Richard Beddard: can Games Workshop’s remarkable rise continue?

This business has a bright future, our companies analyst believes – but its shares are not cheap.

7th August 2020 15:00

by Richard Beddard from interactive investor

The fantasy figurine firm has a bright future, our companies analyst believes – but its shares are not cheap.

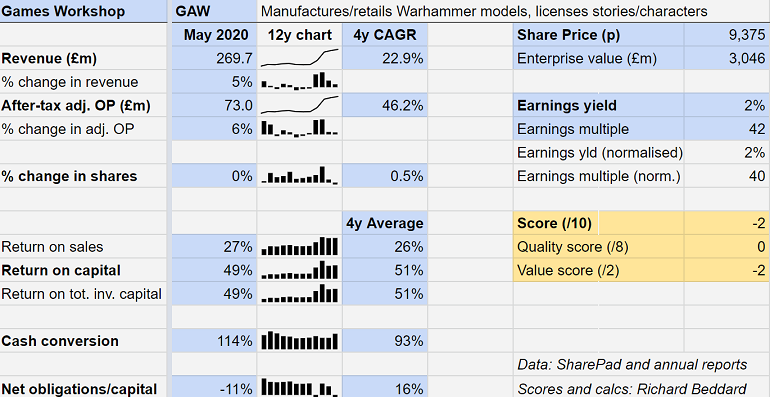

There are two remarkable things about the snapshot of Games Workshop’s performance on the left-hand side of the table below. There are no red flags, and something awesome happened about four years ago:

Games Workshop’s metamorphosis in numbers...

Take a look at the 12-year sparkline charts in the middle column. The fantasy figurine company went from being a profitable business that was not growing convincingly to an incredibly profitable business that experienced an awesome growth spurt.

A flourishing

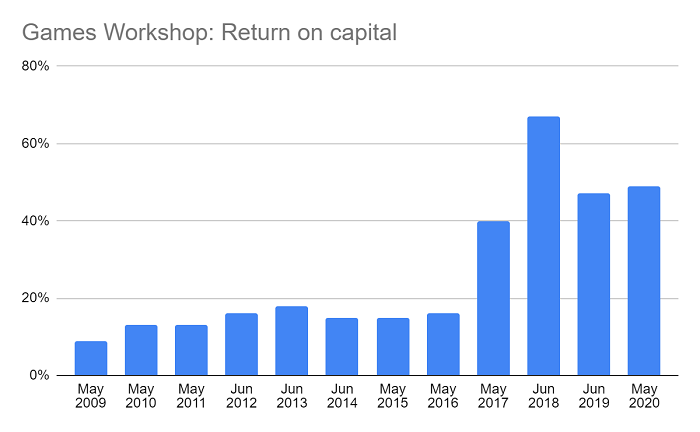

Over the last four years the company has grown revenue at a Compound Annual Growth Rate (CAGR) of 23% and profit at a CAGR of 46%. Before 2017 it was chugging along earning a return on capital in the mid-teens. Since 2017, return on capital has been about 50%. Although most of the growth happened in the first two years of the spurt, the company in numbers looks different now.

Maybe the tiny scales of the sparkline charts do not really do the birth of the behemoth justice. Here is a full-sized chart:

Quite some transformation. Data source: SharePad and annual reports

- Buffettology fund interview: why I love Games Workshop

- Games Workshop, housebuilders, gold and UK banks

- Why Boohoo and Games Workshop are unstoppable

Fantasy worlds

If you do not know what Games Workshop does, you cannot have been reading the business pages, which supply much more fulsome coverage of the company now it is among the best performing shares on the stock market.

Launched in 2019, Warhammer 40,000 Apocalypse is a mass battle system set in the far future. Source: Warhammer-community.com

Games Workshop makes most of its money selling model figures, which it has been doing successfully since the 1980’s. Its competitive advantage is the millions of fans it has created of the worlds it imagined for the models to inhabit.

In basing its prosperity on a universe of its own making, Warhammer is much like Marvel or Star Wars - even though there has only been one Warhammer film, 2010’s Ultramarines, and it flopped.

Warhammer is more marmite than Marvel, and hobbyists are arguably more invested as they are not passive consumers, they paint the models and use them to fight battles. They are probably even more dedicated.

The company controls every aspect of the Warhammer hobby: design, manufacture, marketing, distribution and retail, from its headquarters in Nottingham, which has become something of a wargaming industry cluster.

A cottage industry has developed as other companies, sometimes founded by former Games Workshop employees, have established imaginary worlds of their own.

The scale and richness Games Workshop has achieved presents a formidable barrier to any of them achieving the status of rival.

Bit more than making the best soldiers

Though it looks like it, success did not come overnight. Games Workshop did not buy another, better business. All its prosperity is its own doing, and many of the seeds were sown well before 2017 when the results began coming through and investors stood up to take notice.

