Richard Beddard: this engineering stock has promise, but can it inspire confidence?

Our companies analyst weighs up whether Trifast’s drawbacks are offset by investment that could pay off.

18th September 2020 15:20

by Richard Beddard from interactive investor

Our companies analyst weighs up high executive pay and average returns on capital against internal investment that could pay off long term.

It must have been a momentous day at engineering company Trifast (LSE:TRI) when Malcolm Diamond stepped down as chairman in March. He first joined the company 45 years ago and was chief executive when it floated in 1994.

While his service is remarkable, it is perhaps not surprising. More than 50% of Trifast staff have worked there for more than ten years.

Sales and Marketing director Glenda Roberts has also stepped down from the main board. A relatively new starter, she first walked through the office door as an employee 30 years ago.

Mark Belton, chief executive since 2015, is a lifer.

Trifast’s staff-focused culture may be what distinguishes it from rivals in a highly competitive industry – the supply and manufacture or fasteners, nuts, bolts, and rivets, and other category ‘c’ (low value) components.

It sells these to large manufacturers of cars and washing machines, for example, and their big component suppliers.

- The Week Ahead: Rolls-Royce, WPP, Flutter Entertainment

- 21 shares for the future

- Shares for the future: why I’m losing sleep over these stocks

The product catalogue is huge. While fasteners might seem simple enough, finding or customising the right one in terms of size, weight, design and durability for a particular application requires collaboration with customers when designing new products.

If the engineers and salespeople are well equipped, trained and motivated, the customers will probably be happier, particularly the 25 largest original equipment manufacturers (OEMs) it serves most assiduously.

By courting multinational companies it seeks to reduce competition with the few suppliers with global supply chains, broad product ranges, and sales teams serving customers locally around the world.

