Richard Beddard: friend of Musk and Bezos is third in my share list

21st April 2023 15:05

by Richard Beddard from interactive investor

This small company is working with powerful billionaires and ranks highly in our columnist’s list of 40 stocks. Here’s why he gives it an impressive 8 out of 9.

The space programmes of SpaceX and Blue Origin may seem like high-risk investments for billionaires such as Elon Musk and Jeff Bezos, but listed filter manufacturer Porvair (LSE:PRV) is a much lower-risk bet on the future.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

It has been working with the two rivals on “unusual engineering challenges” and sees space rocketry as one of its markets for the future.

What it does

The beauty of Porvair’s strategy is it is focused on consumables, filters, that protect equipment and the environment from contaminants in liquids and gases, reducing downtime, maintenance costs and pollution, and improving the strength of metals.

The filters are usually bespoke, so they are not easily substituted for rival products, and they need replacing each time they are used or according to maintenance schedules. This provides Porvair with a regular stream of income.

Filters are important, but relatively inexpensive components, so customers stick with reliable suppliers and pay up for quality.

The company’s Laboratory division principally supplies water testing equipment and filters. It makes automated water analysers, robotic sample handlers, and consumables used in sample preparation like microplates.

Filters from Porvair’s Aerospace and Industrial division are specified on most commercial aircraft and in many harsh industrial environments such as nuclear reactors.

- Insider: big spending on company in ‘foothills of growth journey’

- 10 shares for investors wanting defensive options

More than 90 billion cans were made from aluminium filtered by Porvair in 2022. The Metal Melt Quality division, the company says, is the world leader in aluminium filtration. It also supplies filters for iron foundries that make engine blocks and gearboxes, and superalloy turbine blades.

Return to form

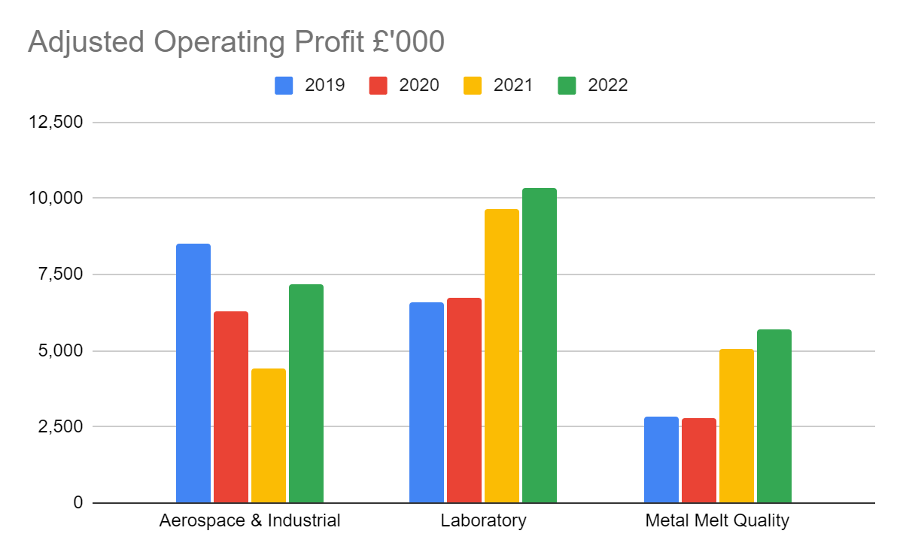

During 2020 and 2021, planes were grounded and factories closed, which reduced Porvair’s return on capital only modestly, but returns from its Aerospace and Industrial division more significantly.

The company’s other divisions prospered during the pandemic and that prosperity has continued, while Aerospace and Industrial has recovered somewhat:

Source: Porvair annual report 2022. Operating profit excludes central costs of £2.7 million.

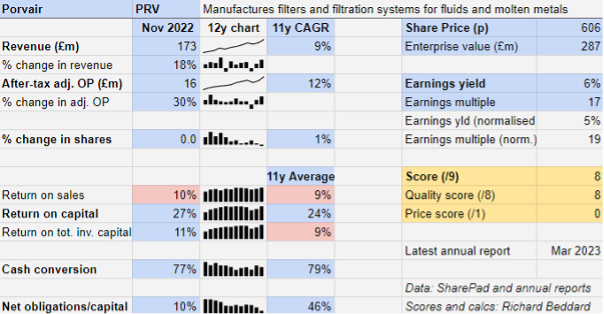

Return on capital in the year to 2022 was back up at 27%, indicating the business is operating as efficiently as ever. Porvair’s alternative performance measures, excluding the impact of an acquisition early in 2021 and favourable movements in exchange rates, show double-digit revenue growth across the board.

