Richard Beddard: could this firm be a stock market darling again?

18th February 2022 15:01

by Richard Beddard from interactive investor

This AIM stock embracing technology may be less well-loved than previously, but our columnist finds it has much to recommend it.

RWS (LSE:RWS) is almost unrecognisable from the patent translator and stock market darling it was five or six years ago. Today it does much more than translate patents – and much of the heat has gone out of the share price.

Maybe traders selling the share are making a mistake.

Language services

Today, RWS occupies a number of large, often technical niches. In addition to patent services, the original but perhaps soon to be smallest division, RWS provides translation, localisation and interpretation for global brands such as technology and consumer goods companies, and specialist translation for regulated industries including medicine, law and finance.

Underpinning these activities are technology platforms that make translation and content management more efficient and automate processes using neural machine translation. This reduces the cost of the service and allows the business to scale more quickly, as it is less restricted by the available pool of translators, whose job is increasingly to validate and edit translations generated by computers.

Following the acquisition of SDL in November 2020 and the combination of its machine translation platform with another one acquired by RWS just five months earlier, the company has created a new division selling machine translation as a service plugged directly into customers’ systems. The new division, which also includes RWS’s content management platform, contributed £100 million – 15% of total revenue – in the year to September 2021.

- Lee Wild's AIM share for 2022

- Top 25 most-traded companies on AIM

- 10 shares to give you a £10,000 annual income in 2022

RWS boasts a client list including almost all the world’s largest and most famous brands and very high proportions of the big patent filers, law firms, medical device manufacturers and pharmaceutical companies.

These are demanding customers, because a mistake in the translation of a patent, a clinical trial, or a legal or financial document can have serious implications. Translation is a small part of the cost of providing a product or service globally, so it is probably not worth cutting corners and getting it wrong.

Being good at technical translation requires valuable language- and subject-specific knowledge. Historically, this expertise has been RWS’s competitive advantage, but the company has used technology to assist translation and patent filing for decades and the opportunity appears to be growing. The two capabilities support each other. RWS’s linguists train its software, and its software makes translation more efficient.

The acquisition of SDL could be a pivotal moment in RWS’s already illustrious history. The company now claims to be the world’s leading language service group, but the industry remains fragmented and this injection of technology may give it the means to grow and scale faster than most rivals.

Hitherto something of a cottage industry, translation and localisation firms are consolidating into an industry that may become dominated by a handful of companies.

TransPerfect, a US firm that also has its own neural machine translation platform, claims to be the world’s largest provider of language and technology solutions. Its revenues of $1.1 billion in 2021 eclipsed those of RWS (about $940 million). The two are in a group of eight mostly privately owned companies dubbed “super agencies” by language industry portal Slator. The smallest of the eight has annual revenues of about $250 million, yet the industry is worth nearly $24 billion.

RWS had no bank debt at the year end and is prepared to borrow up to 2.5 times EBITDA (a measure of profit), so further acquisitions may be inevitable.

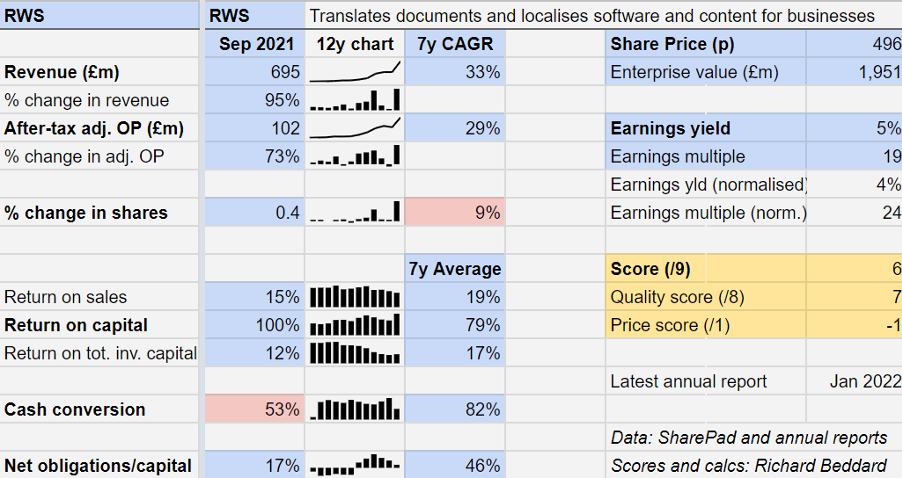

Revenue doubles

At first glance, the numbers are impressive, but most of the 95% revenue growth and 102% increase in profit came from the 11-month contribution of SDL. The pandemic boosted the fortunes of some customers, particularly technology companies, but hampered others.

