Richard Beddard: can Games Workshop keep delivering magic for investors?

6th August 2021 15:21

by Richard Beddard from interactive investor

Our columnist considers the merits of the fantasy gaming firm and asks whether it is now priced for perfection.

Picture credit: Games Workshop

Investors are becoming accustomed to Games Workshop (LSE:GAW) outdoing itself year after year. Its performance in the year to May 2021 was astonishing.

Performance fatigue

Now a darling of investors, I almost gave up on the company five or six years ago.

In the early to mid 2010s, it looked like the company was wasting a hugely valuable asset, a legion of hobbyists, dedicated modellers and gamers, invested in its Warhammer science fiction and fantasy worlds.

By inventing ever more complicated and expensive miniatures for experienced modellers it was earning decent returns, but it was not recruiting enough new fans to the hobby.

The entry-level models were not cheap or appealing enough, and the company had lost the confidence of many of the gamers who would have bought them.

- Games Workshop shows no signs of slowing down

- Read more Richard Beddard articles here

- Check out our award-winning stocks and shares ISA

But changes, some of them a long time in the making, and others following the appointment of Kevin Rountree as chief executive in 2015, resulted in an astonishing rise in profitability and rapid growth.

The company introduced attractively priced starter kits, simplified the game rules, and re-engaged with its disaffected customers online by producing shows for modellers and gamers, and teasing new releases.

Since then, I have scored Games Workshop 2 for profitability, 2 for risks, 2 for strategy, and 2 for fairness. The maximum score is 2 in each of these categories.

It has been a thrilling journey, but two factors have conspired to dull my enthusiasm.

The consensus that Games Workshop is a really good business is nowhere near as exciting as the idea that it could be if only its potential was unleashed. And the dramatic rise in the share price because of that consensus takes the edge off the investment’s potential.

Price versus value

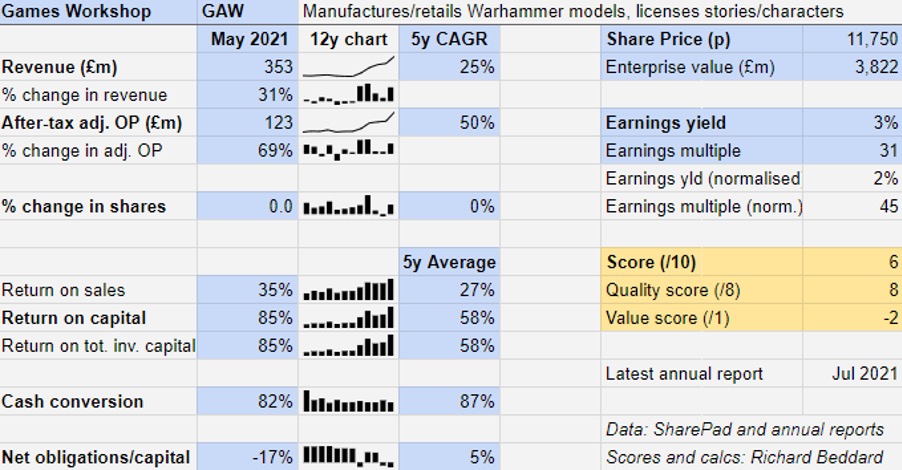

Let us start with price, since that is the principal objection to owning shares in Games Workshop. The shares cost about 31 times adjusted profit in 2021, but 2021 was an exceptional year.

The company earned a return on capital of 85% compared to its already stunning five-year average of 58%, and it earned a profit margin of 35% compared to the five-year average of 27%

Arguably, each of the last five years has been exceptional in comparison to before so being exceptional is the new norm.

Prudence, though, dictates that we take a more modest view as Games Workshop tends to be especially profitable in years when it releases a new edition of Warhammer, like 2021.

It seems clear that Games Workshop since 2015 is a different business to the one before. But the profitability Games Workshop achieved in 2021 is not necessarily more representative of what will happen in future than, say, its profitability in 2020.

Normalising profit by pretending Games Workshop had earned its average return on capital over the last five years, gives a profit multiple of 45 times.

To justify that multiple, Games Workshop must sustain rapid growth for many years.

It has achieved a 50% compound annual growth rate in profit over the last five years. But will it continue growing at that rate, half that rate, a quarter of that rate?

Broadening and deepening the offer

This is a question that cannot be answered scientifically. It is a judgement we need to make based on the challenges Games Workshop faces, and how it plans to overcome them.

Games Workshop’s challenge is to make the most of its intellectual property, the characters and stories of its alternative worlds. This has been developed over decades into an incredibly rich repository, which is still expanding.

It does this in numerous ways, principally selling models based on new scenarios and iterations of the games: Warhammer 40,000 and Warhammer Age of Sigmar. It is also a publisher and has published countless books (150 in 2021) and magazines.

A second stream of revenue comes from licensing characters and stories to board, card game and video game companies.

Generally, licensing is very profitable but Games Workshop has always maintained license income relies on the strength of the core hobby, which is the collection of fantasy miniatures.

