Richard Beddard: this AIM stock looks good, but isn’t cheap

Simple business and experienced team count in its favour, although Covid-19 may weigh in the future.

23rd April 2021 17:06

by Richard Beddard from interactive investor

Simple business and experienced team count in its favour, although Covid-19 may weigh in the future.

Shares in Judges Scientific (LSE:JDG) are not cheap, but it is evolving a well-proven strategy.

Judges buys manufacturers of highly specialised scientific instruments. It is not fussy about what kind of scientific instrument, but its subsidiaries are very similar in other respects.

They are small, profitable and capable of sustaining profitability, because the equipment they make is highly specialised and therefore there are few competitors. Usually the founders want to retire, but also leave their legacies in safe hands.

- Six things you must do before buying any share

- Shareholder voting & information. Have your say on the companies you invest in

About half of Judges’ revenue comes from universities, which are growing rapidly in many parts of the world.

Judges uses debt to finance deals, and the cash flows of the existing business to keep debt at a moderate level. Its reputation for managing debt keeps it on good terms with Lloyds Bank and enables it to follow through on deals once it has agreed terms.

Judges says it has never renegotiated the terms of a deal, which means it also has a good reputation among sellers and their agents.

By not overpaying for acquisitions it has earned very good returns from them.

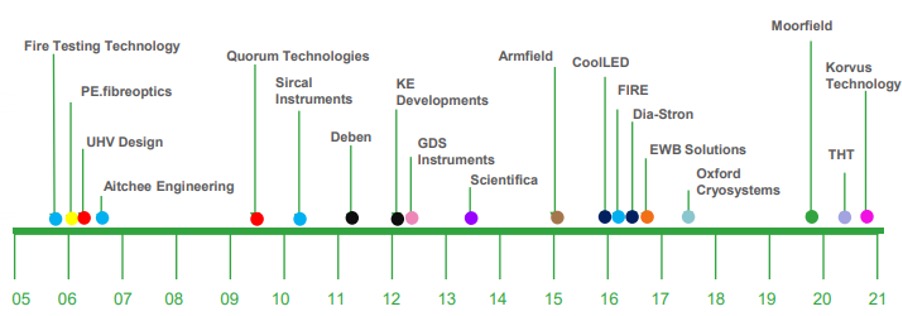

19 acquisitions in 16 years. Source: Judges Scientific full year results presentation, 2020

While the businesses essentially run themselves subject to the financial oversight of the mothership, since the recruitment of chief operating officer Mark Lavelle from Halma (LSE:HLMA) in 2018, Judges has put more emphasis on nurturing them.

The Halma connection is significant because Halma is a similar but bigger business. It is an agglomeration of nearly 50 businesses, with revenue of £1.3 billion compared to Judges’ £80 million. Halma expects about half of its growth to come from the addition of acquisitions and half from the organic growth of existing subsidiaries.

- Read more of Richard Beddard's articles here

- Five AIM shares to generate long-term growth for your ISA

Lavelle says Judges does not look for synergies and cost savings, it slots the independent businesses into its financial systems and encourages them to grow by expanding their geographical reach, funding product development, coaching the managing directors, and encouraging them to help each other.

The strategy is, perhaps, exemplified by the acquisitions in 2020...

Independent businesses, stronger together

In May 2020, Judges acquired Heath Scientific Company. Heath makes calorimeters to improve and verify the safety of lithium batteries, a growing market due to the proliferation of electronic gizmos and electric vehicles.

Judges’ first acquisition in 2005, Fire Testing Technology, also makes calorimeters and the company believes “the interaction between the two... will be constructive”.

In October 2020, it acquired Korvus, a manufacturer of vapour deposition systems used by scientific researchers to coat materials with thin films. Two other Judges Scientific companies have capabilities in thin films.

The absolute cost of the acquisitions depends on their performance, but Heath, the bigger of the two companies, will cost a modest-looking 6 times adjusted operating profit. If you think that sounds like a bargain, Korvus will probably cost less than four times adjusted profit.

If only stock market investors could buy shares on such multiples. That is the attraction of Judges. It buys growing businesses for four to six times their annual profit, so the payback period on the investment is only a few years. After that, the returns belong to shareholders.

Judges uses those returns to fund more acquisitions and pay a growing dividend.

