Before rethinking your portfolio this new year, do this first

Reda Farran shares four key questions for investors to ask themselves in 2024.

5th January 2024 11:15

by Reda Farran from Finimize

- An IPS describes your investment objectives, sets the guidelines for your investment activity, and ultimately determines how to put together your portfolio.

- Your time horizon, liquidity needs, employment situation, and other wealth all determine your ability to take on risk, which should override your willingness to take on risk.

- The return objective specifies the long-term, average real return you want to make, taking into consideration what’s achievable in light of your risk tolerance.

When markets are as volatile as they were in 2023, it's easy to get swept up in the day-to-day price action and lose your focus. That's why the new year is an excellent time to go back to square one for a total investment revamp, and construct your portfolio from scratch. And one of the first steps to do that is to craft an investment policy statement (IPS) that describes your money goals, sets a roadmap for your investment activity, and ultimately determines the outline of your portfolio. You can easily do that by looking at the four main elements of an IPS and asking yourself these questions.

1. Time horizon: what’s the timeline for my goals?

The first step in creating an IPS is to define your investment goals and how long you have to achieve them. If you’re a 40-year-old investing to fund your retirement at age 65, for example, you have a long time horizon – 25 years. On the other hand, if you’re a young professional and you want to buy a house next year with the money you’re investing now, you’ve got a very short time horizon – just one year. To figure out yours, ask yourself what your investment goals are, and what your timeline looks like.

Your time horizon has a major impact on your ability to take risks and, in turn, on the makeup of your portfolio. The longer your horizon, the more risks you can take, because you have more time to ride out short-term market volatility, recover from investment losses, and replenish your account with future savings. The shorter your time horizon, meanwhile, the less risk you can take. Imagine you were retiring next year: a big investment loss could have a huge, negative impact on your ability to fund your retirement.

2. Liquidity needs: how often will I need to withdraw cash?

A liquidity need is a demand for cash beyond what you’re saving in your investment account. If you have to regularly withdraw cash from your investment account to fund yourself, then you have high liquidity needs. If that’s the case, you should mainly invest in liquid assets – that is, those that can be easily and quickly converted into cash. High liquidity needs also lower your ability to take on risk: if you’re dependent on constant cash withdrawals, a big investment loss could be disastrous.

If you have low liquidity needs, however, you can take on more risk and invest in illiquid assets like private equity, real estate, and even collectibles like art and classic cars. These assets can boost a portfolio’s return. And since many of them tend not to follow traditional asset classes, they can increase a portfolio’s diversification and lower its overall risk. If you’ve got a long time horizon, you likely have lower liquidity needs, and you may be able to devote a bigger portion of your portfolio to illiquid assets.

3. Risk tolerance: how much loss can I stomach?

This can be thought of in terms of your willingness and ability to take on risk. Of the two, the latter should generally prevail. In other words, if you have a high willingness to take on risk but low ability to do so, you should definitely avoid it, as it could lead to disastrous financial outcomes. However, if you have a high ability to take on risk but low willingness to do so, you may miss out on potential gains by investing too conservatively. If you’re still struggling to decide which side you’re on, it may be best to invest conservatively. You might miss out on some gains, sure, but you’ll avoid regularly making bad investment decisions in response to market volatility – a worse outcome.

To determine your ability to take on risk, ask yourself this question: how much of a loss can I take before it severely jeopardizes my financial situation and investment objectives? If a small loss leads to a disastrous financial outcome (for example, it prevents you from properly funding your retirement next year), then you have a low ability to take risks. If, on the other hand, you can lose all of your invested money and it doesn’t harm your current financial situation or stop you from achieving your investment objectives (because you have a long time horizon, a good-paying job, or wealth in other places), then you have a very high ability to take risks.

One way to quantify your risk tolerance is to specify the maximum acceptable drawdown you can live with. Maximum drawdown is the largest peak-to-trough decline in the value of a portfolio. Something between 0%-20% means you have a relatively low risk tolerance, between 20%-40% is considered medium, and above 40% is high.

4. Return objective: how much money do I hope to make?

There’s a reason why specifying this is the last step of creating an IPS: your time horizon and liquidity needs help determine your risk tolerance, which, in turn, determines your return objective. So if you’re investing conservatively (because you have a low risk tolerance), then you don’t want to set an unrealistic, high return objective.

This return objective should be stated as a long-term average – not a target you expect to hit every single year. Markets are unpredictable, and such a target is unrealistic. The return objective should also ideally be stated as a real return – that is, return after inflation.

US stocks have generated around 8% average annual real returns since 1928, and US government bonds around 2%. This helps give you an idea of what kind of real return you should be expecting: something between 2-8% is realistic depending on your risk tolerance.

