Richard Beddard: is Dart Group still a good long-term investment?

It’s a great company with solid credentials, but a complex structure and the pandemic muddy the waters.

4th September 2020 15:00

by Richard Beddard from interactive investor

It’s a great company with solid credentials, but a complex structure and the pandemic muddy the waters.

Who can deny Dart (LSE:DTG) its moment in the sun? The first pages of the company’s annual report trumpet a 26% annual growth in revenue and profit at its leisure airline Jet2 and its package tour brand Jet2 holidays over the last five years.

It is a magnificent achievement by a holiday airline and package tour operator that less than 20 years ago was just a glimmer in its swashbuckling executive chairman’s eye and today is second only to TUI as a UK package tour operator.

The next pages explain how it has come so far. Jet2 has put the customer first adding value at each point in the holiday, from innovative payment plans to family friendly flight times and resort flight check-in. Less integrated packagers of flights and hotels like Online Travel Agents (OTAs) cannot match this attention to detail.

- Which aviation stocks are tipped for recovery?

- Covid-19 winners and losers: Airline shares book gains

Jet2’s Net Promoter Score, a widely used measure of whether customers recommend a product or service, is +70 (on a scale that goes from -100 to +100). It has received a Which? recommendation for four years in a row. The venerable consumer association says Jet2holidays has raised the bar for package holidays “through the roof”.