We can be confident the strategy is sustainable, because in more than 15 years of following it Judges’ financial borrowings relative to the capital it uses have been stable. The share count has been pretty stable too.

Judges is a reliable cash generator, and while it can borrow at 2% to buy companies that earn returns many times that, it makes sense to maximise the opportunity.

- Richard Beddard: this FTSE 250 stock prospers through downturns

- Richard Beddard: price drop offers chance to own this small-cap

The most likely pressure point on the strategy is the cost of acquisitions. Bigger companies attract more suitors, which bids the price up. But as Judges grows it needs to make bigger acquisitions or lots more smaller ones to maintain the growth rate. A greater focus on organic growth may help, but ultimately the company may have to consider paying more for high-quality businesses.

Pandemic impact

Strong growth in recent years came to an end in 2020.

The pandemic closed the universities that buy about half the instruments it makes, cancelled the scientific conferences where Judges sells many of them, and restricted sales trips to far-flung customers.

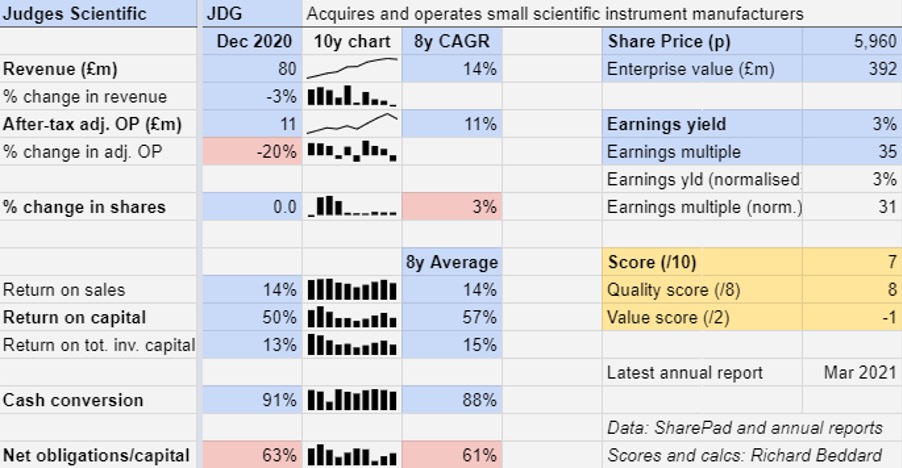

Despite a first full-year contribution from Moorfield, acquired in 2019, and part-year contributions from Heath and Korvus, revenue fell 3% and adjusted profit fell 20%, primarily due to the high fixed costs of factories and equipment.

After the year-end orders have just about returned to budgeted levels and during the first 10 weeks of 2021 order intake was slightly ahead of 2020 and the company is hopeful profitably will normalise this year.

Scoring Judges

I like the simplicity of the business model and the experience of the team running it. Founder and dealmaker David Cicurel is a septuagenarian, which raises the issue of succession, but in terms of finance and operations the company is in experienced hands and it owns growing businesses irrespective of future deals.

- Your chance to win £1,000: take part in the Great British Retirement Survey

- Open an ISA with interactive investor. Click here to find out more

Perhaps the biggest external risk is university spending. Funding comes from governments, who may reign it in to help pay down debt following emergency spending during the pandemic.

Judges expects this, but it earns 85% of revenue around the world, and hopes the impact of austerity will be felt unevenly in different territories over time as it was after the great financial crisis, when Judges often thrived.

Does the business make good money? [2]

+ High return on capital

+ High profit margins

+ Excellent cash conversion

What could stop it growing profitably? [2]

+ Succession of David Cicurel

? Bigger acquisitions tend to be more expensive

? Government funding of universities

How does its strategy address the risks? [2]

+ Financial discipline

+ Strengthening of senior management

+ Increased focus on organic growth

Will we all benefit? [2]

+ Founder David Cicurel owns more than 10% of the shares

+ Head office is small and low key, and executives are sensibly remunerated

+ Subsidiaries have responsibility for their own destinies and staff are encouraged to act like owners

Is the share price low relative to profit? [-1]

˗ A share price of £59.60 values the enterprise at 31 times adjusted profit (normalised)

The shares are not cheap, but why would they be? A score of seven out of nine means it is probably a good long-term investment.

Richard owns shares in Judges Scientific.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.