Richard Beddard: this conclusion might shock some of you

25th June 2021 14:58

by Richard Beddard from interactive investor

Our companies analyst has surprised himself with his latest analysis, giving this recovering small-cap stock a big score.

Last September I liquidated the Share Sleuth portfolio’s holding in Portmeirion (LSE:PMP), a manufacturer of tableware and other homewares. The recent publication of its annual report is an opportunity to reconsider.

Lost coherence

The company had struggled for many years to deter sales between territories. Grey imports undercut Portmeirion’s distributor in South Korea where Portmeirion Botanic Garden is the leading tableware brand and sells for high prices. With much of the demand satisfied by these imports, Portmeirion’s distributor would be left with too much stock in its hands periodically.

South Korea is Portmeirion’s third-biggest and only substantial market after the USA and the UK. The feast followed by famine pattern of demand had a knock-on-effect on volumes going through Portmeirion’s factories, which operate less efficiently in famine years, increasing costs and reducing Portmeirion’s profitability.

Feast and famine made it difficult to judge whether Portmeirion was growing sustainably.

Portmeirion has also diversified in recent years. Prior to the acquisition of scented candle maker Wax Lyrical in 2016, the company was focused mostly on tableware. It had acquired other venerable British potters very cheaply out of administration and turned them around, but these were similar businesses to the home grown, and highly successful Portmeirion brand.

Portmeirion’s strategy then was straightforward. It would produce new designs and refresh old ones to increase the popularity of its plates. It licensed patterns from famous designers like Sophie Conran as well as developing and acquiring its own. For a while it traded on its Britishness.

- Two valuable lessons for every investor

- The ii Family Money Show with Gabby Logan: watch the Richard Curtis interview here

- 10 speculative high-flying stocks beating the market

- Open an ISA with interactive investor. Click here to find out how

Made in the Lake District, Wax Lyrical is also very British, but sales were largely confined to these shores. Portmeirion thought it could use its established distribution channels to export scented candles and reed diffusers too (it still thinks that, but exports are a long time coming).

Coherence regained

Portmeirion followed up with the acquisition of Nambé in 2019, a US brand of tableware, kitchenware, and home décor. The USA, where Spode Christmas Tree is a popular brand of tableware, was already Portmeirion’s biggest export market and the company saw the opportunity for synergies, although Nambé is not a potter, its tableware products are made from wood and metal.

Developing new designs is hard, and Portmeirion has never managed to develop one to match Botanic Garden. The acquisitions suggested to me that it was shifting emphasis, but acquisitions are also risky.

Acquisitions require Portmeirion to be good at distribution, but its track record is patchy. Not only had it struggled to deal with the grey trade, it had also failed to establish Portmeirion in, for example, Japan, demonstrating that its brand appeal is not universal.

In addition, Portmeirion had to contend with a change in the way physical goods are distributed due to the rise of internet shopping.

Perhaps the final straw came during the pandemic when the company, which had repurposed candle production lines to make hand sanitiser, announced it was going to launch a hand and body care range (the launch is imminent).

I felt Portmeirion was not just spinning too many plates, but knives, forks, glasses, candles, pots, pans, wallpaper, picture frames, vases and bottles of hand creme and body wash. Its strategy seemed to have lost coherence.

The company’s long standing chief executive retired in September 2019, and Portmeirion promoted finance director Mike Raybould to the top job. This year’s annual report covers his first full year as chief executive, so perhaps there has been a change in the strategy, or its presentation, or both.

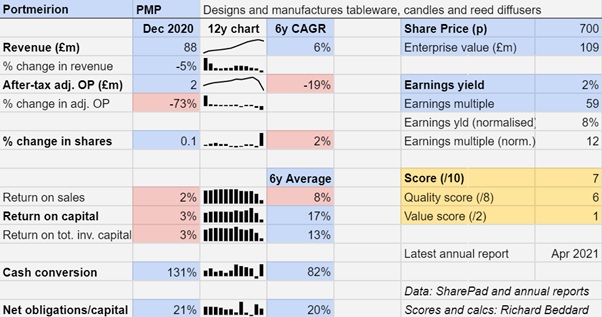

In the year to December 2020, revenue fell 5% (11% like-for-like) and adjusted profit fell 73%. The closure of retailers reduced volumes going through Portmeiron’s factories, increasing costs. The combination of lower sales and higher costs meant much reduced profit.

