Richard Beddard: analysing the RBLI poppy paper maker

The company is one of the world’s best paper makers, but are they a good investment?

6th November 2020 15:33

by Richard Beddard from interactive investor

Aside from poppies the company is one of the world’s best paper makers, but are they a good investment?

If someone named James tells you he is starting a business, back him. In recent weeks I have profiled venerable and successful businesses founded by James Latham (LSE:LTHM) and James Halstead (LSE:JHD) and today we have another: James Cropper (LSE:CRPR).

Though the opportunity to back the founders of these companies has long gone, their descendants are still doing a good job.

Stretching the meaning of ‘paper’

Analysing companies can challenge the vocabularies of the most erudite of investors, and I am not one of those. Having read about James Cropper, I am questioning the meaning of the word ‘paper’.

The company says it makes some of the world’s most distinctive and advanced paper products, using materials from cotton and wood to carbon fibre.

The dictionary confirms paper is a thin flexible sheet used for writing, drawing, printing, wrapping and covering. It is usually made from wood.

It does not mention carbon fibre, glass fibre and polymers.

- ii view: Smurfit shows confidence with another dividend

- ii view: DS Smith in middle of boom for e-commerce packaging

Veils and mats made from these materials, by Technical Fibre Products (TFP), a James Cropper subsidiary, are used in a wide range of industries. Coating composite materials in technical fibres, or incorporating them into the composites, improves their performance and makes them easier to manufacture.

TFP’s products make automotive components hard wearing, utility poles fire resistant and sports equipment stronger. They also shield mobile phones and wind turbines from electromagnetic interference.

Perhaps the most eye-catching application of a TFP product is as a substrate for the Gas Diffusion Layer critical to the functioning of hydrogen fuel cells, one of TFP’s biggest markets.

The company has two other subsidiaries that more comfortably conform to the definition of ‘paper’.

James Cropper started making paper in 1845. It makes the petals of the Royal British Legion poppies you may have bought by mail order this year, and supplies ‘CupCycling™’ recycled paper from coffee cups to Hallmark, the greetings card company, and GF Smith, another paper maker.

James Cropper has been producing “poppy paper” for 40 years. Source: James Cropper - The Poppy Story.

A third subsidiary, Colourform, manufactures moulded packaging for luxury brands. It supplies reusable CupCycling packaging to Lush, the handmade cosmetics brand that usually eschews packaging.

The common denominators between the three businesses are distinctive products that companies are prepared to pay more for, the papermaking process, from which James Cropper developed its technical fibre capabilities, and the stewardship of the Cropper family. Chairman Mark Cropper is of the sixth generation.

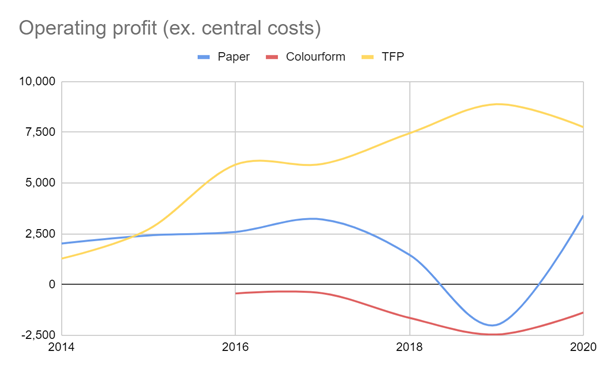

In terms of their financial performance, the subsidiaries are not similar at all.

The biggest business by revenue is the paper business, James Cropper. TFP earns much higher operating profit margins, typically 30% in recent years, and consequently it makes the bulk of group profit.

In contrast, margins in paper making were their highest for a number of years in the year to March 2020 at just 5% (the previous year it made a loss due to escalating wood pulp prices).

Colourform has only been identified in the company’s segmental report as a subsidiary since 2016, and it has yet to make a profit. Its revenues are growing rapidly from a low base, though.

TFP has grown its more substantial revenue and profit rapidly in recent years too, but revenue has largely been flat at the paper business, and profit variable.

Revenue is vanity, profit is sanity. For some years now, TFP has earned the bulk of profit at James Cropper. In 2020, TFP brought in £7.8m compared to £3.4m from Paper and a loss of £1.4m at Colourform. Source: Annual reports.

On the face of it TFP is a growing business in rude health, Colourform is an early stage business and for all its innovation, paper making is struggling to compete effectively in what is probably a very competitive market.

Distinctive products

In the search for differentiation James Cropper is banking on bespoke products and sustainability. It is the only paper company capable of extracting the plastic from coffee cups and turning it into paper, a process described by customer GF Smith as “game changing”.

- ii view: UK software maker Aveva confirms Covid hit

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

TFP claims to be working on 100 new developments in collaboration with universities and customers. It prides itself on the uniformity of fibre dispersion, which underlies the performance of its veils and mats. It makes “the lightest weight wet-laid carbon nonwoven in the world”.

