Richard Beddard: this cash-rich company could be very good value

7th July 2023 15:57

by Richard Beddard from interactive investor

Results for 2022 when it achieved double-digit profit growth were better than average, and our columnist believes this AIM share is one to own.

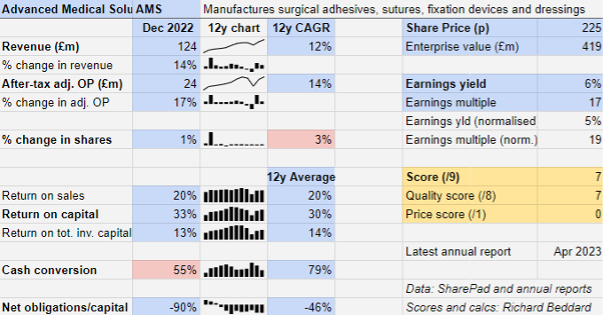

Growth in the year to December 2022 propelled revenue and profit at Advanced Medical Solutions (LSE:AMS) beyond pre-pandemic levels. That followed a couple of years when hospitals performed less surgery than usual, and AMS earned sub-par but nevertheless respectable profits.

AMS makes adhesives, sutures, synthetic bone substitutes, collagen sponges and dressings that doctors and nurses use to help us heal after we have been cut open by surgery or accidents.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

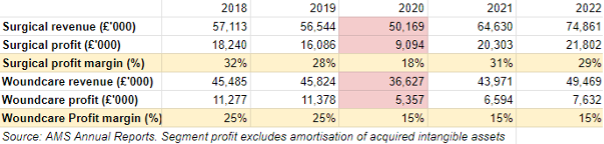

The company is organised into two business units. The larger and more profitable one, Surgical, makes and sells the products that go inside us under a variety of AMS brand names.

The Woundcare division makes and sells dressings, mostly for other manufacturers. AMS owns a brand, ActivHeal, but it avoids competing with customers by distributing the product mostly where they do not operate.

The company’s results for the year to December 2022 were slightly better than average. It achieved double-digit growth in profit, and a return on capital of 33%.

The only pink flag was cash conversion. While profit increased in 2022, cash flow declined as AMS funded more stock to reduce the impact of shortages, and to cope as products transition to the new European Medical Devices Regulation (MDR) regime. At the end of the year, though, the deadline for compliance was extended from 2024 to 2027 or 2028 (depending on the device).

The other big drain on cash was an increase in investment to comply with new regulations and develop new products.

Given good average cash conversion and AMS’ net cash position, we probably do not need to worry about one poor year of cash conversion. Its ability to secure supply and invest is a strength, not a weakness.

Complex competitive environment

The new regulations may be a blessing rather than a curse. Making sure products comply with the regulations is expensive, but that may mean rivals retire products in categories in which AMS continues.

Nevertheless, AMS operates in competitive environments. Low-cost competitors from the Far East compete with big brands, divisions of Johnson & Johnson (NYSE:JNJ), Smith & Nephew (LSE:SN.), and 3M Co (NYSE:MMM), for example.

- Shares for the future: five factors I use to score shares

- Stockwatch: dividend supports this share until good times return

To add to the pressure, customers band together in buying groups to negotiate a better deal with suppliers. This reduced demand for LiquiBand in the US, when buying groups opted for cheaper products.

Currently the Woundcare division is under similar pressure. Governments and insurance companies that pick up the bill for procedures, and products restrict how much they will pay for them, which is resulting in the use of standard dressings over higher priced anti-microbial alternatives.

Perhaps this explains why margins in the Woundcare division, which supplies dressings primarily, appear to be under pressure:

Since 2020, Woundcare has only achieved a 15% profit margin, compared to 25% in 2018 and 2019. The Surgical division is twice as profitable.

AMS’ most successful product range is the tissue adhesive LiquiBand, which has a 20% share of the US market by volume and accounts for 48% of the bigger and more profitable Surgical division’s revenue.

The fruits of investment

Investment has driven LiquiBand’s growth. In 2021, LiquiBand sales recovered after the launch of LiquiBand Rapid, a new quick drying version of the adhesive, and the brand should continue growing as its R&D pipeline continues to bear fruit.

