Revealed: the best-value platforms for investment trusts

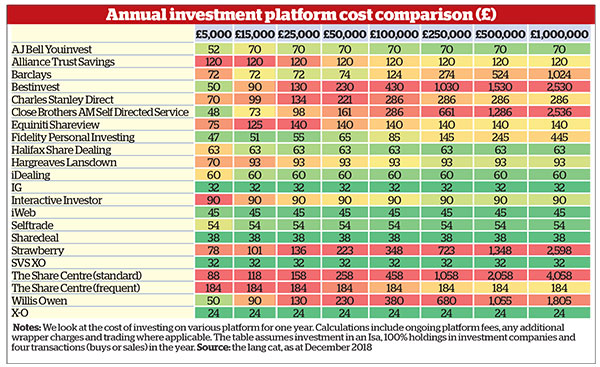

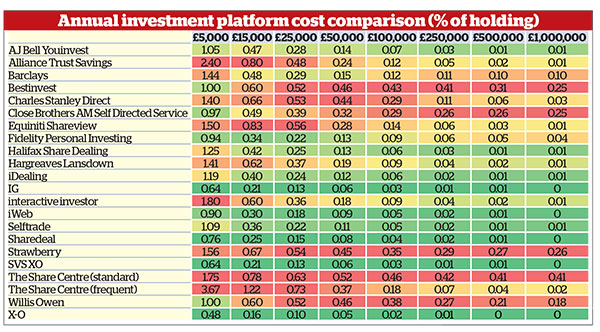

Which are the best-value options for holding investment trust portfolios of different sizes? Our heatmap…

19th February 2019 12:09

by Jeff Salway from interactive investor

Which are the best-value options for holding investment trust portfolios of different sizes? Our heatmaps reveal all.

More than 150 years after the first investment trust came into existence, trusts are still gaining popularity among direct investors. However, the investment environment today is very different from that in 1868 when the Foreign & Colonial trust was launched to offer private investors access to international investment opportunities.

A prominent development over recent years has been sustained growth in the proportion of investors using platforms to access investment trusts. Research published in May 2018 by the Association of Investment Companies found that the greatest growth in investment trust use has been on direct-to-consumer platforms, with many self-registered investors (who bought investment company shares directly) having shifted their holdings to these platforms.

Yet investment trusts generally have a low profile on direct-to-consumer platforms, and some platforms still don’t offer access to them. It’s also true that while investment trust sales on platforms continue to climb, they still lag some way behind sales of open-ended vehicles (as they do across all sales channels).

- To beat inflation, turn to investment trusts

There are distinct advantages to holding investment trusts, however, including some that are unique to platform-based holdings. For example, the way certain platforms structure their charges means that the fees paid by investment trust shareholders are capped at a fixed annual level (in contrast, unit trust holders are typically charged a percentage of the value of their assets).

It can therefore make more sense to buy investment trusts directly through a platform rather than through an adviser, says Steve Nelson, consulting director at Edinburgh-based financial services consultancy the lang cat.

“The cost of accessing investment trusts on direct-to-consumer platforms is fundamentally different from that on advised platforms,” he explains. “Most advised services charge an unlimited percentage-based custody or product charge, while for equities (including investment trusts) direct-to-consumer platforms typically levy either a low percentage charge that’s capped at a modest level or no ongoing charge at all.”

Hargreaves Lansdown, for example, caps annual charges on shares (including investment trusts and ETFs) at £45 a year (Isa), whereas charges for open-ended vehicles are 0.45% a year on the first £250,000 (reducing above that level). AJ Bell Youinvest has a similar structure. It charges 0.25% on the first £250,000 of open-ended funds held in Isas. It charges 0.25% for investment trusts in Isas too, but fees are capped at £30 a year.

- How to generate a £10,000 income: 2019’s investment trust picks

Such savings may, however, be wiped out by buying and selling costs, as investment trusts are treated in the same way as conventional shares, so they are more expensive to trade than funds. The differences are significant enough to give investors plenty of food for thought when comparing platforms for investment trusts.

