Richard Beddard: is this an almost perfect business?

This AIM firm looks like a good long-term investment.

4th June 2021 15:03

by Richard Beddard from interactive investor

This AIM firm looks like a good long-term investment.

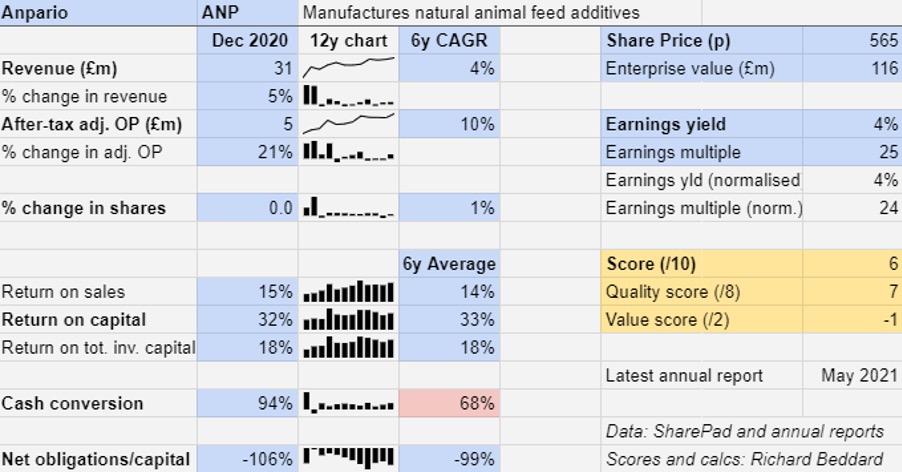

Judging by the numbers, animal feed additive manufacturer Anpario (LSE:ANP) has, in recent times, been an almost perfect business.

Investing by numbers

Over the last six years, Anpario has grown revenue at a compound annual growth rate (CAGR) of 4% and profit at a CAGR of 10%, which has allowed it to accumulate a large cash surplus.

Perhaps the weakest of the financial statistics is the revenue growth rate, which has been flattened by events in and out of Anpario’s control.

It suffered reduced sales in one of its bigger markets, China, since African Swine Fever reached Asia in 2018 driving farmers to cull their herds. In the year to December, though Chinese farmers restocked their farms with pigs, and their feed supply with supplements, helping Anpario put three years of flat profits behind it.

Its performance would have been better were it not for a 38% slump in sales in the Middle East. Due to Covid-19, religious festivals were cancelled and migrant workers returned home, reducing the consumption of meat.

Favouring profitability over market share

Anpario is the product of a series of acquisitions of additive brands between 2006 and 2012 but, barring the acquisition of a couple of distributors, recent growth has come entirely from its own efforts.

The company’s policy is to favour profitability over market share, which has resulted in modest revenue growth and strong profit growth as it has closed or divested less profitable activities such as contract manufacturing and organic animal feed production.

Meanwhile, it has unified the acquired brands under the Anpario name and taken more control of distribution by opening wholly owned subsidiaries in major markets, namely the UK, where it earned 17% of revenue in 2021, and big meat-producing regions such as the US, China and Brazil.

Direct sales, which are more profitable than sales through distributors and include sales through Anpario’s new e-commerce sites, grew strongly during the pandemic to 44% of the total.

Natural growth promotion

In July 2020, China became the latest country to ban antibiotic growth promoters. Concerns about antibiotic resistant pathogens due to the overuse of antibiotics has led governments around the world to prohibit their use to fatten up livestock, thereby boosting demand for more expensive natural products that improve farm productivity.

Anpario’s range includes products containing plant extracts such as oregano oil to improve nutrition, acid products that kill pathogens like salmonella in feed, and toxin binders, which render fungi growing in feed indigestible.

- Shares for the future: a dozen good businesses

- Share Sleuth: taking profits from one holding and adding to another

Sometimes these products are delivered to animals in unique carrier matrixes to ensure they remain effective through the length of the gut.

The requirement to restrict the use of antibiotics in farming is an opportunity for Anpario, as are bans on substances like formaldehyde and zinc oxide. But the company does not have everything its own way.