- Shares for future: this small-cap is top of my latest rankings

- Read more of our content on UK shares here

While the company says some of its entertainment spin-offs appeal to a wider audience, for many of us not involved in the hobby, they are a befuddling curiosity (if we have heard of them). The one audience Games Workshop knows they will appeal to is the modellers, gamers and readers.

The most reassuring indicator that Games Workshop’s mission is intact, is that it is selling more miniatures.

Since 2017, revenue excluding royalties has increased from £158 million to £353 million (an increase of 123%), while royalties have increased by a similar percentage from £7.5 million to £16.3 million (an increase of 117%).

The growth rate of the hobby, therefore, is much the same as the extraordinary growth rate of the group. Because the business, and principally its factories, operate more efficiently at scale, operating profit excluding royalties has grown from £38 million to £152 million (nearly 300%).

More Warhammer. More Often.

Revenue growth of 31% and profit growth of 69% in a year of pandemic seems remarkable when stores were shut, opportunities to play Warhammer were reduced, and the company experienced difficulties shipping the product.

On the other hand, hobbyists had time on their hands to paint fantasy armies, supplied from stores when they were open, and online, and encouraged by the constant flow of content at Warhammercommunity.com.

The company launched a new edition (the ninth) of its flagship Warhammer 40,000 game, with this reminder for investors: “It is worth noting that the launch year of a new Warhammer 40,000 edition is normally the financial high point... until the next edition of Warhammer 40,000.”

New sets of miniatures are launched with the new rule sets, and while it is true that profit spiked in 2018 after the eighth edition was launched, and that was the high point in terms of return on capital until 2021, revenue cantered upward and profit grew modestly in 2019 and 2020, the years between the two editions.

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

- Income seekers will love this company’s dividend history

The company is investing heavily in its IT, but perhaps the pattern of modest profit growth followed by a spike will recur in the coming years as intermediate launches of miniatures keep things ticking over.

This summer Games Workshop released the third edition of Warhammer Age of Sigmar, its fantasy themed game.

A new £4.99 a month subscription service may contribute to growth. Its strapline is “More Warhammer. More Often.” and it launches later this month, mostly with streaming shows: animated series, modelling advice, programmes about Warhammer lore, plus e-books and a free exclusive miniature every year.

Licensing is moving ahead too, with 15 video games in development, some of which are big budget AAA games such as Warhammer 40,000: Darktide and Total War: Warhammer 3. AAA is an industry term applied to blockbuster games.

Scoring Games Workshop

If I were to find fault with Games Workshop, it is that sometimes we hear about exciting developments and then the company goes quiet. There is no mention of progress with Eisenhorn, a TV series the company is developing, in this year’s annual report.

It also produces a lot of plastic miniatures and says it will work with the industry to find a more sustainable material.

But much to my embarrassment I cannot find much to fault.

Games Workshop is an international business that earns nearly twice as much revenue in North America as it does in the UK. Revenue in the rest of Europe is comparable to the UK and Games Workshop expects growth across the board, and particularly from North America, and the Far East.

It controls almost every aspect of design, manufacturing, marketing, distribution and sales through multiple sales channels, independent hobby stores, its own Warhammer stores, and online.

Kevin Rountree finally achieved a swaggering pay cheque in 2021, his total remuneration was £1.4 million, but I do not think we can begrudge him that. He received a maximum 100% bonus (the maximum is 150% in future), 50% of which must be invested in Games Workshop shares (67% in future).

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

- Personal Finance Teacher of the Year Awards 2021: win money for your school

The directors do not receive backdoor pay via free share options from a Long Term Incentive Plan like most listed companies, because it believes LTIPs drive selfish short-term behaviour and widen the pay gap between management and staff. It is an unusual, principled and in my view fundamentally decent policy.

The company’s spoils are widely distributed. Shareholders have done extremely well out of special dividends as well as share price rises. Staff are also becoming accustomed to bonuses.

I am not a customer of Warhammer, but as I score the company as an investment, I have a show previewing Warhammer+ playing in the background.

I feel the excitement customers do, even though the specifics of what they are talking about remains mostly a mystery to me.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Strong cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Direct competitors are sub-scale

+ Indirect competition (e.g. video games) are an opportunity

How does its strategy address the risks? [2]

+ Vertical integration: control of design, quality, sales and marketing

+ Broadening and deepening its IP with new editions, publications, and online content

+ Focused on exploiting IP, as well as creating it

Will we all benefit? [2]

+ Very experienced management, both executives joined in the ‘90’s

+ Offers staff careers they love, and generous bonuses

+ Self-reliant culture

Is the share price low relative to profit? [-2]

? A share price of £117.50 values the enterprise at about £3.8 billion, 31 times profit in 2021 but 45 times normalised profit.

My scoring system has created something of an impasse. It is a nearly perfect company, but the investment is priced for near perfection.

A score of 6 out of 9 means Games Workshop probably continues to be a good long-term investment.

This article has been corrected. Revenue does not include royalty income unlike previously stated, the new edition of Warhammer Age of Sigmar has been launched recently (in Summer 2022 not Summer 2023), and the share price of Games Workshop at the time of writing was £117.50 not £11.75.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Games Workshop.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.