Tough business

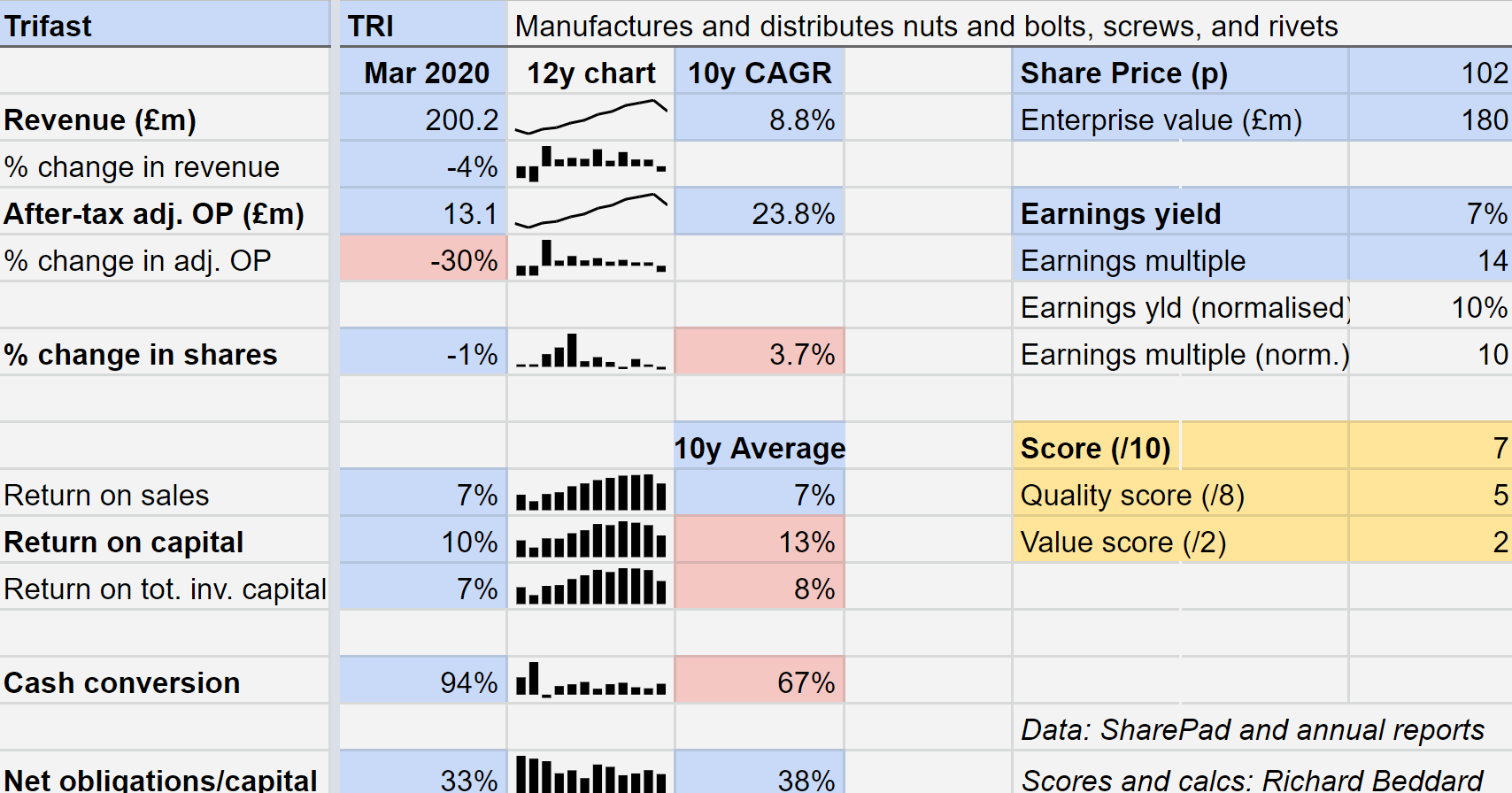

For all Trifast’s teamwork and endeavour, the results in 2020 betray the company’s sensitivity to industrial demand. A 4% reduction in revenue produced a 30% reduction in adjusted profit after tax. When demand falls, Trifast’s profits fall further because it has substantial fixed costs in factories, warehouses and equipment.

Revenue fell because production lines halted as the pandemic swept around the globe in February and March, but Trifast was already reporting slowdowns in some of its markets including the biggest (automotive), domestic appliance manufacturers, and electronics.

The sharpest decline in revenue was in Asia, where factories closed earliest. Since Trifast’s financial year ended at the end of March, the pain experienced in Europe and the USA falls mostly in the current financial year.

Trifast says it returned to profitability in June, but is shy of forecasting how much revenue or profit it might make this year.

Shoring up finances

A reliance on debt means Trifast did not have the resources to finance investment and remain competitive through recession. So, after the year- end it raised £15 million by issuing more shares and selling them to investors at a near-10% discount to the prevailing market price.

The money will be spent on rolling-out Project Atlas, a new IT system that will knit together Trifast’s subsidiaries, other smaller investments and on funding increased levels of working capital (stock and receivables) when demand returns.

- ii view: Babcock scuttles the dividend

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

If there is any money left, Trifast may use it to buy smaller rivals struggling because of the economic impact of Covid-19.

Were the company not to take these actions, it would respond more slowly when demand returns and lose out to better-financed rivals.

When recovery comes, of course, depends on the progress of the pandemic and many other factors.

I have, perhaps, been lenient in calculating Trifast’s financial statistics, averaging the last ten years and excusing it the worst two years of the 2008 financial crisis. That is because I do not think history will repeat itself.

The company still refers to the years of crisis as “darker days”, characterised by mismanagement as well as recession. Malcolm and another former chief executive, both of whom had left the business, returned to turn it around.

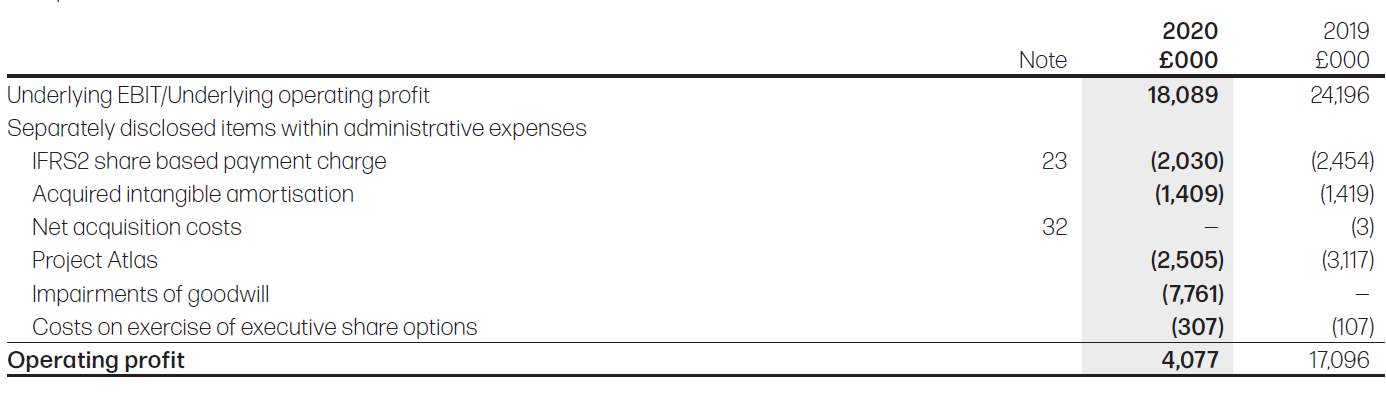

I have also gone along with most of the exceptional costs Trifast ignores in calculating adjusted profit laid out on the reconciliation table below.

Source: Trifast annual report 2020

Only the charges relating to share options are included in my calculations, although I have excluded the costs relating to Project Atlas grudgingly from profit.

Share options are not one-off payments, they are routinely used to reward staff, and more often than not they are a direct cost to the business because companies buy the shares required to satisfy the options in the market. Even if the company issues more shares to give to employees, there is a hidden cost to shareholders because their holdings are diluted.

Project Atlas is a new company-wide IT system, and no-doubt there are one-off costs associated with implementing it. But the size of these costs is a matter of judgement. Boards have an incentive to err on the high side because the more costs they exclude, the higher the profit and the better the results appear to be.

