Richard Beddard: Carex owner needs more than strong hand gel sales

A corporate culture shift is on the cards, and the company is also changing its formula.

13th November 2020 15:10

by Richard Beddard from interactive investor

A corporate culture shift is on the cards, and the company is also changing its formula. How can investors react?

Judging by recent developments Carex owner PZ Cussons (LSE:PZC) has a debatable corporate culture, but maybe more traditional and deeply rooted values are reasserting themselves.

After he retired in January, longstanding chief executive Alex Kanellis was stripped of his bonus and his retirement settlement because of “cash payments and withdrawals” made over a number of years.

The company has also been without a chief financial officer since June 2019, when Brandon Leigh, who had also been with the company for decades, left.

By the time Kanellis left, the company’s growth strategy had already unravelled. This was partly due to the weakness of the oil-dependent Nigerian economy, which was, not so long ago, PZ Cussons’ biggest market, but maybe also because the company was slow to respond to changes in the way consumer goods are sold.

- Share Sleuth: Why I have sold Castings and added shares in Next

- Share Sleuth: putting profits to work to add a new holding

Until the new chief executive arrived in May, it was Caroline Silver who steered the company through this slow-motion reckoning and the early days of the coronavirus pandemic. Silver was a banker who joined as a non-executive director in 2014, became chair in 2017 and briefly executive chair in 2020.

She continued to execute a recovery strategy conceived when Kanellis was chief executive.

Good brand/bad brand

The strategy, to focus on the brands with the most potential, promises to correct the company’s prior diversification, which shovelled cash and management time into less successful brands, and deals with the reality that Nigeria is a much less profitable market than it was.

PZ Cussons has valuable brands. Production of Carex, the UK’s leading hand wash brand, increased threefold during the pandemic to feed increased demand, including donations to vulnerable sections of society.

Carex’s success, though, was at the expense of some of PZ Cussons’ other leading brands. These include Original Source, the UK’s number one vegan shower gel, and Imperial Leather, as production resources were diverted to Carex.

PZ Cussons is staking its future on big brands like self tanning product St Tropez. Source: PZ Cussons

Some products, like fake tan St Tropez, lost relevance during the pandemic, but the company expects America’s leading premium tanning brand to play a major part in the recovery. This will be helped by a new vitamin-infused range “known to mimic the effects of the sun”, plus a renewed focus on digital sales.

In Nigeria, the focus is on Haier Thermocool, a 50-year-old domestic appliance brand and joint venture that is, according to PZ Cussons, Nigeria’s leading supplier of refrigerators, freezers and washing machines.

The focus is on personal care and beauty brands, which the company aims to derive 80% of its revenue from within five years. It is retaining a few homecare brands like Morning Fresh, Australia’s leading washing up liquid, though.

With abundant choice and intense price competition due to online retailers and knock-off brands from discount retail chains, PZ Cussons thinks it is easier to differentiate personal care and beauty brands through innovation and marketing.

Can-do attitude

Perhaps PZ Cussons’ deeply rooted culture is reasserting itself.

The company traces its origins back to 1884, when George Patterson and George Zochonis set up a trading post in Sierra Leone, and its brand acumen dates back at least as far as 1975 when it acquired Cussons.

- Richard Beddard: analysing the RBLI poppy paper maker

- Find out more about interactive investor SIPP and pensions here

Although the founding families and their interests are not represented on the board, by my reckoning Zochonis family interests own about 34% of the shares. They are surely using their influence to keep the company focused on long-term, sustainable business practices.

Like many family businesses PZ Cussons says it treats its employees like an extended family with a flat culture that fosters open communication underpinned by its ‘CANDO!’ culture (Courage, Accountability, Networking, Drive, Oneness).

The company’s determination to leave a legacy is also reflected in its sustainable approach to sourcing ingredients and packaging.

How the arrival of a new chief executive from outside the business will adjust the company’s strategy remains to be seen. New chief executive Jonathan Myers had barely got his feet under the desk by the financial year-end in May. He joined at the beginning of the month, four months or so after his predecessor left.

Reassuringly, rather than waiting to be given shares as part of his performance related pay, Myers bought 50,000 shares in September for over £113,000.

