Richard Beddard: first time scoring this hugely predictable FTSE 100 stock

PPE sales mean the distributor has had a great 2020, but what about the future?

11th December 2020 15:04

by Richard Beddard from interactive investor

PPE sales mean the distributor has had a great 2020, but is it a good long-term investment?

I score companies once a year and generally my confidence grows the more times I do it. This is the first time I have scored distributor Bunzl (LSE:BNZL) though, yet still it inspires confidence.

Maybe I am missing something, but the allure of Bunzl is that it is a pretty straightforward operation.

The company distributes everyday items consumed by organisations. It supplies the toilet paper supermarkets use, not the toilet paper they sell. It sells cleaning products, safety equipment, packaging and medical items in huge quantities across North America, Europe and other places to shops, factories, and hospitals.

Bunzl is experiencing demand for PPE and safety equipment during the pandemic, but it sells all sorts of everyday consumables. Source: Bunzl

Big, and getting bigger

The company has been following the same strategy since 2004, when it sold off its manufacturing arm to focus on distribution. Since 2004 it has acquired more than 160 of them, although it started acquiring distributors much earlier.

The reason for this relentless gobbling of distributors is threefold. On their own, smaller distributors tend to be less efficient, and by plugging them into its systems Bunzl can make them better.

The attraction of Bunzl to large customers is it can supply them with almost all of their regular needs nearly anywhere. It buys more distributors to increase the product range and its geographical reach.

In distribution, scale is important. Having a few large suppliers is more cost effective for customers because it means less administration. They may also pay less for the products because Bunzl can source them cheaply in high volumes.

- ii view: boring Bunzl hits new high

- ii view: Bunzl shares surge amid demand for Covid products

- Richard Beddard: this AIM share appears to be unstoppable

Bunzl has scale. In the year to December 2019 it earned £5.5 billion in North America, £1.8 billion in continental Europe and £1.2 billion in the UK and Ireland. It earned £2.7 billion from catering supplies, £2.4 billion from supermarket supplies, like bags and bakery boxes, and £1.2 billion from safety products.

There are many other industries where scale is a virtue but perhaps few where it is so easily achieved. Acquisitions go wrong when complex businesses are integrated.

Distribution is a relatively simple activity though. The products Bunzl distributes are uncomplicated, and when Bunzl takes over, the managers tend to stay, so they have signed up to do things the Bunzl way.

Frank van Zanten, Bunzl’s chief executive, is one of those managers. He joined in 1994 when Bunzl acquired his family’s Dutch distribution business.

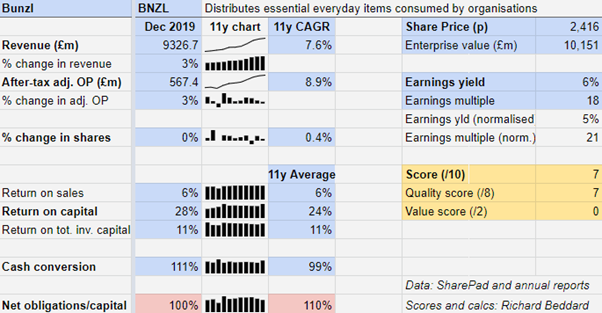

The remarkable thing about Bunzl’s stats is their monotonous regularity: Constant growth and constant returns. The most unsettling thing is the constant debt, which combined with modest profit margins can mean trouble for businesses when revenue falls.

But Bunzl can probably afford to carry debt. A company so consistent has not, and ought not to, have any difficulty paying the interest.

2020 and beyond

We have every reason to expect more of the same from Bunzl when it reports its results for the year to December in February 2021.

The company has reported strong growth in the nine months to September 2020 as demand for safety, health, and cleaning products jumped during the pandemic, more than compensating for slackened demand in other parts of the business.

The company was a major supplier of personal protective equipment (PPE) to hospitals, governments, food processors and grocery stores.

With the year nearly over, Bunzl is anticipating a good result, which it will report in February, but it is more circumspect about 2021. Large orders for protection equipment are diminishing and ongoing pandemic restrictions are limiting the recovery.

Meanwhile, the acquisitions have continued almost unabated.

- Richard Beddard: how to score this rapidly evolving AIM firm?

- Find out more about interactive investor SIPP and pensions here

Bunzl hit the pause button in the first lockdown, but so far this year it has acquired seven distributors costing a total of £400 million. Four of them in the PPE and safety equipment market, two in packaging and one in healthcare.

Scoring Bunzl

When appraising companies we consider what we are getting in return for the price. Bunzl is most unlikely to do a Games Workshop and suddenly unlock an enormous store of value, making shareholders a fortune almost overnight.

What we are buying when we buy shares in a company like Bunzl is predictability, which is arguable what customers are getting when they buy from Bunzl too.

The company has achieved a fraction below 9% compound annual growth (CAGR) in profit. A CAGR of 9% is more than sufficient to double profit in a decade.

While I doubt Bunzl will deviate much from what it has achieved in the past, it appears to be the very definition of a stalwart.

Does the business make good money? [2]

+ High and stable returns on capital

+ Excellent cash conversion

? Modest profit margins

What could stop it growing profitably? [2]

+ Business holds up in recession

+ Does not overpay for acquisitions

? Relatively high financial obligations

How does its strategy address the risks? [2]

+ Acquisitions increase range and reach

+ Operational efficiencies improve profitability

? Leverage increases returns to shareholders

Will we all benefit? [1]

+ Managers of acquired businesses encouraged to stay

+ Decentralised organisation gives managers autonomy

- Total remuneration of chief executive is 110 times median pay

Is the share price low relative to profit? [0]

? No, but it is not high either. A share price of £24.16 values the enterprise at £10 billion, about 18 times adjusted profit.

Bunzl is probably a good long-term investment. A score of 7/10 ranks it 12 out of 38 shares in my Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.