Richard Beddard: an exciting new company for my Decision Engine

17th June 2022 14:39

by Richard Beddard from interactive investor

It only has a short track record as a public company, and this is my first analysis of the company, but I’m giving it a high score. Here’s why.

Marks Electrical (LSE:MRK) published its first set of results as a listed firm last week. Although it was founded in 1987, it floated on the stock market in November last year.

Its short track record in the public eye gives us limited visibility of the past.

Nevertheless, the online retailer of mostly mid and top-of-the-range cookers, fridges, washing machines and TVs, does things differently, and that bodes well.

A glimpse of what Marks Electrical is capable of

The bit of the past we see is misleading as well as short because it was atypical.

Marks Electrical performed strongly during the pandemic, when it experienced business conditions that may never be as conducive to rapid growth again.

Usually it is safer to base our opinions on averages than the most recent financial year because one year can be skewed by exceptional events.

In the case of Marks Electrical, the skew is in 2021 though, and the year to March 2022 is probably more typical than the average of the two for which we have comparable financial data.

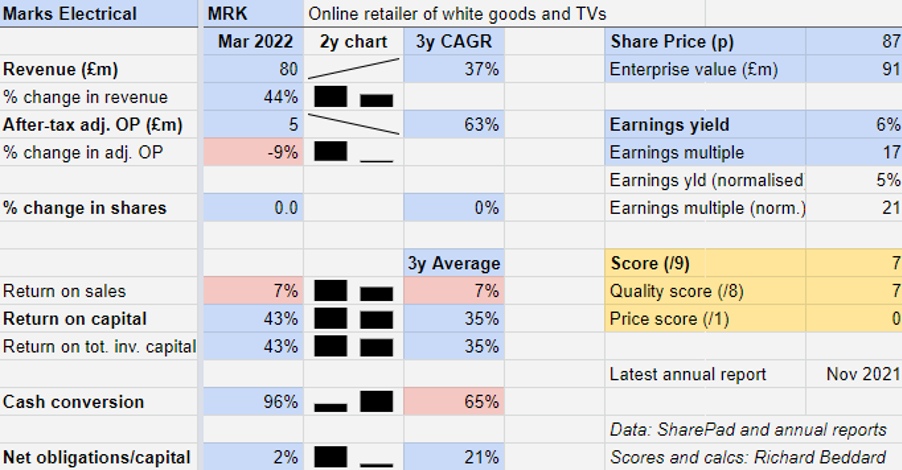

In 2022, revenue increased 44% but adjusted profit declined 9% as the exceptional conditions of the pandemic ebbed.

During the pandemic, many of Marks Electrical’s competitors shut their retail stores down for long periods and operated under difficult conditions when they reopened.

Marks Electrical temporarily closed its one showroom in Leicester, and its vertically integrated online and telesales operation responsible for the vast bulk of revenue grew strongly despite well publicised fuel, product, and staff shortages.

- Read about other AIM shares: six AIM shares for dividend income

- Discover more articles by Richard Beddard here

Meanwhile, a fall in the cost of online advertising meant that while Marks Electrical was earning more revenue, it was spending less money.

The 10% profit margin it experienced in 2021 could not be sustained once the markets for appliances and advertising became more competitive again.

This, and increased costs as the company brought its founder onto the payroll and beefed up management and staff throughout the business to support growth, explains the decline in margins to 7% and the 9% decline in profit in 2022.

The declines may stop here though. Marks Electrical believes profit margins have normalised in 2022.

The company’s EBITDA margin of 9% is within the 8-10% range it reckons it can sustain (it differs from my 7% figure because I measure profit after depreciation and amortisation of internally generated intangible assets).

And it reports 20% year-on-year revenue growth in the first few months of the new financial year, despite a general contraction in the market.

Problems in the pipeline

Although Marks Electrical appears to be growing against the tide, it remains to be seen how strong the tide will be. People are generally put off buying high value items when money is tight.

The company says 80% of revenue comes from distressed purchasers, for example people who need to replace a broken appliance, which suggests sales should hold up.

But a distressed customer in a recession might be satisfied with a less than premium product, which would be less profitable for Marks Electrical.

High returns and low financial commitments should also give Marks Electrical the financial cushion it needs to weather recession and, hopefully, take market share from weaker competitors.

The competition is not especially weak though. There is an established market leader in Curry’s, a vigorous insurgent in AO World, and a respected brand in John Lewis.

If Marks Electrical is to prevail through thick and thin, it must be better at selling high value appliances and TVs than them.

It must also deal with powerful suppliers.

Google has a stranglehold on online search, historically Marks Electrical’s most important source of customers.

When competition for “adwords” relating to products and brands is strong, online advertising can become very expensive.

The company’s dependency on premium brands like Bosch, responsible for 12% of sales in 2022, Miele and AEG, may be of less concern since it has relationships with many of them.