Also reassuringly, he was previously chief operating officer at Avon Products, where he was focused on the nuts and bolts of running a business, with “global responsibility for supply chain, marketing, digital, research & development and IT”.

There is no mention of flashy acquisitions in his CV, and no mention of ambitions to make any in the company’s annual report, which is a good thing as acquisitions too have been part of PZ Cussons’ troubles.

Under the new strategy the company has made disposals. In August 2019 it sold Minerva, a Greek food business, and Luksja, a Polish personal care brand. In March this year it sold Nutricima, which sells powdered milk in Nigeria.

PZ Cussons’ is persevering with its Australian food brands for now, although it has reportedly tried to find a buyer for five:am, a brand of yoghurt. A relaunch of baby food brand Rafferty’s Garden in 2019 merely flattened its declining sales.

Fading financials

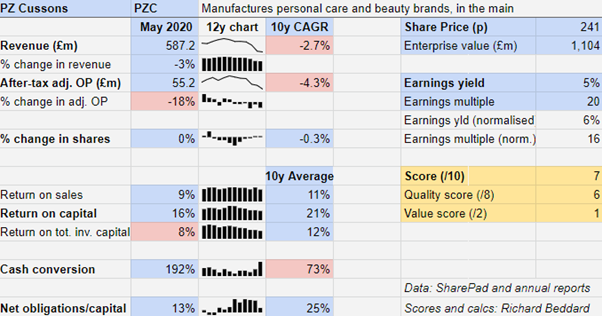

In the year to May 2020 revenue fell 3% as runaway sales of Carex were unable to stem the impact of the pandemic on other brands. Adjusted profit fell 18%. The declines follow similar falls last year and the company is making less money than it was ten years ago.

It remains pretty profitable though. After tax, adjusted return on capital was 16%, 5% below the average.

On a reported basis return on capital was just 8%.

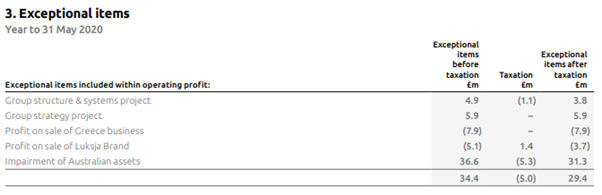

Source: PZ Cussons annual report 2020

The company is ignoring some pretty hefty costs in calculating its preferred measure of profit (see table above).

The biggest, a £36.6 million writedown in the value of fiva:am and Rafferty’s Garden follows large writedowns in the value of five:am and Nutricima in the previous year.

Although the writedowns are not operational losses, and should be ignored in judging the company’s performance in 2020, they are an indictment of its earlier acquisition strategy.

The Structure & Systems project is restructuring costs as PZ Cussons streamlines its headquarters and regional offices. The company has treated restructuring costs as ‘exceptional’ every year since 2014, which makes me question just how ‘exceptional’ they really are.

The Group Strategy project refers to costs associated with the disposal of Nutricima, which might rightly be deemed one-off costs.

All in all, the accounts are not pretty, as we might expect of a company going through a transition.

Hopefully that may change under new management, apparently brought in to get PZ Cussons innovating new products and marketing already successful brands.

Scoring PZ Cussons

PZ Cussons is difficult to score because the past is tainted by failure, and the company is preparing for a multi-year turnaround, starting, it says, with another comprehensive review of strategy.

Does the business make good money? [1]

? High returns on capital blighted by adjustments

? Ditto profit margins

? Modest cash conversion improved markedly in 2020

What could stop it growing profitably? [1]

+ Strong finances

+ Demand should be resilient in recessions

- Strong competition online, and from discount brands

How does its strategy address the risks? [2]

+ Focus on higher margin beauty and personal care

+ Investment in development of distinctive products

+ Working on a digital transformation programme

Will we all benefit? [2]

+ Long-term ethos due to family ownership

+ Treats employees well

+ Commitment to sustainability and the environment

Is the share price low [1]

+ A share price of 240p values the enterprise at 20 times adjusted profit in 2020, or 16 times normalised adjusted profit

Backing a company that has to change to improve, rather than persisting with an already successful formula, is risky. But I think PZ Cussons is an interesting speculation.

It scores 7/10 and is ranked 10 out of 36 shares in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.