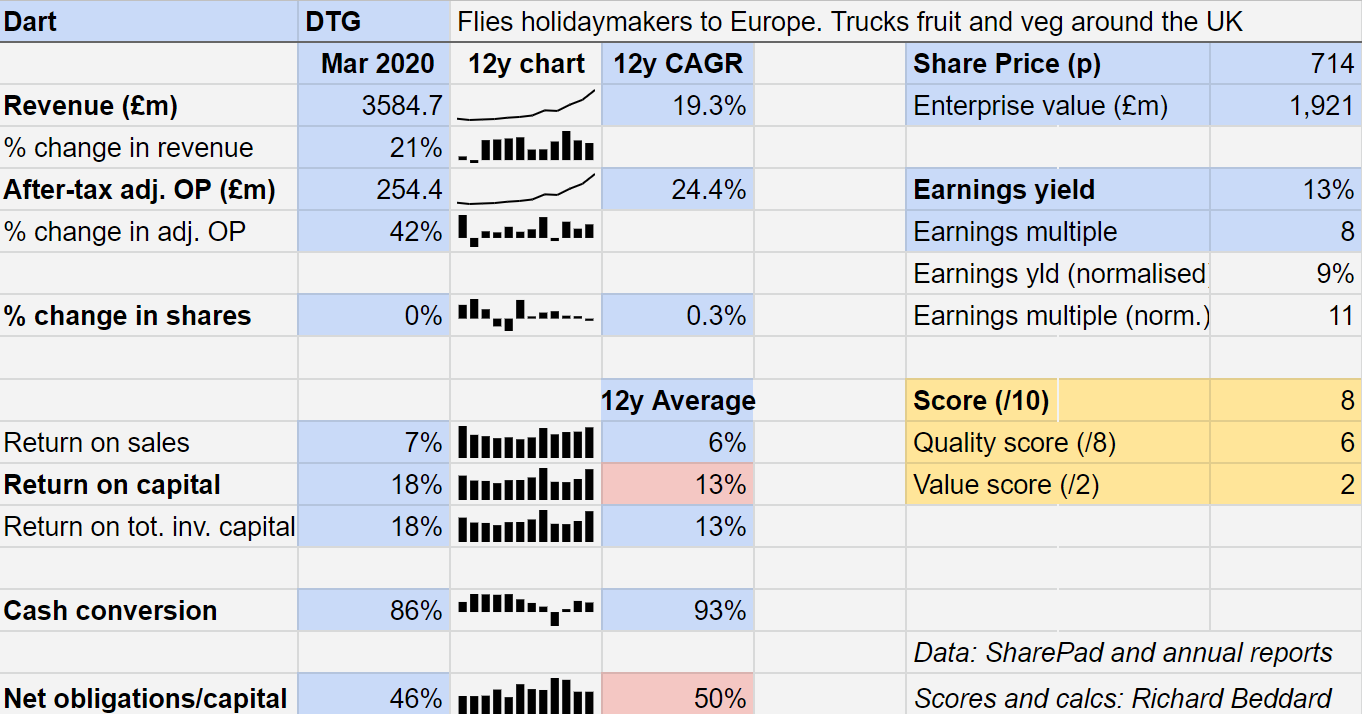

As a guide to 2021, Dart’s 2020 results are about as useful as a duffel coat on a summer holiday on a Greek island, but they do illustrate what a good business it is during normal times.

Over the years, my enthusiasm for the business has been tempered by its complexity and doubts about the fidelity of the investment ratios I calculate from the accounts.

Two issues in particular vex me. First, how much of Dart’s cash really belongs to the company, and therefore its shareholders. Second, its hedging strategy, which is designed to make costs more predictable but has the potential to create large losses.

Neither issue is unique to Dart, they are common to all airlines and some other businesses. Both plague airlines and investors right now due to flight cancellations caused by the pandemic.

Cash conundrum

Dart typically has a large cash balance at the year-end, but that does not mean it can just redistribute it to shareholders or reinvest it in the business.

Other parties have a claim on some of the cash. Much of it is ticket money for flights yet to be flown, which may be refunded if the flight does not take off. The company is required to hold some cash by the Civil Aviation Authority (CAA), and it may be required as collateral against financial transactions, the hedges I will discuss in a moment.

- The bull case for Dart looks pretty clear to me

- Buffettology fund: top 10 stocks and a buying spree

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Cash impacts all of the key investment ratios: return on capital (RoC), gearing (net obligations/capital) and enterprise value (EV). Most companies need some cash to operate, but with airlines the cash requirement is higher and so I assume that an amount equal to 15% of Dart’s turnover does not belong to the company.

However, 15% is just a guess, and not a particularly educated one.

Horrible hedges

Dart’s profit and return ratios exclude the £108.4 million cost of “ineffective hedges”, which it has deemed exceptional.

Hedges are financial contracts that offset movements in the price of jet fuel and foreign currency up to a year in the future. They fix costs and make it easier for airlines to budget.

Because jet fuel prices and the value of the US dollar have both fallen, airlines are losing money on hedges because they hedged at higher rates.

Normally, this would not matter because the airline has budgeted for the cost, but when an airline cancels flights it must still honour the contracts, which are ineffective because there will be no revenue to offset them against.

According to accounting regulations the company must recognise losses (or gains) due to ineffective hedges based on the value of the hedges at the year-end.

These losses are not a reflection of how the business performed in the year to March 2020 (most of the cancellations are in 2021) or, necessarily, of the cash cost of closing the contracts when they mature (also mostly in 2021). But there will be a cost, and in ignoring it we may come to an overly favourable impression of Dart’s profitability.

Step 1: survive

Dart suspended flights in the final weeks of its financial year in March due to the pandemic. While overseas travel has returned, most holidaymakers are put off by the risks of catching the disease in transit, last minute cancellations as the government’s travel advice changes and the possibility that they might have to quarantine when they return.

The case for investing in Dart is simple, but not easy. It is simple because all European airlines and tour operators are run ragged by the pandemic. Jet2 has taken steps to bolster its survival prospects, and since it is such a focused and competitive business it should prosper disproportionately when the industry recovers.

It is not easy because the prognosis for the holiday trade is dismal. Jet2 has reduced its schedule for summer 2021, and airports are planning for a much longer return to normal. Can we be sure even the strongest will survive in a form that profits shareholders?

Since the year-end Dart has shored up its finances by furloughing staff, cancelling leased aircraft and deferring capital expenditure. It secured £300 million from the government’s Covid-19 Corporate Finance Facility, which it has yet to draw on, raised £171 million from investors in an undiscounted placing and sold Fowler-Welch for £98 million.