In the second half of 2022, Liquiband sales received a boost from the US launch of LiquiBand XL, for closing large wounds, and AMS should be selling LiquiBand Fix8 in the US next year after it has been approved.

AMS describes this product, an adhesive already marketed in Europe that fixes hernia mesh, as the first product of its kind in the US and a “significant opportunity”. It is an alternative to staples and tacks, which are more painful and lengthen recovery time.

The US market is important because of its size, the fact that LiquiBand is very profitable, and most of LiquiBand revenue (65%) comes from the US.

But the growth of the product line in the US seems to be under pressure again, at least temporarily, despite the new products, and this time it is self-inflicted.

- When companies leave AIM for Nasdaq: is the grass greener?

- Five of AIM’s most attractive dividend stocks

AMS says a strategic review of its distribution partners, reduced LiquiBand sales in the second half of 2022. At constant currency it earned less revenue from LiquiBand in 2022 than it did in 2021. Because this trend has continued into 2023, it has cast a pall on profit forecasts.

AMS tells me it has elevated one of its three main US distributors to be the main reseller of the LiquiBand product, an arrangement that should incentivise it to market LiquiBand more heavily and, the company hopes, lift market share in the USA from 20% towards 50%.

The other two distributors will have different roles, one of them fulfilling orders won by AMS directly and the other selling products to be launched by Connexicon, another tissue adhesive brand acquired by AMS in February.

As a result, these companies are winding down stocks of LiquiBand, which is why AMS’ revenue has been impacted. The good news is, AMS says order patterns should be normalising this summer and the company is “highly confident” of re-igniting LiquiBand growth in the US.

Closer to home, following clinical trials, Seal-G is scheduled for its European launch in the current year. It is an internal sealant used in gastrointestinal surgery originally developed by Sealantis, a company AMS acquired in 2019.

In the second half of the last decade, AMS may have been resting on its laurels a bit, and R&D spending fell to 4% of sales. Since then, the ratio has improved to 10%, which augurs well, and for the first time in five years the proportion of products sold in the previous five years has increased (15.4% compared to 13% in 2021).

Perhaps the two statistics are connected.

Acquisitions

In addition to innovation, AMS seeks to grow through acquisition. In recent years these have included Raleigh Coatings, a supplier of silicone coatings and perforations for dressings, in 2020 and AFS, an Austrian distributor of surgical devices, in 2022.

After the year-end in February 2023 AMS added Connexicon Medical, which brings new tissue adhesives and an R&D hub in Dublin.

Hitherto the acquisitions have been small and played second-fiddle to organic growth, but the company is mooting larger “more transformational” deals, which may be why I feel a little trepidation.

I do not think the company needs transformation, and I do not like the potential for disruption.

Scoring AMS

I like AMS. The company generates good returns for shareholders, and it wants “a world where the outcome of every patient can benefit from our products and a company where every employee feels invested and valued.”

Employees seem to be happy. Employee attrition increased to 13% in 2022, which is high by the standard of the previous five years. AMS puts it down to global labour shortages, which is making employers compete much more intensely for staff.

This may be true, because employees are not in themselves dissatisfied. AMS reports an employee engagement score of 84%, the highest in the last five years.

The executives must deserve some credit. Chris Meredith, CEO, joined in 2005 and became chief executive in 2011. Eddie Johnson joined in 2005 and became chief financial officer in 2019. Reassuringly, below board level many of the senior management team have been promoted into their current roles.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Strong average cash conversion

What could stop it growing profitably? [1]

+ Cash rich

? Complex competitive environment

? LiquiBand dependency

How does its strategy address the risks? [2]

+ Innovation

+ Vertical integration

? Potential large acquisition

Will we all benefit? [2]

+ Experienced board

+ Happy employees

+ Improves patient outcomes

Is the share price low relative to profit? [0]

+ It is reasonable. A share price of 225p values the enterprise at about £419 million, 19 times normalised profit.

A score of 7 out of 9 indicates AMS is probably a good long-term investment, and if the current issue with distributors in the US is temporary, it could be very good value.

AMS is ranked 13 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.