Richard Beddard: can this share stage a phoenix-like recovery?

19th August 2022 14:58

by Richard Beddard from interactive investor

This UK firm is a well-managed business, but it operates in a very risky industry. Our companies analyst explains his enduring faith in this particular investment.

Jet2’s financial year, which ended in March 2022, roughly coincides with the second anniversary of the declaration of the pandemic.

It is impossible not to appraise the business without reminding ourselves of the circumstances that grounded the airline and package tour operator some of the time, and severely reduced the number of holidaymakers the rest of the time.

The next set of results for the year to March 2023, the first year in three when many of us will have taken overseas holidays, should give us an indication of how strongly the airline is performing now restrictions have been lifted for a full summer season.

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

Jet2 (LSE:JET2) should have emerged strongly, with its competitive position strengthened by actions before the pandemic and during it.

More losses

In the year to March 2020, Jet2 flew 15 million passenger legs. The next year, it flew 1.3 million, and in the year to March 2022 it flew 4.85 million.

With the cost base of a much larger airline, planes not fully loaded with holidaymakers, and tickets discounted, it was fantastically inefficient. For the second year running, Jet2 lost lots of money.

The last two years have almost obliterated Jet2’s prior record of highly profitable growth.

The silver lining in 2022 is that cash flowed back into the business as customers booked holidays that are being flown in the current financial year.

At 37%, net obligations are higher than average because Jet2 has borrowed money to stay afloat (in addition to accepting government help, issuing more shares and selling off an unrelated road haulage business).

Last year, the big worry was that even if the company could resume flying a full programme, people might not want it. It turns out the problem was less about demand once people could fly again, but the ability of airports to meet it.

Risky business

Flying holidaymakers is a risky business. Airlines must predict demand 18 months ahead and fix the volatile cost of jet fuel, without which it would be impossible to budget.

This involves contracts known as hedges, which provide some certainty at a fairly modest cost.

In March 2020, though, the company had committed to its busiest-ever schedule when its planes were grounded for much of the following year.

The company was obliged to settle the contracts even though it did not fly the trips that would pay for them.

A pandemic was not listed as a principal risk in Jet2’s annual reports before 2020 and neither was another risk that seems obvious and is included now: climate change.

The two are linked. A changing climate will not only result in airlines shouldering the cost of reducing or offsetting the damage their industry does. It also submerges the beaches they fly to, dries up the water supplies of resorts, and encourages new pathogens that may result in new pandemics.

These risks loom larger than more prosaic risks such as competition, and not just because they define our times. The competition, online travel agents and low-cost airlines for example, are very different businesses and, to my mind, subordinate threats.

- Insider: small-cap firm gets backing as Afentra boss buys

- Richard Beddard: what will follow this UK share’s annus mirabilis?

Threats and opportunities

Jet2 should emerge from the pandemic stronger than its rivals because it went into it stronger.

Since it was founded 20 years ago, the airline has grown to be the UKs second-biggest ATOL licensed package tour operator after TUI (LSE:TUI), a much more diversified business. It had already leapfrogged Thomas Cook before that company went bust in 2019, and today it is the UK’s largest package tour operator to the Mediterranean.

It achieved this under its own steam by investing in owning and operating its own planes and airport slots at a time when most of the industry was moving in the opposite direction.

Owning its own planes and slots gives the company more control of flights, enabling it to offer family friendly flight schedules, generous baggage allowances and help at airports and resorts to make holidays less stressful.

Because it was born in the age of the low-cost airline, it borrowed from the low-cost playbook selling most of its holidays online or over the telephone.

It gradually expanded outwards from its base at Leeds-Bradford airport, honing its business model on the less-competitive routes to and from the North of England and finally reaching as far south as London Stansted in 2017 and Bristol in 2021.

The new frontier, though, may be sustainability.

Jet2 published its sustainability strategy last year, and its goal is to become the leading brand in sustainable air travel and package holidays. Ninety-nine per cent of Jet2’s emissions arise from flying planes (as opposed to ground handling, engineering, and administrative activities).

