Reversal is fresh opportunity to buy this global chain

It’s throwing ethical caution to the wind, but analyst Rodney Hobson expects investors will keep buying this stock with a long history of outperformance.

15th January 2025 07:58

by Rodney Hobson from interactive investor

Has ethical investing passed its peak? Was it just a fad? Just when the world is watching icepacks melting and California burning, the desire to “do the right thing” seems to be on the wane.

Only three years ago there was relentless pressure on companies to adopt policies on sustainability, diversity and other ethical issues. The supply chain had to be kept squeaky clean. Failure to do so would encourage customers and investors to look elsewhere.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Something has changed radically. The heavy numbers that turned up for the annual London Sustainable and Social Investing Show have dwindled and the event has been rolled into the larger London Investor Show. Companies have likewise cut back on paying even lip service to issues such as sustainability and social diversity.

That change in mood is likely to accelerate in the United States once Donald Trump, a man not known for his woke agenda, resumes as President next Monday. Recent rulings by the US Supreme Court with its conservative majority have thrown doubt over the legality of what is sometimes referred to as positive discrimination.

The latest American company to throw ethical caution to the wind is restaurant chain McDonald's Corp (NYSE:MCD),which has scrapped the diversity initiatives it introduced under pressure from activists, rescinding such measures after attacks from different agitators. McDonald’s will no longer set “aspirational representative goals” worldwide, nor will it continue to require its suppliers to make a commitment on diversity, equity and inclusion.

The chain says that it remains committed to inclusion but these are, more than ever, just words. An activist investor called Robby Starbuck has made it his mission to attack what he perceives as woke companies, claiming that cash-strapped customers now have different priorities.

The shift in the mood has also produced similar changes in policy at retailer Walmart Inc (NYSE:WMT)and motorcycle maker Harley-Davidson Inc (NYSE:HOG). Walmart has suffered noadverse impact on its share price; indeed, it has gained from $55 to $90 over the past 12 months. Harley on the other hand has slipped from $34 to $27 in that time.

Among tech stocks, Meta Platforms Inc Class A (NASDAQ:META)and Amazon.com Inc (NASDAQ:AMZN)have both decided to roll back their diversity programmes, while Apple Inc (NASDAQ:AAPL)is urging shareholders to reject such a move.

- This secret indicator is warning about a lost decade for the S&P 500

- ii view: Airbus commercial plane deliveries grow

The overall impact is likely to be that companies are judged solely on their financial record, rather than having pariah stocks such as oil and tobacco seeing their shares trade at a discount because they are shunned by ethical investors.

Back to McDonald’s. Its shares dropped 2% in one afternoon when an outbreak of e.coli was linked to its quarter pounder burgers in October. There were 75 reported cases in 13 western US states, including one death and more than 20 people being admitted to hospital. Lawyers were, as usual in the US, quick to leap on the litigation bandwagon.

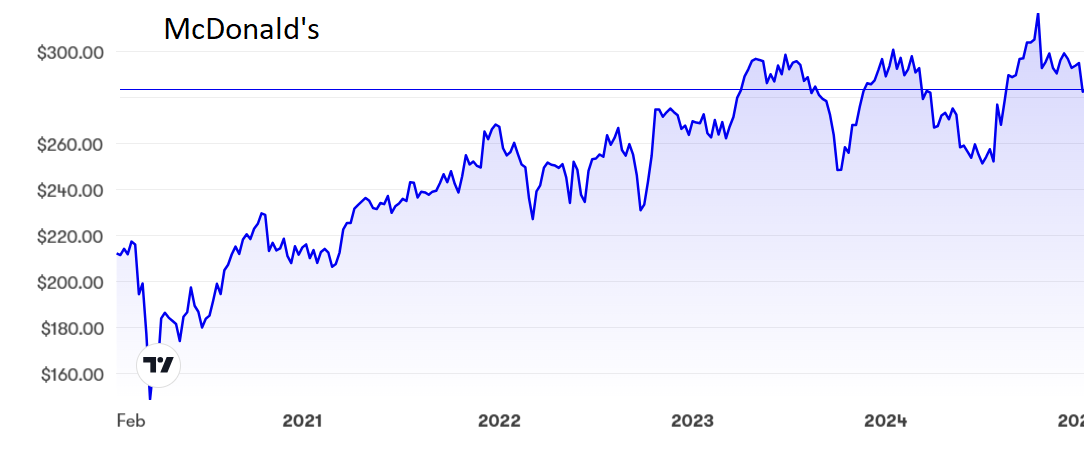

Source: interactive investor. Past performance is not a guide to future performance.

No sooner had normal service been resumed than McDonald’s produced third-quarter figures showing net profit down 3% to $2.26 billion despite a small rise in revenue to $6.9 billion. A 6% rise in costs was to blame for the profits shortfall. Undaunted, the fast-food chain raised the quarterly cash dividend by 6% to $1.77 per share.

The stock has slipped from a peak of $318 in mid-October to $280, where the price/earnings (PE) ratio is factoring in better news at just under 25 while the yield is 2.4%.

Hobson’s choice: McDonald’s shares have remained above my initial buy recommendation at $244, and my later suggestion that $300 was attainable took a little longer than I expected but eventually happened. The latest slippage in the share price restores the buy rating.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.