Richard Beddard: to diversify or not to diversify?

Our columnist scores two businesses – one sticking to its knitting and the other transforming.

22nd January 2021 15:04

by Richard Beddard from interactive investor

Our columnist scores two businesses – one sticking to its knitting and the other transforming.

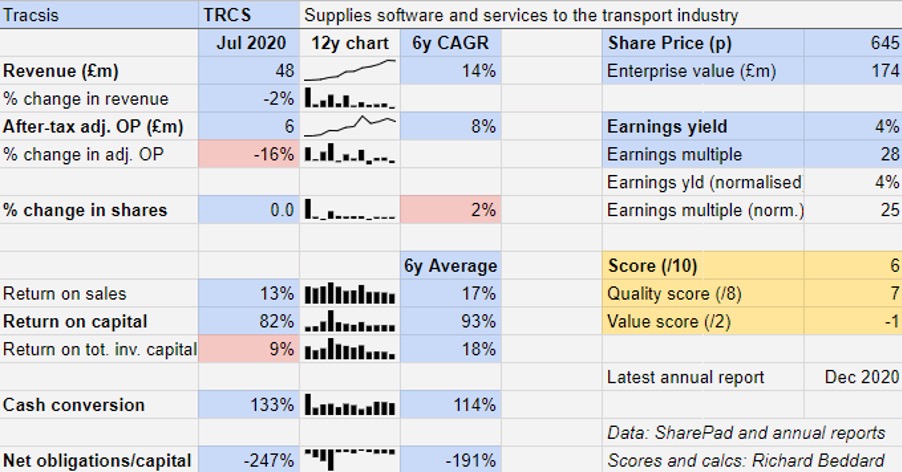

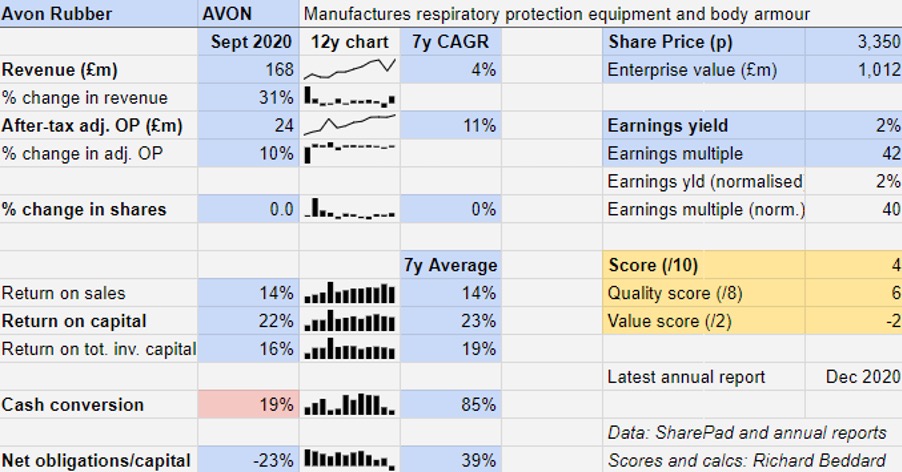

When is it right to diversify, and when is it right to focus a business? Tracsis (LSE:TRCS) has furiously diversified since it came to the market in 2007, while Avon Rubber (LSE:AVON) has two spent two decades sharpening its focus.

Not much traffic

Tracsis is a gaggle of businesses acquired over the last 15-or-so years and organised into two divisions.

Rail, the most profitable, harks back to the company’s origins as a developer of crew-scheduling software. Today, it has knitted together crew and rolling stock scheduling, resource management and health and safety software into TRACS Enterprise suite. It also supplies trackside condition monitoring systems, which report faults in train tracks and ticketing software.

A second division, Traffic and Data Services, surveys and analyses traffic and manages admissions and parking at major events.

While the Rail business is technology-led, the Traffic side of the business relies on manual data collection and stewarding, although technology is playing a bigger role.

Perhaps not surprisingly, the recurring revenue from software contracts has been more profitable, especially during the pandemic.

A 16% reduction in adjusted profit in the year to July 2020 makes Tracsis’ after-tax return on total invested capital look weak. However, it would be very harsh to judge the price paid for Tracsis’ many acquisitions (the bulk of total invested capital) by the company’s performance during a year in which we experienced the outbreak of a pandemic and some of those acquisitions were barely able to operate.

Regardless of the price paid, Tracsis’ businesses remain highly profitable and cash generative compared to the capital required to operate them.

In the Rail division the impact of lockdown was limited to a reduction in delay-repay services, which facilitate the payment of compensation by train operators when services are delayed or cancelled.

Thanks to recent acquisitions, 70% of the industry’s claims were processed by Tracsis in 2020. But, unlike Tracsis’ typical annual or multi-year software contracts, which are priced per user, revenue from delay-repay depends on the number of claims. This depends on the number of passengers delayed. Idle railways mean less income.