Solutions in the strategy

Marks Electrical is addressing these risks by focusing on the parts of the business that come into direct contact with customers, and diversifying its marketing spending.

It has homegrown e-commerce systems that keep its prices competitive and delivers using its own customised vehicle fleet, maintained and fueled in-house, at its headquarters in Leicester.

Crews of two deliver to 90% of the UK population the next day, seven days a week, for free. They install products and take away packaging and old appliances for recycling.

Free next day delivery differentiates the company from rivals with more complex distribution networks because it makes Marks Electrical the cheapest place to buy.

- Read more of our content on UK shares here

- How Terry Smith is investing as markets crash

- Richard Beddard: why this is one of my six favourite shares

Complex networks and third party logistics partners, means moving products between warehouses using Heavy Goods Vehicles. This is expensive. It can increase delivery time, and the opportunity to damage a product.

It can also result in an inconsistent experience for customers.

Marks Electrical’s delivery service would be overkill for a kettle, which is why it specialises in unfriendly freight: Bulky high value items that must be delivered carefully, and installed by drivers that have been trained for three months and incentivised with cash bonuses for going out of their way and earning the company good reviews.

In some categories, like cooking and TVs, Marks Electrical’s average selling price is almost twice the market average. High value items make each delivery more profitable and result in fewer returns because of their quality and better packaging.

This is how Marks Electrical can afford to pay for free expert next day delivery and still earn a return on capital of 43%.

With the efficiencies of specialisation, Marks Electrical ought to be able to grow at the expense of less focused businesses, a notion that may be born out by the statistics.

In 2022, the company says its share of the Major Domestic Appliance (MDA) market grew from 1.2% to 1.6% (its share of the online MDA market grew from 1.5% to 2.6%).

Meanwhile in striving to increase that market share, it may also have found a way to address the high cost of online advertising.

Marks Electrical’s research shows that only a small minority of people have heard of it. The average in England is 7%, and the average in London is just 4%.

To address its low profile it has turned to TV advertising, which due to its cost was not available when it was a smaller business.

In 2021, Marks Electrical launched its first nationwide TV advertising campaigns, spending between 30% and 40% of its marketing budget on them. It expects that percentage to increase over time.

One route to market that does not depend on advertising, online or offline, is repeat purchases. Marks Electrical reports 25% of revenue comes from existing, presumably happy, customers.

Scoring Marks Electrical

A few weeks ago I saw a Marks Electrical van delivering in a neighbouring village. It was my first experience of the company apart from its website and corporate communications, a sign perhaps, a portent, a sliver of evidence that its reputation is spreading.

I am encouraged by the company’s distinctive strategy, which makes tough choices.

Sadly for the small populations of Mid Wales, Dumfries and Galloway, and the Scottish Highlands and Islands, Marks Electrical’s Unique Selling Point is free expert delivery, next day (or bi-weekly in a few far flung more densely populated regions). If it cannot reach you from Leicester, then you will have to go elsewhere.

Likewise, if it is not big or expensive, and preferably both, it is not in stock.

I am also encouraged by Marks Electrical’s self-sufficient culture. Two of the reasons it coped effectively with the shortages during 2021 were that it had its own reserves of fuel, and its own well paid fleet of drivers (which it augmented strongly).

When Marks Electrical floated, each employee received free shares and having watched its founder and chief executive Mark Smithson deliver corporate presentations, the founder’s zeal is obvious.

Mr Smithson says the company scrutinises every bad review, and I believe him.

Although his 70% ownership gives him the freedom to do what he wants, so far he has used it to create a singular and unusually profitable business.

Marks Electrical says it is going for the John Lewis market, and as a participant in that market I can confirm the next time my family needs a cooker, a fridge, or a TV, the first place I will look is Marks Electrical.

You can add me to the 7% that recognise the brand now.

Does the business make good money? [1]

? Returns on capital flattered by pandemic

? May not sustain profit margins through thick and thin

+ Decent cash conversion

What could stop it growing profitably? [2]

? Strong finances and growth in market share mitigate recession risk

+ Large but less focused competitors

+ Dependence on Google advertising reducing

How does its strategy address the risks? [2]

+ Vertical integration

+ Geographical and product specialisation

+ Diversification of marketing channels

Will we all benefit? [2]

+ Owner managed

+ Decent pay and bonuses for staff

+ Communicates well with shareholders

Is the share price low relative to profit? [0]

+ It is reasonable. A share price of 87p values the enterprise at about £91 million, 21 times normalised profit.

A score of 7 out of 9 suggests Marks Electrical is a good long-term investment.

Its short trading history and the fact that this is my first evaluation of the company warrants some caution though.

To make space in the Decision Engine for Marks Electrical, I have removed Portmeirion (LSE:PMP), the manufacturer of homewares, for now.

Marks Electrical is ranked 15 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.