Richard Beddard: an abundance of red flags at this fascinating company

18th November 2022 14:20

by Richard Beddard from interactive investor

Rarely has our columnist had so much to moan about, but this is a business with great potential and investors have been tolerant of red flags.

Because I follow growing businesses with strong finances, it is rare that I tolerate as many red flags in the long-term financial statistics of a company as I do with James Cropper (LSE:CRPR).

That is because there is more to James Cropper than the struggling paper-making business it shares a name with.

Not much reassurance in the numbers

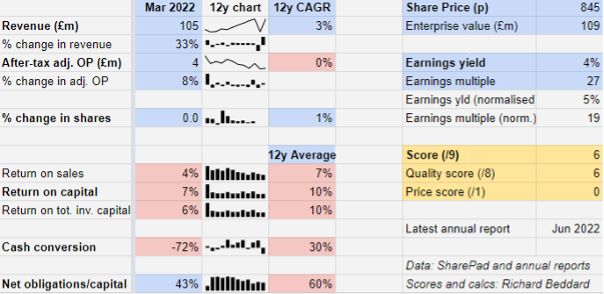

The company has contracted in real terms over the last 12 years. It is only modestly profitable, cash conversion is poor and James Cropper has significant financial obligations.

- Find out about: Trading Account | Share prices today | Top UK shares

There is nothing in the numbers to give us much confidence in its prospects.

To sour these first impressions more, all of the statistics relating to profitability and cash flow were worse than average in the year to March 2022, and the trend of that year intensified in the first half of 2023.

Across the business, demand is recovering after the pandemic and consequently revenue increased 26% in 2022 and 33% in the half-year to September 2023.

But that is where the good news stops.

Growing sales mean more cash has been used to fund stock and receivables (money owed by suppliers), which, combined with payments to plug the deficit in its pension scheme, the resumption of investment and a dividend, explains why in cash terms, the company made a loss in 2022.

Raw material costs have risen strongly and energy costs are soaring, which the company has tried to offset with price rises and by levying energy surcharges on customers.

Market prices, though, have moved much faster than James Cropper’s response, and the lag has had a dramatic effect on profit margins.

During the first half of 2023 James Cropper just about broke even. It expects profitability to improve in the second half of the year as price increases kick in, but it thinks it will earn only half the adjusted profit (before tax) it achieved in 2022.

A tale of three businesses

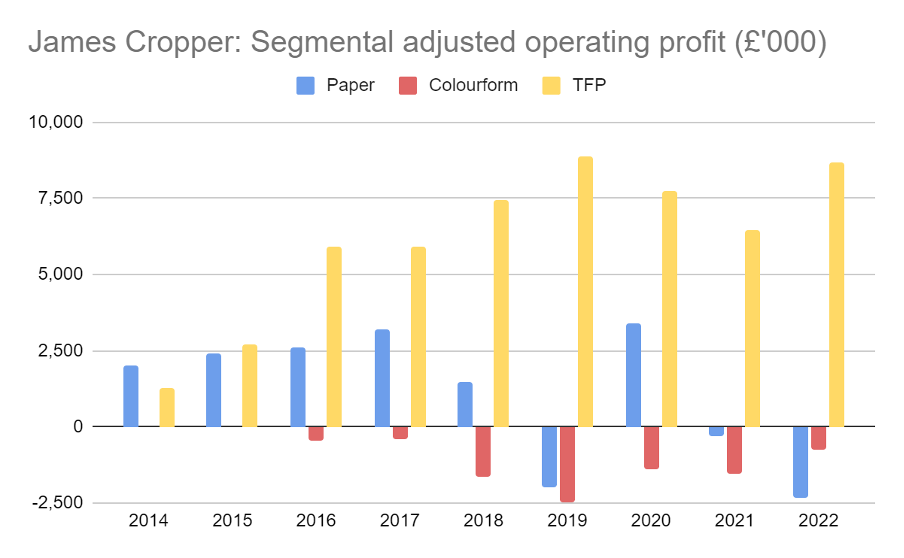

Scratch beneath the surface though, and James Cropper is revealed as three very different businesses. One of them, TFP (which stands for Technical Fibre Products) is carrying the other two.

Paper is by far the biggest of the three businesses. It earns more than twice as much revenue as TFP and employs three times as many people, but it is contracting and only intermittently profitable.

Although paper-making is energy intensive, and cost inflation explains some of its recent poor performance, it has been a low margin business for a long time. Repeated restructuring has yet to change this.

Colourform, which makes exquisite, shaped, sustainable, bespoke and environmentally sustainable packaging, is a start-up. Although it has never made a profit, the numbers are going in the right direction: revenue is rising, and losses are diminishing.