Games Workshop took investors by surprise. Its share price is up over ten-fold since 2017. Source: SharePad

In 2017, Games Workshop’s stated strategy was the same as it had been for years, quoted ad nauseum in annual reports. It existed to:

“...make the best fantasy miniatures in the world and sell them globally at a profit, and it intends doing so forever.”

Before 2017, the company appeared to be on the defensive, besieged by enthusiasts of the game who felt neglected. Games Workshop was making good profit from fewer sales of ever more intricate and expensive models. They delighted hard-core modellers, many of whom had long since given up the game.

Shareholders were bemused. The company was good at making profit, but where was the growth?

Change was already well under way. By 2015 it had downsized its stores and stripped out layers of management. It had also switched from manufacturing mostly in metal, to mostly resin, which enabled it to make more intricate models.

That year Games Workshop re-launched its eponymous fantasy game as Warhammer Age of Sigmar, breathing life into a franchise that had long-since been eclipsed by Warhammer 40:000, a science-fiction themed version.

A new chief executive was appointed in 2015. Kevin Rountree is an accountant who joined the business in 1998 and was promoted to chief financial officer and then chief operating officer. He had also gained experience as head of sales for “Other Activities”, a division that licensed Games Workshop’s characters and stories to computer game companies.

- No signs of retreat by Games Workshop

- Why Games Workshop rallied again and Keywords Studios dived

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Today, Games Workshop’s strategy is only slightly more wordy. It does not just say what the company wants to do but how, by engaging and inspiring customers:

“...to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains.”

From these guiding principles, coherent actions flow.

Back in 2015, the corporation was getting such a hard time it had more or less given up talking to customers outside its stores, leaving each hobby store to promote itself online. But it re-thought its marketing and launched the Warhammer Community website in November 2016.

Through articles, videos, podcasts and cartoons, the site teases new character and story launches, and helps with modelling and gaming. Today, metrics from Warhammer Community are used as key performance indicators for customer engagement. It achieved 145 million page views from 8 million users so far in 2020.

A cinematic trailer teasing a new edition of Warhammer 40,000 published on YouTube in May has received nearly 2 million page views so far.

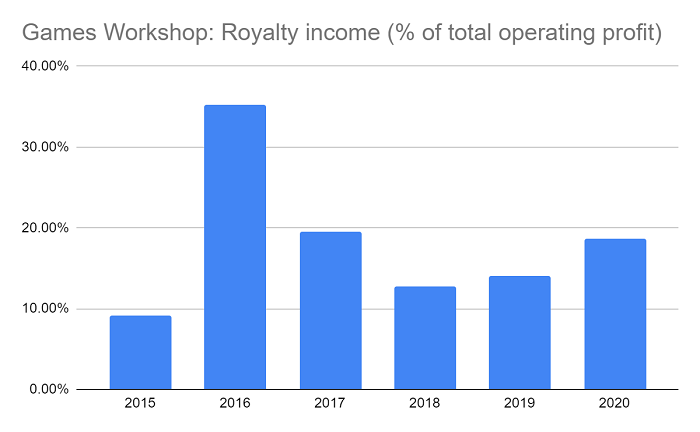

Historically, Games Workshop has regarded licensing as a fickle source of income over which it has little control, but under Rountree the company is “constantly looking to grow royalty income”, signing new licenses at a rate of one every two or three months.

Earlier this year, Counter Strike Global Offensive, a popular multiplayer video game, released Warhammer 40:000 themed stickers. The stickers are cosmetic, allowing gamers to customise their guns. 400,000 packs were sold in the first week.

The company has also launched its first action figure in collaboration with Bandai, a Japanese toymaker, and struck a deal with Marvel to publish Warhammer comics.

In partnership with a number of animation studios Games Workshop has begun production on three Warhammer 40,000 animated series, which it may sell or release itself, and it is developing a TV series too, although it says progress is slow.

Royalty income has nearly tripled since 2016, when Games Workshop received a big bump in payments from two computer games: Total War Warhammer and Warhammer: End Times - Vermintide.

“Core profit”, income from models, paint, publications and so on has increased even faster though, and contributes more than 80% of operating profit:

Such is the growth of the hobby, that burgeoning royalty income is struggling to keep up.

Scoring Games Workshop

Does the business make good money? [2]

+ High return on capital

+ High profit margins

+ Strong cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Control of design, manufacture distribution

+ Narrow focus on modelling unlikely to return

How does its strategy address the risks? [2]

+ “Constantly looking to grow royalty income”

+ Treats customers as fans

+ Growth focus: North America and China

Will we all benefit? [2]

+ Experienced management, modestly paid

+ Long-term focus

+ Self-reliant culture

Are the shares cheap? [-2]

− £93.75 values the enterprise at 42 times adjusted profit

− Growth is probably moderating...

? ...but Games Workshop should keep growing

Today the company’s qualities are there for all to see, and that is reflected in the share price.

Games Workshop scores 6/10. The valuation is off-putting, but it is a unique business that may well still reward investors over the long-term.

It is ranked 21 out of the 34 companies I follow closely.

Richard owns shares in Games Workshop.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.