Richard Beddard: business is buoyant at one of my favourite companies

9th June 2023 15:30

by Richard Beddard from interactive investor

There’s plenty to celebrate at this small-cap company, it has a strong competitive position, and the shares are good value. It’s why they’re in our columnist’s top 10.

The economy may be going through ructions, but it is business as usual at the UK’s largest protective packaging distributor.

Macfarlane Group (LSE:MACF) supplies cardboard boxes, tape, and bubble wrap to protect goods in transit and related products like packaging machines. It also manufactures bespoke packaging.

- Invest with ii: How to Buy Shares| Free Regular Investing | Super 60 Investment Ideas

Coping with cost increases

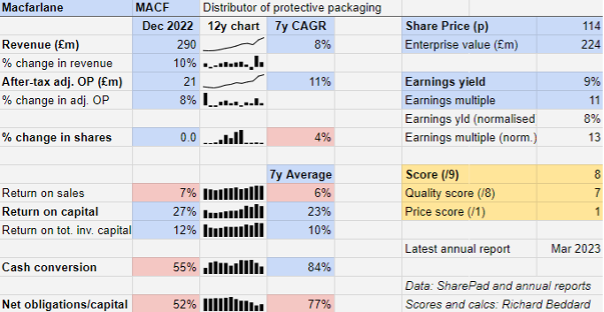

Despite rising costs, the company grew revenue and profit roughly 10% in the year to December 2022, which is typical.

Steady growth is one of the characteristics that suggests Macfarlane is a good potential long-term investment, but the figures mask contrasting fortunes for customers. Due to the end of pandemic restrictions, online retailers that had benefited subsequently faltered, and industrial customers recovered.

Although some of the numbers are highlighted pink in my table, there is probably not much to worry about.

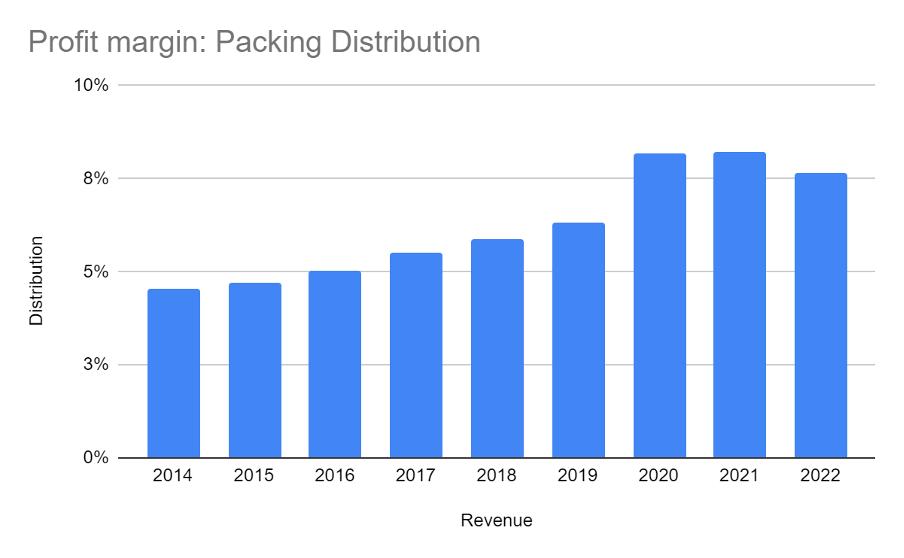

Group profit margins are relatively modest, but they have consistently improved to 7%. Likewise, debt and other financial obligations as a percentage of operating capital is on an improving trend. It is higher than my 50% benchmark, but it has been falling for many years, to 52%.

A large decrease in payables, money owed to suppliers in 2022, meant cash conversion was sub-par, but this should be temporary, a result of payments for elevated stock levels as the economy emerged from the pandemic, and higher bonuses.

Although the risk of obsolescence and non-payment has increased as Macfarlane works through its stockpile, generally business is buoyant.

- Share Sleuth: why I picked this share out of eight contenders

- Shares for the future: one of my 26 good value shares just hit a record high

In May, the company reported that revenue and profit in the first quarter of 2023 was ahead of the same period in 2022.

Decent growth rates do not take account of dilution, which has simultaneously reduced shareholders’ stakes in the business by 4% a year on average over the last seven years.

This reduces the attraction of the investment somewhat, but it has been over five years since Macfarlane asked investors for additional funds - to acquire Greenwoods in 2017.

By a small margin, Greenwoods is Macfarlane’s biggest acquisition. Since 2017, it has self-funded seven acquisitions, a cautious and sustainable approach to growth.