Although the company experienced shortages, now diminished, and inflation, which is shifting from materials to wages, it coped well.

It seems the 10% compound annual growth rates (CAGR) Porvair achieved before the pandemic are still achievable.

Challenges ahead

Historically, Metal Melt Quality has been a cyclical and relatively low margin business in comparison to the others, but currently it is running hot. Demand for aluminium filters is high due to post-pandemic restocking, which means Selee, Porvair’s US factory, is operating efficiently.

Although the cycle will cool, Porvair says its performance has also improved due to factors likely to endure. It has introduced new patented filters that it sells at higher margins, and aluminium is increasingly in demand for electric vehicles, because it is lighter than steel, as well as beverage cans, which are more easily recycled than plastic bottles.

Long term, some of Porvair’s filtration markets will diminish though as power generation, transport and industry decarbonise.

The company says growth in air travel will probably slow, there will be fewer internal combustion engines, fewer petrochemical processes and a reduction in the production of some oil-based polymers, all of which use Porvair filters.

During the transition to greener energy sources and materials, the company expects to profit from Sustainable Aviation Fuel (SAF) made from biomass, the increased use of lightweight aluminium components and ultimately the production and storage of hydrogen.

I would not put much store in this, because the future is uncertain and the data might not be comprehensive, but we can tot up the contribution of the parts of Porvair’s business that are likely to come under pressure because the company lists them in its ESG report.

- Richard Beddard: these shares are good value after triple hit to results

- 10 cheap FTSE 350 shares with momentum

Aviation, internal combustion engine components, and plastics and chemicals account for about 25% of Porvair’s revenue, although not all of this business will disappear.

On the other hand, Porvair says 50% of the current business should benefit directly from the changes it sees coming, due to tightening industrial emission regulations and water quality standards, and increasing aluminium production.

Porvair will adapt by continuing the classic buy and build strategy it has pursued for the past 18 years, tilting investment and acquisitions towards demand.

In November, Porvair refined its priorities to focus on investment in Laboratory filtration, consumables, instruments and robotics, and filters for microchip manufacture, nuclear power generation and waste, space rocketry, and turbine blades.

Even though acquisitions have not come particularly cheaply, Return on Total Invested Capital is a relatively modest 11%, Porvair has achieved very decent growth without diluting shareholders or borrowing large amounts of money.

Scoring Porvair

The filtration business is no doubt complicated, but Porvair explains it well in the annual report and, dare I say, makes profiting from it look almost routine.

Credit goes to chief executive of 25 years, Ben Stocks, who is about 60 years old. I once asked him whether he would countenance larger acquisitions, the kind that would require the company to take a bigger financial risk.

There are a handful of rivals he would find it very hard to resist, so we have to be prepared for the eventuality, but I would almost certainly trust his judgement.

Under Mr Stocks, the company has prospered, and it seems likely that staff prosper too.

Last year, Porvair promised it would report employee turnover in 2022, and this year it told us the voluntary quit rate for the group was 12.2%. The median plant had a quit rate of 7.1%. These metrics should prove a useful benchmark to judge the company’s efforts to improve, now that it has incorporated them into the calculation of senior managers’ bonuses.

Happy staff, of course, mean happy customers.

Does the business make good money? [2]

+ High return on capital

? Reasonable profit margin

+ Good cash conversion

What could stop it growing profitably? [2]

+ Resilient businesses due to diverse markets

? Decarbonisation of industry

+ Judicious acquisitions

How does its strategy address the risks? [2]

+ Focus on consumables

+ Managing decline, focusing on green economy

+ Acquisitions funded from cash flow

Will we all benefit? [2]

+ Very experienced chief executive

+ Employee focus

+ Helps businesses be more efficient, less polluting

Is the share price low relative to profit? [0]

+ It is fair. A share price of 606p values the enterprise at about £287 million, 19 times normalised profit.

A score of 8 out of 9 indicates Porvair is a good long-term investment.

It is ranked 3 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Porvair

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.