Fowler-Welch, a road haulage firm, has been part of the group longer than Jet2 but it has long been dwarfed by the travel business and in 2020 contributed less than 5% of revenue and a smaller proportion of profit.

No travel operator could have handled the mayhem caused by the virus and our reaction to it flawlessly. But newspaper coverage and people’s reactions on social media suggest Jet2 stuck to its customer-first ethos and been more responsive than rivals.

In June, Moneysavingexpert.com ranked travel firms from best to worst for cancellation refunds. The statistics include travel agents and other businesses, but Jet2holidays was the highest ranked tour operator in fourth position, British Airways Holidays was sixth, EasyJet Holidays was 14th and Tui was 37th. On the Beach and Love Holidays, the two biggest online packagers were 17th and 40th respectively.

In terms of airlines, Jet2 was first in fifth position. EasyJet was 22nd and Ryanair was 47th.

People will remember. Jet2 sells most of its holidays and flights directly and although the company does not publish how many customers book again, reportedly more than half re-book within about eighteen months.

Step 2: prosper

Dart’s growth has been based on a stealthy expansion from underserved airports in the north of England. But the company flew its first flight from Stansted in 2017 and has quickly ramped up flights and destinations for passengers in the South East, the country’s most populous region. The roll-out is not necessarily over, but it must surely slow, which may explain why Jet2holidays has diversified from its core family-friendly beach holidays in pursuit of growth.

Having launched Jet2Villas, package holidays incorporating self-catering accommodation, and Indulgent Escapes (luxury five-star holidays), it diverged from the family-friendly blueprint in November 2019 by launching Vibe by Jet2holidays, which caters to the young and young at heart.

While this will bring Jet2 new customers, helping it to fill its growing fleet and earn high levels of profitability, the company doesn’t say how it will cater to families and party goers, who it may have to accommodate on the same flights, without comprising the experience of families.

Jet2 says it has reduced its flying programme for the rest of 2020 and 2021. It has a “satisfactory” load factor for winter 2020/2021 and the much busier summer period in 2021 looks “encouraging” with a higher than usual level of high margin package tour holidays booked.

However, we do not know how much financial damage has already been inflicted by this summer’s mayhem or how many flights scheduled this winter and next summer will actually take off.

Scoring Dart

Scoring Dart is tricky. For me, it is an article of faith that during bad times bad businesses fail and good ones survive and emerge even stronger due to the winnowing of competitors. But, for a while, Dart’s unstoppable business model has collided with an immovable pandemic.

It is reassuring that the executives that built Jet2 are still running it and that executive chairman Philip Meeson owns 26% of the shares. Aside from protecting the business he built, he has a strong motive to preserve value for shareholders.

Does the business make good money? [1]

+ Cash conversion is generally strong.

? Most years Dart is highly profitable. This year it won’t be

? Calculating airline profitability is complicated and my estimations may be incorrect.

What could stop it growing profitably? [0]

+ Competition. Jet2 is unique. It is a strong competitor

? Brexit. Rules for airlines not yet agreed, both sides want to keep them flying

− Covid-19. We do not know how bad its impact will be.

How does its strategy address the risks? [2]

+ Specialisation. Jet2 flies holidaymakers to the Mediterranean

+ Vertical integration. Jet2 has more control of the traveller's experience

? Not sure how the party-going vibe by Jet2 crowds fits with family-friendly ethos.

Will we all benefit? [2]

+ Founder and chairman Philip Meeson owns 26% of the shares

+ Other executives are very experienced

+ Customers speak highly of Jet2, and they book again.

Are the shares cheap? [2]

+ A share price of 714p values the enterprise at about £3.5 billion, eight times adjusted profit.

A score of 7 out of 10 means Dart is probably a good long-term investment, but that does not make owning the shares a comfortable proposition in the short-term.

Richard owns shares in Dart.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.