Richard Beddard: the challenge of scoring two top-flight companies

Our columnist digs beneath the surface of a language services company and manufacturer.

12th February 2021 15:50

by Richard Beddard from interactive investor

Our columnist digs beneath the surface of a language services company and manufacturer.

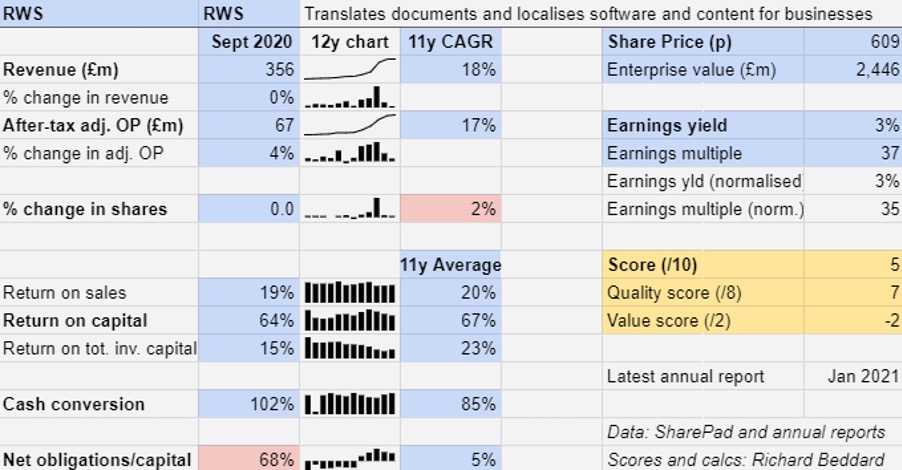

By a series of acquisitions RWS (LSE:RWS) has transformed itself from a specialist patent translator and filer into the world’s leading language services company, albeit with sales amounting to only a per cent or two of a market estimated to be worth more than $50 billion (£36.17 billion).

A new force forged in Bucks and Berks

The deal-making has increased the scope of RWS’s activities, introducing it to new geographical and commercial markets, and, perhaps most important of all, new capabilities.

The high point of this acquisition activity occurred a few months ago in November with the purchase of SDL, another big name in language services. It is headquartered in Maidenhead, only a few miles away from RWS.

RWS had already acquired new and lucrative language niches translating technical documentation for drug companies and localising websites and software for technology companies.

It had also embraced machine translation through the acquisition of software firms and translators with more machine translation expertise.

The acquisition of SDL extends the proliferation of markets and capabilities. SDL’s homepage boasts that 90 of the world’s top 100 brands are customers. While its translators translate 1.4 billion words a year, its machines translate 300 billion.

Digesting SDL is RWS’s main focus this year. It will use SDL’s language technology throughout the business and sell SDL’s customers specialist language and intellectual property services, while combining administrative functions and reducing costs.

SDL’s chief technology officer has taken on the role for the enlarged group as RWS makes machine translation and content management into new competitive advantages.

Software enables more translation at a lower cost, allowing language services businesses to scale more rapidly. It could be turning what was something of a cottage industry into the kind of winner-takes-all environment we are seeing in other digital industries.

That probably explains why RWS is in such a rush.

2020 figures already out of date

The acquisition of SDL is not yet reflected in the numbers because it took place after the financial year ended in September, but we can expect leaps in revenue, profit, and the share count next year because RWS paid for SDL in shares.

The company’s continuing ability to earn high returns on capital will be the acid test of the acquisition strategy though.

The pandemic left a small mark on the year to September 2020 in a reduction in the number of patents filed. The company earned no more profit than it did the year before. It earned typically high returns on capital and cash conversion was strong.

During the first quarter of 2021 (October to December 2020) RWS reported double digit growth in pre-tax profit, helped by SDL, and it repaid borrowings used to finance its earlier acquisitions.

Scoring RWS

I think RWS is awesome. The problem is the light is blinding.

The benefits of the strategy are there for us all to see. It addresses risks like the much-delayed EU Unitary Patent, which for years has threatened to reduce the amount of patent translation required in Europe.

In this year’s annual report the Unitary Patent gets only one mention in a list of potential legal and regulatory risks. The company has simply diversified away its geographical dependence on Europe and intellectual property.

- Richard Beddard: to diversify or not to diversify?

- Are you saving enough for retirement? Our calculator can help you find out

But the means of diversification, large acquisitions, is risky. The company must integrate SDL, a business with many clients outside of RWS’ existing niches, and which has itself acquired technology and reportedly struggled to integrate it.

While the company’s prior acquisitions were probably judicious, SDL is another step up.

To buy SDL, RWS issued over 113 million shares, valuing the company at more than £850 million or about 22x SDL’s adjusted operating profit in its most recent financial year.

The cost was about 13x RWS’ adjusted operating profit before the acquisition.

That is serious money. Time will tell whether it was well spent.

Does the business make good money? [2]

+ High and consistent return on capital

+ High and consistent profit margins

+ Strong cash flows

What could stop it growing profitably? [1]

+ Not very cyclical, low borrowings

? Big acquisitions are risky

? Machine translation is disrupting the industry

How does its strategy address the risks? [2]

+ Industry diversification reduces risk of e.g. Unitary Patent

+ Machine translation drives down cost, is more scalable

+ Scale drives efficiency

Will we all benefit? [2]

+ Chairman is major shareholder and very experienced

+ Executive pay not excessive (by today’s standards)

+ Employee friendly

Is the share price low relative to profit? [-2]

− No. A share price of 609p values the enterprise at about 35 times adjusted profit.

A score out of five ranks RWS 23 out of 38 shares in the Decision Engine. It may be a good long-term investment but the share price leaves little room for error, and large acquisitions create the opportunity for that.

DWHT or DWHA?

The share ranked number one by my Decision Engine in January was Dewhurst (LSE:DWHT), a manufacturer of lift components, transport products, and keypads for ATMs. I also scored the company last week and the two articles led to a flurry of questions from readers.

One reader asked if I had any thoughts on Dewhurst’s two classes of shares, DWHT or DWHA, also known as the ordinaries and the A ordinaries. The shares confer the same rights except if you buy the A shares you sacrifice the right to vote at company meetings.

The chart above shows the prices of the two classes. In the 1990s, the A shares sometimes achieved parity, although since then the spread (difference in price) has increased.

The widest spread since 1994 was achieved a few days ago on 8 February. Then, an A share costing 750p was worth just 42% of an ordinary share worth £17.75. At the time of writing, an A share is worth a little more (44% of an ordinary).

I do not know what the right spread is, but £10.25, the difference in price on 8 February, seems a high price to pay for a vote that is unlikely to count since the Dewhurst family own most of the shares.

Although the A shares have performed less well than the ordinaries, they are much cheaper, which means we will collect more dividends for the same outlay and the yield is higher. In 2020, the company paid out a total dividend of 13p, a modest 0.7% yield on the ordinaries. The yield on the As was a somewhat more respectable 1.7%.

For what it is worth, I own some of each class in my pension. That is partly because, when in doubt, I prefer to hedge my bets. But also because although I dream of the spread narrowing and a more rapid appreciation in the A price, I do sometimes vote at AGMs. Therefore, companies know what I think even if the modest amount of shares I own carries little weight.

The Share Sleuth portfolio only contains ordinaries. I cannot remember why. Probably I was just trying to keep things simple!

Richard owns shares in both classes of Dewhurst shares.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.