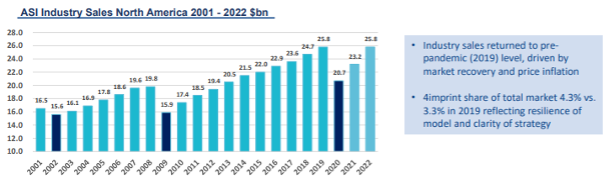

This chart from 4imprint’s annual report shows that the industry has recovered to pre-pandemic levels of sales:

Source: 4imprint/ASI. In 2021, 4imprint was the third largest distributor of promotional goods in North America and the largest direct marketer.

Revenue at 4imprint is 32% higher than it was in 2019, though, and it says it has increased market share from 3.3% to 4.4%.

4imprint’s double-digit revenue and profit growth over the last eight years has come entirely from its own endeavour. Acquisitions are low down the company’s list of strategic priorities, but in 2022 it broke the mould by taking over Fox Graphics, a nearby screen printer.

4imprint wanted to bring the capability to print on clothing, its biggest category, in-house, although it will have to invest to scale Fox Graphics up. Fox is tiny, it cost just $1.7 million, but the company says it is a seed from which it can develop.

The strategic rationale is vertical integration, having built up an in-house capability in embroidery that has underpinned the sales of embroidered apparel.

The small size of Fox and the fact that 4imprint has decided to return money it could use for bigger acquisitions to shareholders through a special dividend paid earlier this month, suggests that, for now, 4imprint expects to continue growing market share by being the biggest most efficient supplier of promotional goods.

The friendliness advantage

I like 4imprint. It has a fairly straightforward job and it does not overcomplicate it. The company’s golden rule is to treat others as you would wish to be treated yourself.

It is headquartered in Oshkosh on the shore of Lake Winnebago, the ninth largest city in Wisconsin. One of the attractions of Oshkosh to a sales organisation, I have been told by the company, is the friendliness of the people, and 4imprint plasters its marketing materials with their smiling faces.

2022 was a bonanza year and 4imprint rewarded employees well. On top of an average pay rise of over 7%, the company paid out regular quarterly bonuses and a special one-off bonus.

- Insider: big bets placed on FTSE 100 stock and a £1bn AIM firm

- Have the big super-trends for the next decade changed since Covid?

4imprint says staff turnover is low, without putting a number on it. Sadly, it does not report the results of employee engagement surveys, but I imagine it scores highly.

It treats customers well too, offering so many guarantees on price, delivery, satisfaction, and answering calls within 60 seconds, the business must run like clockwork, or it would be processing almost as many refunds as orders.

One potential wrinkle though is 4imprint’s great strength, its Americanness. Its Manchester operation is completely dwarfed by Oshkosh, and in 2022 chief executive Kevin Lyons-Tarr did not attend the London AGM in person.

It would be logical to list where the headquarters is, and companies are relisting on US markets in pursuit of more shareholders and bigger valuations anyway, so it would not be a surprise if 4imprint were to follow the trend.

These days, though, investing in US listed businesses is a relatively minor hassle for most private investors.

Scoring 4imprint

I like 4imprint, it exists to supply customers as cheaply and efficiently as possible and the results bear out the story. It does this by being friendly!

It also does it by being responsible. The company is carbon neutral in terms of scope 1 & 2 and parts of scope 3 (transportation from immediate suppliers). It also helps customers find sustainable products by designating them “Better Choices” and transitioning its own brands to recycled and sustainably sourced materials.

Does the business make good money? [2]

+ High average return on capital

+ Good cash conversion

? Modest profit margins

What could stop it growing profitably? [2]

+ Very strong finances

+ Market leader

? Work from home

How does its strategy address the risks? [2]

+ Investment in people

+ Shift to brand marketing

? Acquisitions are a “strategic option”

Will we all benefit? [2]

+ Experienced CEO

+ Employees treated well

? Commitment to private investors/UK listing?

Is the share price low relative to profit? [-1]

− No. A share price of £50.10 values the enterprise at about $1.8 billion, about 32 times normalised profit.

A score of 7 out of 9 indicates 4imprint is a good long-term investment.

It is ranked 24 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in 4imprint

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.