Richard Beddard: the company that plays at Glastonbury every year

4th March 2022 15:57

by Richard Beddard from interactive investor

This small-cap expert in train travel and festival parking has done well over the years, but there’s change at the top. Is our stocks analyst right to be nervous?

The year before Covid-19 struck, Tracsis (LSE:TRCS)’ founder and long-standing chief executive stepped aside. Last year its chief financial officer moved on too.

As the pandemic recedes, we are beginning to get a clearer picture of the business the new duo are building.

Running road and rail

Tracsis primarily supplies software, hardware and consultancy services that help train operators, infrastructure providers like Network Rail, and transport authorities manage railways and roads more efficiently.

It also manages traffic and parking at events. CTM, one of Tracsis’ events subsidiaries, has managed transport at the Glastonbury Festival since 1998.

The company’s first product was rail crew scheduling software, but over the last 18 years Tracsis has grown and diversified through almost as many acquisitions as it has had years.

The traffic and event management side of the business was stymied by the pandemic but is recovering now. Meanwhile, the strategic focus is on four technology platforms and Tracsis’ capabilities in data and geographic information systems (GIS).

- Share Sleuth: my first trades of 2022 lead to a new holding

- Richard Beddard: could this firm be a stock market darling again?

- Read more of Richard Beddard's articles here

- Check out our award-winning stocks and shares ISA

Tracsis has brought together some of its software as modules in TRACS Enterprise, a software suite for rail operators that includes crew-scheduling, but also many other modules like rolling stock planning, incident management, and asset management.

The company also has a large installed base of trackside remote condition monitoring equipment, sensors and data loggers that monitor level crossings, track, wiring and signalling systems, These enable infrastructure providers to detect and predict faults.

Also for infrastructure providers, another Tracsis subsidiary automates risk management and health and safety through RailHub, a mobile app that checks workers have the right skills for a job and provides them with all the information they need to do it.

Tracsis’ fourth product platform is smart ticketing solutions including smartTIS, which is much like an Oyster Card for mainline commuters. Tracsis says it is the only UK accredited account-based ticketing solution. It is already used by 20% of the rail network including Southern, Thameslink, Great Northern and South Western.

The company’s fifth strategic priority is perhaps its newest, a data and analytics business welded together from three acquisitions: Compass Infomatics, Flash Forward, and Icon GEO that helps customers across the road, rail and utility industries know where their assets are and how they are performing.

Profitable growth

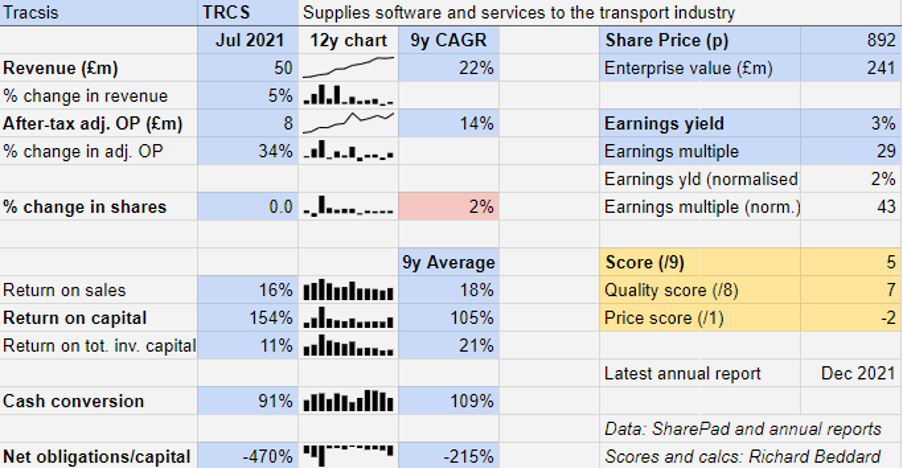

If that sounds complicated, the financial results are not. Highly profitable and cash generative, profit contracted somewhat as the pandemic shut down activity in the traffic management and events businesses, but the dent is barely visible in Tracsis’ long track record of profitable growth.

Past performance is not a guide to future performance.

The company continued to prosper due to the resilience of its rail technology platforms, revenues from which are largely insensitive to fluctuations in passenger numbers. This coupled with redundancies and other cost saving measures in the traffic and events businesses, contributed to a rebound in profit in the year to July 2021.

In a trading update for the first six months of the current financial year, which ended in January, Tracsis said that the traffic and events businesses had recovered strongly, which is auspicious for the full year.

Scoring Tracsis

I like Tracsis. It exists to make transport more efficient, which has got to be a good thing. It is complicated because it is a collection of niche businesses, but niches can be profitable and Tracsis, in aggregate, is very profitable.

But its various activities are not equally profitable or resilient. The newly defined Data, Analytics, Consultancy and Events division commands adjusted EBITDA (profit) margins in the low-double digits, compared to 30% plus for Rail Technology and Services.

It employs technology to gather and analyse data, but it is less technological. It does traffic surveys and provides stewarding for events, for example.

The technology focus of the Rail business means a much greater proportion of revenue is defined as recurring or repeating business (about 70% compared to 40% for Data etc.).

Data, Analytics, Consultancy and Events sounds like a hodgepodge and I wonder whether some of Tracsis’ diversifications have increased the complexity of the group without adding much value to it.

- When markets fall heavily, here's what to avoid doing

- 10 ways to manage your ISA allowance at tax year-end

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

The company is knitting its disparate businesses together. It has launched group-wide branding, expanded shared back-office functions, and launched an innovation hub. From now on, chief executive Chris Barnes, says smaller acquisitions will be integrated into existing businesses rather than stand alone.

But, with £25 million in cash on the balance sheet at the year end, he is also pursuing larger acquisitions.

I think Tracsis' rail niches are earning more money than it can profitably reinvest in them. The company believes the division’s addressable market is £100 million in the UK, and it already has more than a 25% market share.

One solution is to expand overseas, but this has been an ambition for many years and it has not gone far. In 2021, Tracsis earned 88% of revenue in the UK, and 98% from the UK and Ireland.

A contract for remote condition monitoring equipment won by the company’s North American reseller and destined for a “major transit agency” sounds promising, but this equipment is relatively straightforward to sell abroad as it just requires a different power supply. Maybe the UK optimised software products are less straightforward to export.

Following the acquisition of its Irish business Compass in 2019, which is at the heart of the new Data and consulting division, Tracsis may be planning to grow the consultancy side of the business in Europe.

That is a big addressable market, but consultancy is less easy to differentiate and the market is likely to be competitive.

Does the business make good money? [2]

+ High return on capital

+ High profit margins, especially in Rail

+ Strong cash conversion

What could stop it growing profitably? [1]

+ Very strong finances, resilient businesses

? Widening niches is difficult

? Growing overseas is proving difficult too

How does its strategy address the risks? [2]

+ Organic growth focused on four technology platforms

+ Overseas expansion will increase market

? Larger and overseas acquisitions may be more risky

Will we all benefit? [2]

? New management

+ Communicates well with shareholders

+ Executive pay is not excessive

Is the share price low relative to profit? [-2]

+ No. A share price of 892p values the enterprise at about £241 million, about 43 times normalised profit (the return it would have made had it earned its average return on capital over the last nine years).

A score of 5 out of 9 indicates Tracsis is probably a good long-term investment, but the high share price and prospect of larger, perhaps overseas acquisitions makes me nervous, particularly if they expand the consultancy business

Chris Barnes should be alive to the risk, he was recruited from Ricardo, an engineer that married a consultancy and acquired many offspring. The marriage has yet to thrive.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.