Buy and build

The acquisitions date back to a buy and build strategy starting with Lane Packaging in 2014:

Macfarlane: acquisition history

Name | Year | Consideration (£ million) | Activity | Location |

Gottlieb | 2023 | 3.55 | Distribution | Manchester |

Suttons | 2023 | 9 | Manufacturing | Chatteris |

PackMann | 2022 | 8.625 | Distribution | Eppelheim (near Heidelberg), Germany |

Carters | 2021 | 4.5 | Distribution | Redruth |

GWP | 2021 | 15.1 | Manufacturing and distribution | Salisbury and Swindon |

Leyland | 2019 | 3.25 | Distribution | Leyland |

Ecopac | 2019 | 3.9 | Distribution | Aylesbury |

Greenwoods | 2017 | 16.75 | Distribution | Melton Mowbray |

Nelsons | 2016 | 6.75 | Distribution | Leicester |

Edward McNeil | 2016 | 1.8 | Distribution | Glasgow |

Colton | 2016 | 1.25 | Distribution | Teesside |

One | 2015 | 2.75 | Distribution | Bingham |

Network | 2014 | 7.5 | Distribution | Wolverhampton |

Lane | 2014 | ? | Distribution | Reading |

Source: Regulatory News Service. Price includes maximum earnout. The Nelsons, Greenwoods, and Network acquisitions were part funded by share placings.

This roll-up of regional distributors has grown Macfarlane into a substantial business, which enables it to source products cheaply from manufacturers and supply customers wherever they operate in the UK, and saves customers from having to finance and store large amounts of stock.

Lower cost, investment spread over a larger network, and the consolidation of acquired warehouses may explain the doubling of profit margins in the packaging segment, a trend that was well underway before the pandemic, but accelerated during it.

Perhaps, in common with large and financially strong distributors in other industries, Macfarlane was able to meet demand when rivals struggled to source scarce supplies.

A slight reduction in the division’s profit margin in 2022 may represent a reversion to the pre-pandemic trend:

Macfarlane’s national footprint puts it between regional distributors and multinationals such as Bunzl (LSE:BNZL) that supply much more than protective packaging. Naturally it pairs up with customers that also have UK-wide operations such as Dunelm Group (LSE:DNLM) and Argos, although it supplies businesses of all sizes including multinational logistics company DHL.

As demands on packaging have grown because of the growth of e-commerce and pressure to reduce plastic and the carbon footprint of packaging, it has become a more complicated product.

This has given Macfarlane the opportunity to add value through clever design at its innovation centre and using its Packaging Optimiser tool, an online sales process that helps customers choose packaging that, for example, reduces return rates due to fewer breakages in transit, costs less to store and transport, reduces waste, and eases packing and unpacking.

Another thing to celebrate is the resurgence of Macfarlane’s manufacturing business, which mostly sells direct but also supplies Macfarlane’s distribution network. It shares design and sourcing capabilities, with its larger sibling too.

- Stockwatch: this small-cap share is the epitome of value investing

- Two attractive stocks that could leave you sitting pretty

- Remembering William O’Neil - and 10 shares that suit his strategy

Manufacturing’s flourishing seems to have started with the near simultaneous sale of a business that made labels in 2021, and the acquisition of GWP.

Manufacturing contributed more than 25% of adjusted operating profit from less than 10% of group revenue in 2022, and the division has been augmented by the acquisition of Suttons in March.

Europe, where the company earns very modest revenues, may also be an opportunity to grow. A year ago, Macfarlane acquired a German distributor PackMann, which compliments an existing subsidiary in the Netherlands.

Macfarlane does not have scale advantages in Europe, so the rationale for the European expansion is different. It is supplying UK customers with operations in Europe, and intends to serve them better there by extending the network further and picking up local customers too.

Although Macfarlane has added another UK distributor to its network in 2023, its recent forays abroad and into manufacturing raise the possibility the company is anticipating limits to the proven UK roll-up strategy.

Macfarlane tells me the protective packaging distribution market is probably worth about £1.1 billion in the UK. In 2022, it earned revenues of £260 million, almost a quarter of the market.

Numbers match the story

I like Macfarlane. It is a straightforward business that develops lasting relationships with customers. In a promotional video, a packaging technical manager from Dunelm says her account manager at Macfarlane is like a colleague. The returns back up the marketing story, and so do Macfarlane’s customer surveys.

Macfarlane has a net promoter score of 50, which is higher than average for business to business companies, and says its annual customer satisfaction survey shows 92% of customers are happy. Staff are key to customer satisfaction, and perhaps they are happy too. The company launched an employee engagement survey in 2022, although the result was not disclosed in the annual report.

Mostly Macfarlane uses sustainable raw materials, two-thirds by value is corrugated paper, it is part-electrifying its fleet of vehicles and slowly rolling out solar panels at the rate of one distribution centre a year (it has 27).

Perhaps it could be thinking more about scope 3 emissions (those created by its supply chain, and its products in use) too. At the moment it only reports emissions from business travel, as it is required to.

Success has come steadily under the stewardship of Peter Atkinson, the company’s chief executive for 19 years, and finance director of 22 years, Ivor Gray.

Scoring MacFarlane

Does the business make good money? [2]

+ Good return on capital

+ Growing profit margin

+ Strong average conversion

What could stop it growing profitably? [1]

? Significant lease obligations

+ Strong competitive position in the UK

? Limits to growth in the UK?

How does its strategy address the risks? [2]

+ Roll up strategy has generated good returns

+ Focus on national accounts in growing industries

? Europe might be more risky

Will we all benefit? [2]

+ Experienced chief executive

+ High NPS and Customer satisfaction scores

? Could be moving faster on emissions

Is the share price low relative to profit? [1]

+ Yes. A share price of 114p values the enterprise at about £224 million, 13 times normalised profit.

A score of 8 out of 9 indicates Macfarlane is a good long-term investment.

It is ranked 6 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.