Despite my leniency, Trifast’s performance after tax is merely adequate. Average return on capital (ROC) is 13%, and average return on total invested capital (ROTIC) is 7%. Exceptional items in this and prior years, as well as investment, go some way to explaining why average cash conversion is only 67%.

The company has improved, and profitability over the next ten years may well be better than it was over the last ten. But the events of the year to 2020 show Trifast’s profitability is still linked to capricious demand in its industrial markets.

The company’s sensitivity to outside forces may even have been exacerbated by the acquisition of suppliers to the automotive industry, a diversification that allowed it to reduce its dependency on the cyclical electronics industry.

It worked. Today, the company only earns 14% of revenue from electronics and 34% from automotive.

But the automotive industry is cyclical too, and its requirements are changing due to the adoption of electric vehicles. While World Trade Organisation tariffs on nuts and bolts are low, the tariffs on cars are high. If the UK leaves the European Union on those terms, the UK car industry, a big customer, will likely suffer.

Change presents opportunities as well as threats, but Trifast has replaced one capricious market with another.

Scoring Trifast

Trifast is a difficult company to score. The annual report presents a good account of the company, and its staff-oriented culture ought to be producing results, but I am not convinced those results are good enough.

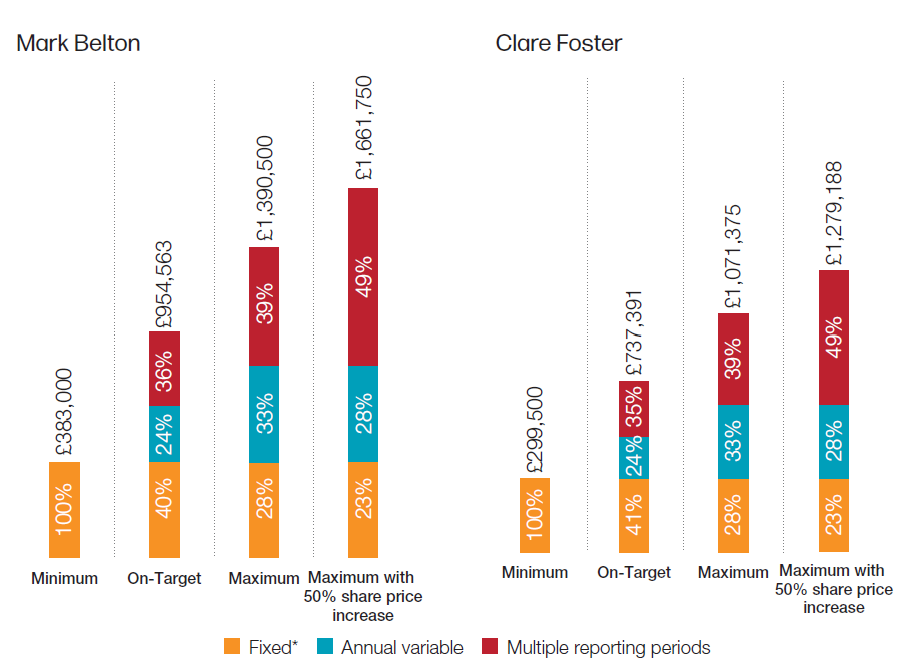

It looks as though the staff-first policy extends to the bosses, who under a new remuneration policy earn pretty high basic pay and the opportunity to earn extravagant bonuses (though the company says pay is lower than the median for companies in the FTSE SmallCap Index and reflects increased responsibilities because the board has shrunk to two executive members).

Potential future executive remuneration for Trifast’s chief executive and chief financial officer under different performance target scenarios. Source: Trifast annual report 2020

Aspects of this bonus culture filter down, so salespeople and engineers are rewarded too. This is a good thing but sometimes I wonder whether Trifast is profitable enough to justify it.

On the other hand, Trifast promises a 25% annual return on its considerable investment in Project Atlas. Perhaps Atlas, and Trifast’s long standing commitment to “continuous improvement” will deliver enhanced returns in future.

Does the business make good money? [1]

? Average return on capital of 13% is unexceptional

? Average return on sales of 7% is too

? And so is average cash conversion of 67%

What could stop it growing profitably? [1]

? Capricious markets

? Expensive acquisitions, average ROTIC is only 7%

? Other companies have similar strategies

How does its strategy address the risks? [1]

? Diversification, but new markets are capricious too

? Investment drives efficiency

+ Focus on biggest OEMs reduces competition...

Will we all benefit? [2]

+ Explains itself well to investors

+ Puts staff first

? High pay and and potentially high bonuses

Are the shares cheap [2]

+ A share price of 102p values the enterprise at £180 million, about 14 times adjusted profit, in a year the company did not perform well.

A score of 7/10 suggests Trifast is a good long-term investment, however it is not yet the kind of high-quality business that inspires great confidence.

Currently it is ranked 15th of 34 companies I have scored and ranked in my Decision Engine, which helps assess if this list of firms are cheap or not.

Richard owns shares in Trifast.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.