As of January this year, the airline is offsetting scope 1 and 2 emissions (i.e. emissions from its own operations, but not those of suppliers).

Within the next three years, Jet2 expects to reduce emissions using Sustainable Aviation Fuel (SAF), which is produced from recycled sources such as cooking oil and municipal waste and can dilute fossil fuels by up to 50%. It plans to invest in production within a year.

Longer term, the company says an order for 75 new Airbus A321 neo planes will provide it with the most sustainable aircraft available in its class today.

Beyond, say 2030, it is beholden to new technological developments and committed to monitoring regulatory developments and consumer sentiment, with the aspiration of achieving net zero before 2050.

None of this is unique to Jet2, but then again neither is customer focus. What may make the difference is the company’s commitment.

Commitment

If the pandemic has revealed one thing about Jet2 it is that in touting a customer-first strategy, it was not just paying lip service to the concept.

The company won plaudits for the speed with which it refunded customers using automated systems and quickly introduced confidence-building measures such as offering travel insurance with Covid-19 cover.

The key to customer satisfaction is staff satisfaction, Jet2 says. Although it made redundancies in 2021, the airline topped up the salaries of the staff it retained above the level of the government funded Coronavirus Job Retention Scheme, and this year has paid them an 8% pay rise with the promise of another £1,000 for all staff at the end of the summer.

This, it says, put the company in a better position to cope with the summer flying programme and the unpreparedness of airports and other suppliers for what it describes as the “unforgivable” chaos experienced when flights resumed.

It also gave employees an additional four days of annual leave in 2022.

True to its vertically integrated ethos, it trains crews and engineers at its own centre near Leeds Bradford Airport.

Jet2’s commitment to staff explains why Jet2 is employee review site Glassdoor’s number one airline and the only airline to make the site’s UK’s top 50 Places to Work list.

Scoring Jet2

Even though Jet2 is such a well-managed business, it operates in a very risky industry and that makes it an incredibly difficult share to score.

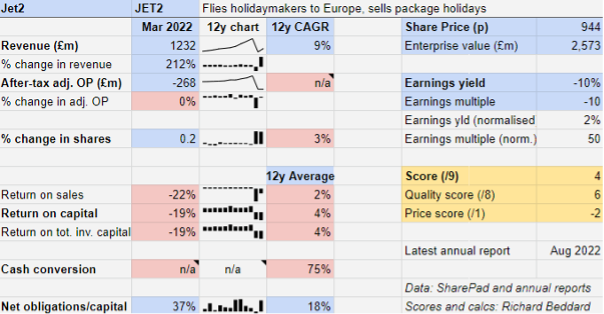

Does the business make good money? [1]

? Low average return on capital

? Low average profit margin

? Cash conversion is OK

What could stop it growing profitably? [1]

? Finances recovering

+ Strong competitive position

− Complexity of industry makes it susceptible to shocks

How does its strategy address the risks? [2]

+ Vertical integration gives control of the product

+ Service culture drives repeat business

? Early days for sustainability strategy

Will we all benefit? [2]

+ Customer first policy

+ Employee focused culture

+ Extremely experienced board

Is the share price low relative to profit? [-2]

+ No. A share price of 944p values the enterprise at about £2.5 billion, about 50 times normalised profit.

A score of 4 out of 9 suggests Jet2 is probably not a good long-term investment.

The score is penalised because of two extraordinary years in which the company was barely able to operate and kept alive through the well-deserved goodwill of all its stakeholders and the government.

We can doubt that a situation as severe will occur again in the next 10 years or so, but we cannot be sure and that makes the shares something of a gamble.

It is a gamble I am embracing. The company believes customers will remember how it treated them during the pandemic and fly with an airline they trust.

I believe that too, and for as long as Jet2 is true to its strategy and maintains its culture, I will continue to hold shares.

Jet2 is ranked 40 out of 40 stocks by my Decision Engine, and as the only share I own with a score below 5 it is something of a faith-based investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Jet2.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.