Cheapest doesn’t always mean best, of course. Myriad factors will influence platform comparisons, especially perhaps when it comes to investment trusts. But cost is a vital factor, not least because of its impact on long-term returns.

That’s why we asked the lang cat to provide us with ‘heatmap’ tables showing how much investors pay for investment trusts on the main direct-to-consumer platforms. The heatmaps show the cheapest platforms in green cells and the most expensive in red cells. Everything in between becomes redder in shade as cost rises or greener as it falls.

The shading is based solely on comparisons with the other platforms shown and not with the wider market or any other particular benchmark.

The two tables – one using percentages and the other pounds and pence – show the cost of investing in investment trusts on a range of platforms for one year, assuming 100% investment in an Isa and four transactions a year. The figures include ongoing platform fees, any additional wrapper charges and the costs of trades where applicable.

Please click here for larger version of table

Please click here for larger version of table

What the data tell us

The main costs in holding investment trusts on platforms are ongoing costs – also known as administration or custody costs and usually based on a percentage of assets held – and transaction costs relating to buying and selling, typically of between £5 and £12.50 per trade. The low ongoing costs on investment trusts – capped or not levied at all, as already noted – mean that typically in practice the main costs to consider are ad-hoc or regular trading costs.

One of the first patterns that jumps out from the tables is the effect of fixed fees. Alliance Trust Savings (ATS), interactive investor (which acquired the ATS platform in October) and The Share Centre all take the flat-fee approach, rather than charging a percentage of the assets invested.

This means that while these platforms tend to be more expensive for those investing modest amounts, they become progressively more affordable from around the £50,000 mark. The fixed-fee approach is therefore most cost-effective for investors with the biggest pots, which under a percentage-based approach would see their charges increase as their investment grew in value.

There are several exceptions to this price dynamic, thanks to a cluster of specialist execution-only share dealing services. XO, SVSXO, IG, iWeb and Sharedeal are cheap across all pot sizes, with fixed fees below £50. That’s because the heatmaps assume fewer trades (four a year) than users of those services would realistically carry out in a year.

- Use specialist investment trusts to shore up a portfolio in stormy waters

Their universal cheapness also reflects the absence of ongoing charges on most of those services. The downside to this is more limited functionality. For instance, users of X-O, SVS XO, Sharedeal and IG can’t automatically reinvest their dividends. More significantly, these execution-only operators cater exclusively for share traders – with no funds, bonds, ETFs or other assets available – and tend to be pretty basic in terms of service and facilities.

In contrast, while fellow fixed-fee operators including ATS, interactive investor and (to a lesser extent) Halifax Share Dealing start off a little more expensive for smaller pots, they offer a wider range of services, functionality and asset choice.

The outlier here is the pricing for The Share Centre. For frequent traders (who deal more than £750 frequently or have a lump sum to invest), its fixed fee makes it relatively cost-effective at the higher end. But for standard traders (those who typically deal less than £750 or only occasionally) the cost quickly becomes prohibitive. This is because the firm’s ‘standard’ option has a trading charge of 1% of the value of the trade, which means that investors with large portfolios will invariably go down the frequent trader route.

Away from the fixed-fee cohort, the picture is mixed. Percentage fee (ad valorem) services are generally better for those with pots of around £50,000 and below, and this is quite clear from our tables. Charles Stanley and Bestinvest start off fairly cheap at the lower end but quickly become less cost-efficient.

For larger pots the difference in charges between these services and the flat-fee operators will be a significant deterrent for some. At the high end of the market, however, investors are prepared to accept those margins for the service levels and choice range they can expect for their money.

Of the other big names, the cap on fees keeps Hargreaves Lansdown, AJ Bell Youinvest and Fidelity around mid-market in cost terms, with the latter more competitive for small pots and the former duo for larger pots.