In the UK and the USA, where Portmeirion operates online stores and sells through online retailers, the damage to revenue was limited.

In South Korea, where the company quashed grey imports, revenue fell 37%. Portmeirion says its distributors’ sales have increased 15% though, which may mean it has finally got to grips with the problem by, it says, designing unique products for its South Korean distributor. It expects revenue to grow in a steadier fashion from these reduced levels.

No doubt troubles in South Korea explain the apparent decline of Botanic Garden, still the company’s biggest selling brand. In 2015 Portmeirion sold £33 million of Botanic Garden. In 2019 the company reported sales over £25 million, and in this year’s annual report the company discloses ongoing sales over £20 million.

- How the AIM market took over the world in 2020

- Inflation watch: nowhere to hide for savers following cost of living shocker

- Read more of our content on UK shares here

Portmeirion believes its biggest opportunity is online. In the UK online sales rose 69% in 2020. It achieved nearly 13% of UK sales through its own website at higher margins than distributor sales.

Portmeirion has shared a digital roadmap that promises to improve its websites and customer data, reformat products and packaging for an online market, and build warehouse capacity and capabilities.

It is also promising to “improve the vitality rate” of product development, led by a new Sophie Conran for Portmeirion collection of contemporary tableware.

Sophie Conran for Portmeirion. Source: portmeirion.co.uk

And it wants to build two or three new significant markets in the Far East, the Middle East and Europe, where it has refreshed management teams and signed up new distributors.

It is reducing factory costs through automation and increased capacity, and lower procurement costs.

At the AGM in May, Portmeirion said revenue in the first four months of the year was modestly ahead of 2019 on a like-for-like basis, before the pandemic, although most of its sales are earned in the second half year.

On the face of it, Portmeirion has gone back to basics. It is still spinning lots of plates, but actually I am more favourably disposed to the company.

Scoring Portmeirion

Better products, lower operating costs, and more direct sales should lead to more sales at higher profit margins. And Portmeirion is so busy hiring digital marketing executives, building websites, improving its factories, and launching new products, it has not got time for acquisitions.

In a presentation in March acquisitions were not one of the strategic priorities listed (though they get a very brief mention in the annual report).

Chief executive Mike Raybould said: “We have got a lot of work to do with the six brands we already own and so my first priority is to deliver on the opportunity that we see for those six brands... Further down the line if there is a compelling acquisition opportunity that comes along, then absolutely we would consider it.”

The situation is complicated by the pandemic, which dramatically reduced profit but so far I do not believe either of Portmeirion’s recent acquisitions have delivered on their promise.

Nambé did not contribute to Portmeirion’s diminished profit in 2020, and home fragrances’ contribution to profit was a fraction of the £2.1 million Wax Lyrical earned in 2015, its last year as an independent company. More worryingly in 2019, home fragrances only earned Portmeirion £1.1m.

The level of detail disclosed by the company has also increased. Portmeirion is communicating with investors better, and that is reassuring.

Does the business make good money? [2]

+ Good cash conversion

+ Good average return on capital

? Adequate average return on sales (though trending downwards)

What could stop it growing profitably? [1]

? High fixed costs impact profitability in recessions

? Heightened competition due to internet and leakage between markets

? Cost and suitability of recent acquisitions

How does its strategy address the risks? [1]

+ Investment in online capabilities and product development

+ Focus on manufacturing and procurement efficiency

? Potential for more acquisitions?

Will we all benefit? [2]

+ Employee friendly. Committed to National Living Wage

+ Improved communication with shareholders

? New executives have modest shareholdings

Is the share price low relative to profit? [1]

? Yes. A share price of 700p values the enterprise at about £109 million, about 12 times normalised profit.

Portmeirion still has much to prove. It must show that its attempts to stabilise South Korea have worked. And its strategic initiatives must lead to greater sales and higher margins than before the pandemic.

I have surprised myself though. A score of 7 out of 9 indicates Portmeirion should be a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor. He owns shares in Churchill China.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.