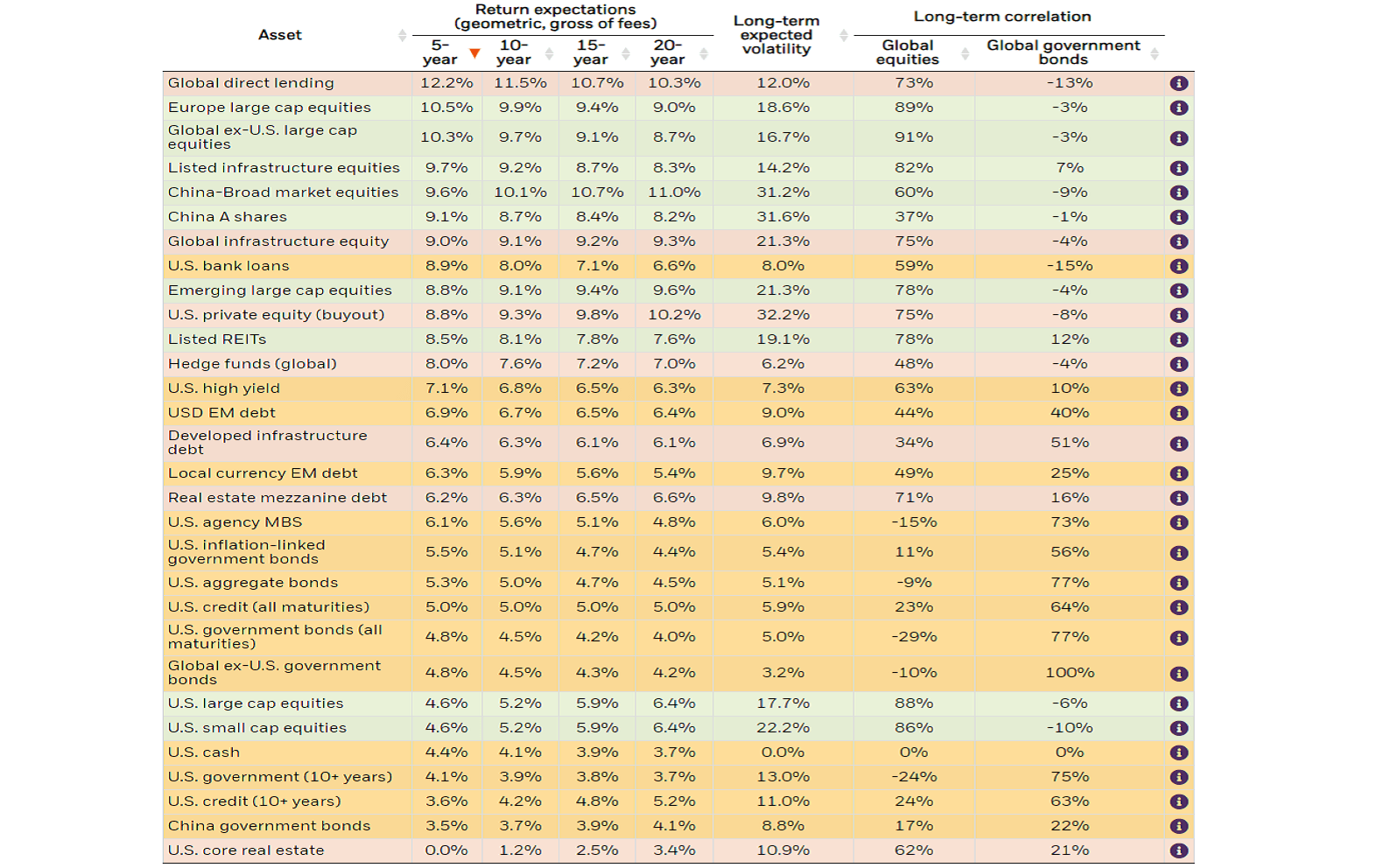

Once you’ve set a return objective, you can use BlackRock’s capital market assumptions to get an idea of which asset classes you can include in your portfolio to help you achieve that target. These are BlackRock’s expectations of different asset class returns over different time horizons taking into consideration the current macroeconomic environment, valuations, and more. Note that BlackRock’s return assumptions are nominal – that is, before inflation. To arrive at real returns, just subtract 2% (a good proxy of long-term inflation expectations) from each of them.

Major asset classes’ return, volatility, and correlation expectations. Source: BlackRock.

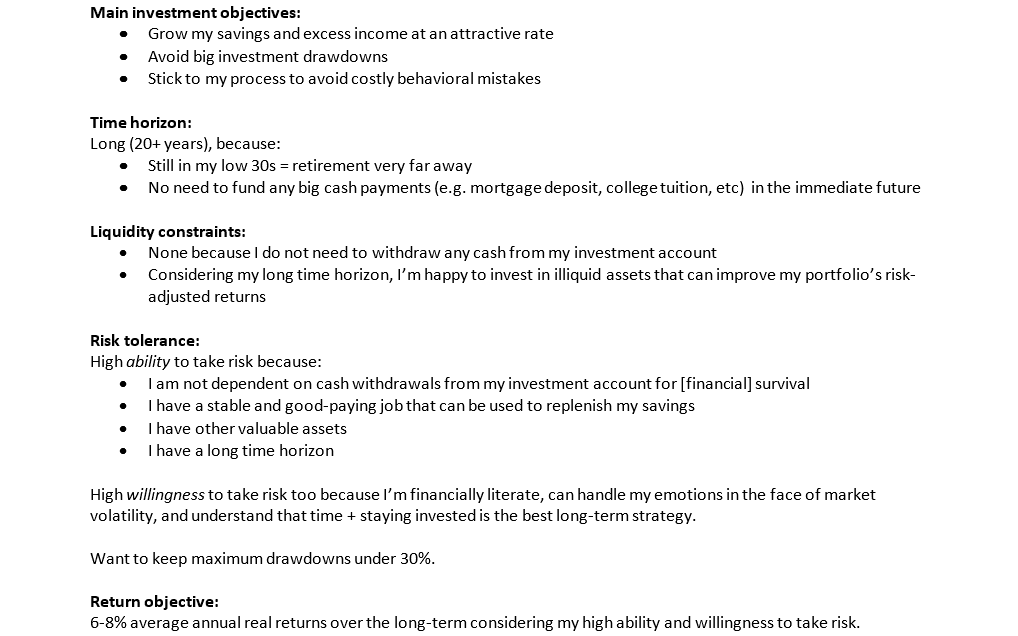

If you want to take a look at an actual IPS as you assemble your own, here’s a summary of mine.

Example IPS. Source: Finimize

Reda Farran is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.