TFP is the jewel in a crown mostly made of lead and quicksilver. It was growing strongly before the pandemic, and it has earned an average 29% profit margin over the last five years.

The three businesses complicate the investment case for James Cropper. Not only must TFP sustain profitable growth, it must turn the paper business around or keep refining it until it finds a profitable core or nothing is left.

Colourform must also prove itself by making profit.

Finding the profitable core

TFP’s technical fibre business developed out of the paper manufacturing process decades ago. The company makes fibres out of carbon and other technical materials with particular qualities that, blended with other materials, improve their strength, make them fire resistant, or turn them into insulators or conductors of electricity.

These improve the performance of a wide variety of products, from tennis rackets to telegraph poles sheathed in fire resistant coatings.

One of TFP’s most promising products is a substrate for the gas diffusion layer of hydrogen fuel cells.

Hydrogen fuel cells are an alternative to batteries for the storage of renewable energy either in vehicles or for the grid. This is a nascent market TFP already supplies with technical fibres that coat wind turbine blades and cowls. The wind turbines are a green source of electricity to power the production of hydrogen.

Last year, TFP acquired a third hook into the hydrogen economy in the form of PV3, a small Cornish business that supplies catalyst powders and coated electrodes for electrolysers and fuel cells. Electrolysers are devices that produce hydrogen from water.

In 2021, 20% of TFP’s revenue came from PV3, now rebadged TFP Hydrogen, and, the company said, 50% of the world’s hydrogen fuel cells incorporated its materials.

TFP Hydrogen hopes to grow as the “hydrogen economy” grows, a process that may have been hastened by the Ukraine War and increasing emphasis in the West on energy security.

During the pandemic, James Cropper reorganised its three divisions into separate vertically integrated groups, giving it the opportunity to distinguish their strategies more.

This should help it grow TFP and Colourform, while “rightsizing” Paper.

The new group chief executive is the former managing director of the paper division, but he is making the right noises by focusing the paper business on the same market as Colourform.

Luxury packaging, James Cropper says, is more profitable than the commodity paper markets it has been steadily withdrawing from.

Meanwhile, innovative sources of sustainable raw materials like recycled coffee cups and natural dyes help customers meet their environmental targets and James Cropper differentiate its paper.

Growth, but not at any cost

The company says it seeks business growth in line with its purpose and values, not growth at any cost. This is a good thing, as businesses that lust for rapacious profit often take shortcuts that undermine their long-term prospects.

One of James Cropper’s values is to be “forward thinking”, but I wonder if James Cropper has been slow to respond to the inadequate performance of its paper-making division because it cannot imagine itself not being a papermaker.

This was the original business, founded by James Cropper, a Quaker, in 1845 and still operating from its mill in Kendal, on the southern fringe of the Lake District, and still chaired by Mark Cropper, a descendant of the founder.

- Is this phoenix share rising from the pandemic ashes?

- Stockwatch: is this mid-cap share’s positive surprise a cue to buy?

Judging by the annual report, the group has a family ethos. Like many companies, it celebrates the achievements of staff internally, but unlike most, it publishes them in the annual report. In 2022, it opened a free gym for staff.

The company also has a progressive attitude towards the environment. It already generates solar energy from its rooftops and is working towards carbon neutral operations by 2030.

It wants the majority of sales to come from products supporting the “global drive to net zero” through, for example, the light-weighting of vehicle components and the manufacturing and storage of hydrogen.

Scoring James Cropper

The poor performance of the paper business is hiding the much better performance of TFP, which also has an unknown but potentially large opportunity to grow if hydrogen becomes a prominent component of our energy supply.

That prospect though, is uncertain, and while the paper business sucks away management’s attention and the company’s financial resources, the company is not in the best position to take the full opportunity.

Traders and shareholders are more tolerant of the red flags. The share price is not low in comparison to profit even if we judge James Cropper by its average profitability, including years in which it was considerably more profitable than the last one.

Does the business make good money? [1]

? Modest return on capital

? Modest return on sales

? Weak cash conversion

What could stop it growing profitably? [1]

? Significant financial obligations

? Strong competition, particularly in paper-making

? Susceptibility to pulp, paper and energy prices

How does its strategy address the risks? [2]

+ Innovation of niche sustainable products

+ Vertical integration

? Pivot to hydrogen economy

Will we all benefit? [2]

+ Experienced board, not overpaid

+ Family culture celebrates achievements of staff

? Is its loyalty to its paper-making heritage too strong?

Is the share price low relative to profit? [0]

+ No. A share price of 845p values the enterprise at £109 million, about 19 times normalised profit.

A score of 6 out of 9 indicates James Cropper may be a good long-term investment.

It is ranked 26 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.