- New kids on the block: we examine five new investment trusts

Keep an eye on activity costs

The standout theme here is the impact of making frequent transactions. Investment trusts are ideally long-term savings vehicles, and those who approach them as such (with a buy-and-hold strategy) will generally keep costs down.

However, for investors not trading frequently enough to qualify for a discount, the trading costs that most platforms levy on investment trusts can pile up rapidly, taking a decent bite out of their long-term investment returns. This is where some of the biggest differences are between the various services. While low-cost services such as X-O and iWeb charge around £5 for buying or selling a trust, Charles Stanley and Halifax come in at £11.50 and £12.50 respectively for each trade.

Some services offer activity-related discounts (similar to that offered by The Share Centre) that bring initially expensive trading costs back into the mid-range. For example, the £11.95 per trade fee at Hargreaves Lansdown falls to £8.95 if you made between 10 and 19 trades in the previous month, and drops to £5.95 when more than 20 trades were placed over that period.

It’s worth noting that while Charles Stanley Direct looks fairly pricey for modestly sized investments – after it increased its lowest annual charge from 0.25% to 0.35% in September – this is waived for investors who make even a single trade each month.

If you are in the habit of buying and selling open-ended vehicles (such as unit trusts) on platforms, you might not be accustomed to paying for those trades, so it pays to be vigilant with your trading activity when it comes to investment trusts.

If you want to reinvest your dividends, it pays to check the varying charges you might need to pay for doing so. With most platforms you have to pay the usual transaction costs, but some – including ATS, Barclays, Selftrade and Willis Owen – will allow you to reinvest dividends for a lower fee.

Similarly, some platforms, such as AJ Bell Youinvest, ATS, interactive investor and Hargreaves, are more tolerant towards monthly investing.

Take a broad perspective

Our heatmaps reinforce the importance of understanding the total cost of investing and comparing different platforms accordingly. But cost is not the only factor to consider. The types of accounts available, the level of service, the usability of a platform website and the range of investment trusts on offer can all determine which platform is most suitable for your needs.

“Most direct-to-consumer platforms that fall within our ‘do it yourself’ segment offer a decent range of investment trusts,” says Nelson. “In terms of functionality and availability, the likes of AJ Bell Youinvest, Hargreaves Lansdown and interactive investor offer good-value, fully featured propositions.”

However, investment trusts are still not available through either Old Mutual Wealth or Cofunds (now part of the Aegon platform). Even on some platforms that we have included, the range of investment trusts is limited – on Fidelity’s Fundsnetwork, for example. Similarly, investment trusts rarely feature prominently in the bestbuy lists or ready-made portfolios that many direct platforms promote – interactive investor is one exception in this respect, with a good choice of trusts in its Super 60 fund list and the Active growth and income model portfolios.

- The top 15 performing investment trusts of 2018

There is an additional sticking point for investors who might want to vote using their investment trust shares, as not all platforms provide for shareholder voting, while some levy an additional charge for voting.

When comparing the cost of different investments, it’s important not to overlook the broader advantages of the various vehicles. Investment trusts might not be to everyone’s taste, but there are distinct advantages to using them in addition to other types of pooled investments. For example, unlike open-ended vehicles, they are allowed to gear (borrow) to invest additional funds, which may enable them to take advantage of certain market conditions.

They can trade at a discount or a premium to the underlying value of the assets held, allowing investors to buy investment trusts on the cheap. Moreover, for many direct investors, their appeal might lie in their ability to hold back up to 15% of annual dividends received from their underlying holdings in order to continue making or even growing payouts during leaner times.

As demand for investment trusts grows, it seems certain that they will become increasingly prominent on direct-to-consumer platforms. It’s clear there are good deals to be had by investors already. But as our research shows, it’s worth taking time to think about the service you want, so that you can find the platform that best suits your needs.

Further up-to-date information on the costs of holding investment trusts on platforms can be found on the AIC website, theaic.co.uk.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.