Antibiotics were banned in the EU as long ago as 2006, but bans are only as good as the enforcement that goes with them. Antibiotics may still be used in animals for the treatment of disease and sometimes for its prevention, which offers a loophole to less scrupulous farmers who still use them indiscriminately.

This means Anpario has a cheaper competitor in some territories more than others.

The company also has rivals producing natural animal feed additives, including larger ones such as Alltech, headquartered in the US, and Biomin of Austria.

And, as Chinese pig farmers have learned from African Swine Fever, vaccination, basic hygiene and raising pigs in better conditions produces healthier animals.

To compete with other means of improving animal health, Anpario’s strategy is to ‘sell the science’, collaborating with universities and research centres to demonstrate the efficacy of products and use its local sales teams to communicate the results to farmers.

In a world where antibiotics are not used to keep animals productive in sometimes appalling conditions, a combination of medicinal antibiotics, feed supplements, vaccination and hygiene can ensure farms are as productive as possible.

Is meat killing the planet?

An antibiotic growth promoter-free future will be a better world for humans and animals. But it is not good enough for some, because meat is an inefficient means of delivering protein to people.

Although most of the feed consumed by livestock, like pasture, is not suitable for human consumption, animals reared for humans still consume more plant-based protein fit for humans, like soy, than they give us.

Furthermore, meat production causes methane emissions and deforestation, which are both major factors in global warming.

Anpario has a positive role to play because a healthy animal gut produces less methane, but this is unlikely to be enough for global warming activists.

- Two US stocks Beyond Meat and Tattooed Chef

- Share your views on retirement for a chance to win £1,000

Mike Berners-Lee, author of There Is No Planet B, sees an “undeniable need” for a reduction to “perhaps half today’s global average meat and dairy consumption”.

This, I think, is a distant threat to Anpario. Meat consumption has been on the rise for decades, particularly in developing countries where increasing numbers can afford it. The UN Food and Agricultural Organisation predicts a 23% increase in meat and dairy consumption by 2050.

Perhaps the trend could reverse though, driven by health as well as environmental and ethical concerns. Credible people urge us to eat more plants and less meat.

Scoring Anpario

Agriculture is a capricious and competitive market, but Anpario avoids the risk of regional agricultural slumps by selling all over the world.

It occupies a profitable niche that it can grow by developing stronger relationships with end users, a strategy that has served many of the companies I follow well.

Although Anpario has had the money to splurge on acquisitions in recent years, it has largely chosen not to. Such restraint is a good thing, and I expect it means when the time probably comes, the money will be spent judiciously.

Chief executive Richard Edwards is very experienced, and although there have been a number of board changes in 2020 they have been planned carefully.

I particularly liked the appointment of Marc Wilson, the new chief financial officer. He replaces Karen Prior, who will remain on the board as company secretary and executive director responsible for corporate and social responsibility (CSR).

- Read more of our content on UK shares here

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Wilson is only 33, he joined Anpario aged 22 and is a product of its ‘multi-faceted internal development programme’.

Further evidence that the company treats staff well comes from the wage bill, which increased 27% in 2020 despite the number of people employed increasing only 5%.

The company did well compared to 2019, triggering staff bonuses. Judging by the relatively modest bonuses earned by the executives, the rewards were widely shared.

The company also issued one of my favourite regulatory news items of the year when it announced the victory of Orego-Stim-fuelled racing pigeon Lady Oregon in the famous Sydney Gold Ring Race.

With top birds changing hands for more than £1 million, Anpario says owners are keen to improve their chances of winning.

I cannot imagine it is a big market, but it makes a good headline.

Does the business make good money? [2]

+ High return on capital

+ High profit margins

+ Decent cash conversion

What could stop it growing profitably? [1]

+ Very strong finances

? Capricious and competitive markets

? Global warming

How does its strategy address the risks? [2]

+ Focus on international sales

+ Develops direct relationships with farmers

+ ‘Sells the science’

Will we all benefit? [2]

+ Experienced management, not excessively remunerated

+ Promotes from within

+ Communicates well with shareholders

Is the share price low relative to profit? [-1]

− No. A share price of 565p values the enterprise at about 25 times adjusted profit

With a score of six out of nine, I consider Anpario to be fairly valued. It probably is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Anpario.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.