Excluding the impact of SDL and currency movements, RWS grew revenue by 4%.

Past performance is not a guide to future performance.

Impressive growth rates in the region of 30% over the last seven years have been achieved in part by diluting shareholders to the tune of 9% through share issuance to fund acquisitions.

Although it is too early to declare the SDL acquisition a success, the much higher revenue and profit growth rates and a reasonably high level of return on total invested capital (including acquisitions at cost) suggest the company’s acquisitions may be making RWS a better business.

The one wrinkle in 2021’s figures is cash flow (after capital expenditure), which was just 53% of adjusted profit. The company explains that weaker cash flow was mostly due to working capital movements related to the acquisition of SDL, which should reverse in the current year. Capital expenditure also increased because of investment in software, which is likely to continue.

Scoring RWS

RWS has diversified away from its dependence on patents, a lucrative business in a relatively small market that is somewhat sensitive to fluctuations in the economy and potentially also to a change to European law when the much-delayed European Unitary Patent comes into being. That part of the business now contributes 16% of total revenue.

But RWS does not appear to have diworsified. Profit margins have declined somewhat, latterly due to the higher cost base of SDL. This has been more than compensated for by higher volumes of translation, perhaps due to automation. RWS is committed to reducing administrative costs, and return on capital is as high as it has ever been.

- Five AIM share tips for 2022

- From AIM to Main: does moving markets make sense?

- Watch our share tips here and subscribe to the ii YouTube channel for free

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

The acquisition of SDL was not the only big change in the year to September 2021. An outsider, Ian El-Mokadem, took over as chief executive in July, after the resignation of Richard Thompson. Des Glass, who replaced Thomson as chief financial officer when he was promoted, is also leaving.

The chief source of continuity in a rapidly changing and increasingly complex business remains the company’s chairman and major shareholder, 81-year-old Andrew Brode, who owns 23% of the shares.

Brode is a committed owner-manager. He acquired RWS with the investment firm 3i in 1995. Last summer he told Forbes: “I’m known in the City for the fact that I have never sold a single share...I tell all my mentees that equity is blood and don’t sell unless you have to.”

The company also writes seriously about its culture. It says 80% of colleagues would recommend RWS as an employer, and identifies attracting and retaining skilled employees – closely followed by data privacy and client satisfaction – as the most important factors in running the business sustainably.

Despite its nurturing policy, about 14% of staff leave voluntarily each year. The company says it is comfortable with this figure, although it looks high compared to some of the other high-quality businesses I follow. Perhaps it is a high turnover industry.

The biggest quandary I experienced scoring RWS is one on which I am ill-equipped to adjudicate. It is the impact of machine translation, which is disrupting the whole industry. Bringing machine translation in-house, though, makes RWS one of the disruptors.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

+ Strong cash flow

What could stop it growing profitably? [1]

+ Strong finances, blue chip clients

? Technology is disrupting the industry

? Business is increasingly complex

How does its strategy address the risks? [2]

+ Acquisitions target profitable language niches

+ Technology platforms position RWS to benefit from disruption

+ Broader portfolio means more services to sell customers

Will we all benefit? [2]

+ Chairman is RWS’ major shareholder and very experienced

+ Employees and client satisfaction are focuses

? Remuneration is aligned at FTSE 250 median, which is considerable

Is the share price low relative to profit? [-1]

+ No. A share price of 496p values the enterprise at a normalised enterprise multiple of 24 times adjusted profit.

A score of 6 out of 9 means RWS probably is a good long-term investment. It is ranked 17 out of 40 companies by my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.