The company says in many of its markets it has little direct competition.

Mixed results

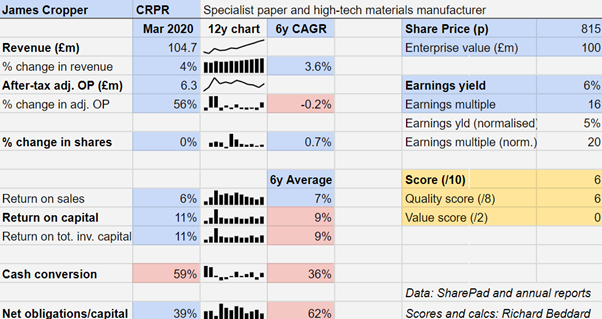

This mixed bag of business is producing mixed results at the group level. Average post-tax profit margins of 7% are not particularly special, and neither is an average post-tax return on capital of 9%. Average cash conversion of 36% is weak.

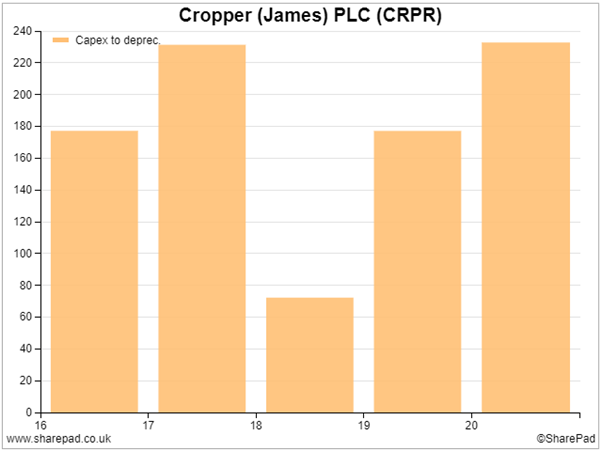

The biggest drain on James Cropper’s cash flow is capital expenditure. The company is spending well in excess of depreciation, suggesting that it is investing heavily in more productive capacity to support future growth:

Capex to depreciation. Depreciation is a rough proxy for the replacement cost of property, plant and equipment. Companies routinely spending well in excess of 100% of depreciation are likely to be increasing their production capacity. Source: SharePad.

An upsurge in capital expenditure in 2020 was mainly due to a project to increase TFP’s capacity by 50%. The project has since been deferred though, to conserve cash during the pandemic.

On a less positive note, the next biggest drain on the company’s cash resources is payments to reduce the deficit in its large defined benefit pension fund.

Currently, TFP is carrying the Paper division, Colourform and the pension fund.

The divergent performance of the three businesses during the coronavirus pandemic appears to have forced James Cropper’s hand somewhat.

The company does not expect TFP to be held back by the pandemic. Growth in fuel cells and renewable energy is likely to compensate for a reduction in sales to the aeronautics market, TFP’s biggest, which is hamstrung by the pandemic.

But the group as a whole made a loss in the first quarter of 2021 when the country was locked down for the first time (April, May and June 2020) and the company has accelerated plans to rationalise the Paper division and its head office that will reduce the number of employees by no more than 10%.

Reading between the lines, it seems likely losses in the Paper division and perhaps Colourform may all but wipe out TFP’s profit in 2021.

Scoring James Cropper

James Cropper appeals to me despite the group’s undistinguished financial performance. The company is showing all the right instincts by investing in technical niches and focusing the traditional paper business on sustainable and bespoke products.

The company says it consults all staff, and 15% of its headcount are involved in Research & Development. This not only opens up new markets but also solves old problems, for example CupCycling was a response to soaring pulp prices as well as a gap in the market for sustainable paper.

A year ago, James Cropper invited staff to the ‘Big Listen’, a consultation to help determine the paper making division’s future. Eighty-five percent of staff participated, generating 5,000 suggestions. Source: Annual report.

Perhaps a more profitable business will emerge.

Does the business make good money? [1]

? Modest return on capital

? Weak cash conversion

? Low profit margins in paper making

What could stop it growing profitably? [1]

? Large defined benefit pension scheme

? Competition, especially in paper making

? Sensitivity to pulp prices in paper making

How does its strategy address the risks? [2]

+ Innovation of niche products

+ Rationalisation of paper making business

+ Overseas growth (Exports were 60% of revenue in 2020)

Will we all benefit? [2]

+ Explains itself well

+ Celebrates achievements of staff in annual report

+ Experienced and not overly remunerated board

Is the share price low [0]

+ A share price of £8.20 values the enterprise at £101 million, about 20 times normalised profit (16 times adjusted profit in 2020)

The shares are nearly 60% below their high point in 2017, and 40% below their level at the beginning of the pandemic, but they are still not obviously cheap.

A score of 6/10 means they are probably a good long-term investment. James Cropper is currently ranked 22 out of the 32 shares by my Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.