Traffic surveys were put on hold during the first lockdown because there was not enough traffic, and event traffic management, which was responsible for 20% of revenue in the year to July 2019, dried up.

Overall, Tracisis believes Covid-£19 cost it £10 million in lost revenue, mostly from Traffic and Data Services, which would have been more than sufficient to maintain its growth company credentials.

Due to continuing pandemic restrictions, the company is still experiencing lower revenues, although it has reduced its outgoings so the impact on profit is lower. Despite the pandemic, Tracsis expects revenue to improve modestly in the year to July 2021 too.

Looking further ahead, train operators may delay buying new systems as they transition to new government contracts that will replace the franchise system of the last 25 years.

And if the government were to reduce funding for transport through Network Rail and local and highways authorities in response to precarious national finances, Tracsis might be affected.

That said, demand for the company’s services should be resilient as mostly they are designed to make transport more efficient.

Scoring Tracsis

Tracsis has a great track record, but the pandemic, worries about future government spending and the abolition of the rail franchise system introduce uncertainty at a time when the board has also changed.

The company’s founder left in 2019 and Max Cawthra, chief finance officer, is stepping down soon. He impressed me one year by paying some of his bonus to his colleagues.

Chief executive Chris Barnes was recruited from Ricardo, and the new chief financial officer Andy Kelly, comes from Vitec. They will be adapting the company’s buy and build strategy to our new circumstances.

Barnes is encouraging Tracsis’ businesses to work more closely together, and says international growth (a long time aspiration of the business) is a priority.

Does the business make good money? [2]

+ Return on capital is high

+ Profit margin is high

+ Cash conversion is very good

What could stop it growing profitably? [1]

? Very strong finances

? Restructuring of UK rail industry

? Traffic more ad-hoc and less specialist than rail

How does its strategy address the risks? [2]

+ Applying technology to traffic and data

+ Niche acquisitions diversify risk without compromising returns

? Overseas growth

Will we all benefit? [2]

+ Employees are shareholders

+ Executive pay is reasonable

? Recent changes to management

Is the share price low relative to profit? [-1]

− No. The enterprise multiple is 28x normalised adjusted profit

A total score of 6/10 puts Tracsis in fair value territory. It is ranked 20 out 38 shares in my Decision Engine.

Cows come home

I used to moan when editors routinely adorned articles about Avon Rubber with pictures that could have been from a dystopian novel. Granted, Avon Rubber manufactures gas masks, but it also sold equipment for milking machines and a picture of a cow occasionally might have lifted the mood.

No longer. After a year of acquisitions and disposals Avon Rubber has gone from being a world leader in respirators and milking equipment to being a world leader in respirators, helmets and body armour for the armed forces and police.

Step one was the acquisition of 3M’s ballistic protection business in January 2020, which cost £75 million, more than three times Avon Rubber’s adjusted operating profit in the year to September 2019.

Step two was the £180 million sale of Milkrite|Interpuls in September, which restored Avon Rubber’s finances and gave it cash for more acquisitions.

It followed up after the financial year in November with step three, the £100 million acquisition of Team Wendy, another supplier of helmets. At more than four times adjusted profit in the year to September 2020, it was more transformative expenditure not reflected in the results for the year:

The accounts bear the scars of the surgery. Restated to exclude the results of Milkrite|Interpuls in 2019, and excluding substantial one-off costs relating to the acquisitions, Avon Rubber profited handsomely although the increase in profit was almost entirely added by acquisitions in 2019 and 2020. Very weak cash flow highlighted in the table above was due, at least in part, to a marked increase in capital investment.

But the company announced in December that body armour supplied under two new contracts had failed in testing, which will delay certification, push shipments into the year to September 2022 and reduce growth this year.

Avon Rubber had estimated the value of these contracts to be a maximum of $600 million (about £440 million) over up to four years.

The uncertainty, and delayed US Army helmet order while a rival challenges another contract, show that swapping a distinct revenue stream from farmers to the US Department of Defence brings risks.

In 2020, the company earned £95.3 million revenue from the department, 57% of the total. Due to the acquisition of Team Wendy, that proportion will rise again in 2021 - as will revenue and profit.

Scoring Avon Rubber

Avon Rubber is a more focused business than it was when I started following it and the shares are a lot more expensive. To my mind, the potential risks have increased as well as the potential rewards.

The company’s two executives have received big pay rises, which will also inflate their already generous bonuses and incentive plans.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Strong average cash conversion

What could stop it growing profitably? [1]

? Large pension obligation (four times operating capital)

? Dependence on US Department of Defence

? Large acquisitions can be risky

How does its strategy address the risks? [2]

+ Product development in partnership with customers

+ New customers outside the US

? Disciplined acquisitions

Will we all benefit? [1]

+ Experienced board

+ Focus on employee engagement

− High levels of executive pay

Is the share price low relative to profit? [-2]

− No. The enterprise multiple is more than 40x adjusted profit

A total score of 4/10 means I have doubts about Avon Rubber’s potential as a long-term investment. My Decision Engine ranks it 32 out of 38 shares.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.