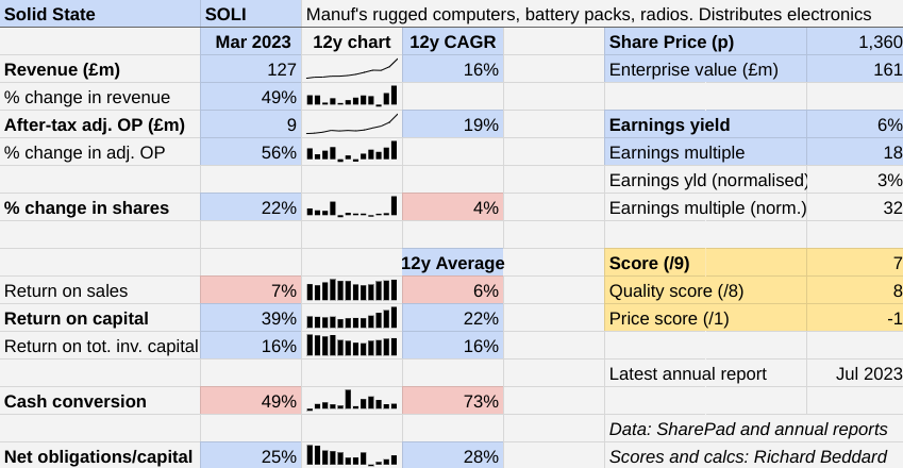

Richard Beddard: can this specialist share continue a spectacular run?

Our columnist considers whether this small-cap tech stock can move from good to great, and whether recent strong performance is the new normal.

11th August 2023 15:31

by Richard Beddard from interactive investor

Solid State (LSE:SOLI) is one of those rarities, a business that prospered throughout the pandemic, and then prospered through the subsequent years of shortages and inflation.

The company has performed better over the last three years than it ever has before, and its performance before was far from shabby.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

The company has two divisions: Systems, which assembles computers, battery packs, and radios and antennas, and Components, which distributes third-party and own branded electronic components.

Because Solid State adds value by designing systems and configuring components it collaborates closely with industrial, healthcare, defence and transport equipment manufacturers and end-users.

The businesses in each division share suppliers and customers, which means they can help each other with sourcing and refer business to each other.

Historically, Components has been a low-margin but efficient and relatively easy to scale business. Assembling systems gives Solid State more opportunity to add value and earn higher margins, but the bespoke nature of the products makes it harder to scale.

The combination is highly profitable, and growing quickly.

Trusted technology for demanding applications

Solid state’s strategy is summed up by its mantra “Trusted technology for demanding applications”.

Many of Solid States products are used in hazardous or high-security environments. It requires specialist skills and accreditations, and sometimes combinations of accreditations, to handle this material and information.

The company is growing by broadening its product portfolio, widening its geographical footprint, and by developing its own brands of components and easily customisable products. It has also established a product development consultancy to advise the company’s businesses, and other clients.

The acquisition of Custom Power for the Systems division a year ago makes the US Solid State’s second-biggest geographical market after the UK. The company is planning to establish component distribution channels in continental Europe and the US, where it is also planning to manufacture antennas.

- Shares for the future: why the rule of three could be the answer

- DIY Investor Diary: how I invest to preserve wealth

Today, Solid State earns 43% of revenue abroad, much more than it did a few years ago.

Profit margins have been pretty stable over time, but the company has long sought to improve on its 6% average.

After three years of elevated profitability, that may be coming due to the company’s sharpened focus on semi-custom and own-branded products, which attract higher margins.

Semi-custom is like having your cake and eating it. The products are bespoke, but easy to make from common components. The cost of manufacture is less than if the company started from scratch each time, but the products still attract high prices.

The strategy is applicable, for example, to battery modules, now, thanks to the acquisition of Custom Power, the more profitable Systems Division’s biggest product type.

Another recent acquisition Willow Technologies, this time in the Components division, brought with it the Durakool brand of contactors and relays, which is now a focus for investment.

From good to great?

The acquisition of Custom Power, Solid State’s largest ever, early in the financial year along with favourable exchange rates, turbocharged 49% revenue growth and 56% profit growth.

But disregarding these factors, Solid State reported an 18% increase in revenue for the year to March 2023.

Accounting for the full historical cost of acquisitions, Return on Total Invested Capital was 16%, the same in March 2023 as it was in March 2022. Such high returns suggest that, historically, Solid State has not overpaid for acquisitions.

And the company’s post-pandemic returns on operating capital have escalated to 39%, well above the long-term average of 22%, suggesting that Solid State is operating more efficiently than it used to even though its prior profitability was more than satisfactory.

With strong finances and good customer relationships, Solid State has probably navigated the last few years better than many of its rivals, financing high levels of stock to ensure supply and win new customers.

There may have been a larger pool of potential acquisitions, and fewer rivals with sufficient resources chasing them.

The numbers are not universally good though. For the second year running cash conversion at around 50% of adjusted profit was well below average. Once again, though, this was due to high levels of stock and investment, a sign of strength, not weakness.

- The Income Investor: don’t overlook these dividend stocks

- Keep hold of these shares for dividends and growth

Net obligations, including borrowings and lease obligations, are around the long-term average, although they would have been higher had Solid State not raised £27 million from investors to help pay for Custom Power.

Nevertheless, shareholders have lost much less from dilution than they have gained from growth. Compound annual growth of 4% in the share count over the last 12 years pales next to 19% compound annual profit growth.

As things normalise, it is tempting to believe Solid State’s performance might too. After a very strong first quarter, the company expects things to calm down as shortages ameliorate. There is a risk that some customers will have overstocked, but even so it anticipates double-digit revenue and profit growth in the year to March 2024.

Scoring Solid State

Solid State’s first strategic pillar is to invest in people. Its annual report talks proudly of its family culture and internal promotions, which may explain impressive 92% employee retention for the year.

Chief executive Gary Marsh has led the company for decades and grown his personal wealth through his substantial shareholding.

In more uncertain times, when businesses are trying to become less dependent on far-flung supply chains, Solid State is re-shoring the development of and assembling of technology.

Not only is this a good thing, it is probably another factor in its success.

Does the business make good money? [2]

+ High return on capital

? Profit margin improving

+ Good average cash conversion

What could stop it growing profitably? [2]

+ Strong finances

+ Diverse customers in growth markets

? Complexity

How does its strategy address the risks? [2]

+ Strong finances

+ Customised and branded products

+ Good at acquisitions

Will we all benefit? [2]

+ Very experienced management

+ Loyal employees

+ Re-shoring component and system supply

Is the share price low relative to profit? [-1]

+ No. A share price of £13.60 values the enterprise at £161 million, about 32 times normalised profit.

Arguably I am being too harsh in scoring Solid State -1 for price. That calculation is based on the profit the company would have achieved had it earned its average return on capital of 22%.

If the level of profitability achieved over the last three years were to prove sticky, the shares would be more attractively valued.

I have erred on the side of caution in using the average, because I am not sure to what extent Solid State’s profitability has improved permanently, and to what extent it is enjoying a temporary bump due to its ability to continue supplying customers at a time of shortage.

A score of 7 out of 9 indicates Solid State is a good long-term investment.

It is ranked 26 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Solid State.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.