Reasons to sell Sainsbury's shares

18th June 2018 12:07

by Leigh Himsworth from interactive investor

Each of the big four supermarkets have struggled in recent years to meet the ongoing competitive threats from Waitrose's quality offer, the home delivery of Ocado Group, the discounters, and now the potential threat of the 'beast' called Amazon.com Inc. There have been multiple responses to these threats, with each of them now having a strong local offering, while also delivering to your home.

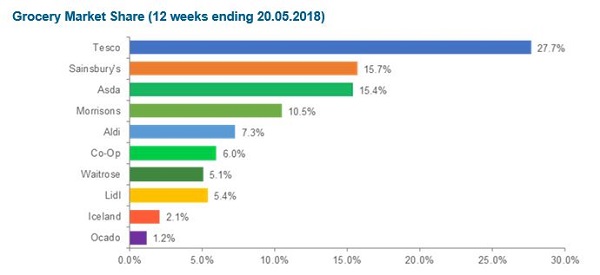

The changing nature of food retailing means that whilst commentators only really discussed the 'big four' some years ago, the discussion now, rightly includes Waitrose, Marks & Spencer Group, Ocado, Aldi and Lidl, the latter two with a combined market share of 12.7% - in excess of Morrison (Wm) Supermarkets at 10.5%.

Source: interactive investor Past performance is not a guide to future performance

Corporate activity has also driven change, such as with the Tesco acquisition of Booker, the Morrisons supply deal with McColl's and the recently announced link-up between Sainsbury's and Walmart-owned Asda.

Having been a significant holder of shares in Sainsbury's, it is this move that has grabbed my attention. A quick glance at the statement makes for a compelling reading, with at least £500 million of buying synergies, opportunities for all staff, 10% price cuts on regular items, an improved covenant for pensioners, technological tie-up with Walmart, double digit earnings accretion - the list goes on.

It is the sheer fact that we are looking at the number two in the market buying the number three that is causing a potential competition issue. That would take Sainsbury's & Asda to a number one market position with a market share of 31.4%, clearly giving the CMA (Competition and Markets Authority) an issue - ‘all qualified staff to the checkouts please.’

In theory, the issues to be determined are whether such a step would disadvantage the customer and stifle investment? The part of the statement referring to 10% price cuts on regularly purchased products, is clearly designed to address the first point as the comment, and I paraphrase, "Walmart... to share knowledge and technology developments,.." is aimed at the latter.

There are however, clearly, other factors to be considered such as the position of the employees, (over 300,000 of them), the pension trustees, and the suppliers. The landscape has changed though somewhat in recent years with new players involved and so time will tell as to whether "Asbury, or Saisda" will succeed.

Ultimately, I like the idea of three strong brands (including Argos) getting together as there will be massive buying benefits and rationalisation that may well work.

But critically, the deal will take at least until the end of 2019 to clear, and will involve a large chunk of management time. Let's also remember that winning in Food Retailing is not just about buying benefits, it is about clear market positioning and execution.

The complexity of this deal may mean a lack of focus on the day job for senior management, and could benefit the competitors in the short term, as could any store disposals. It is for this reason that into the announcement I sold the entire position in Sainsbury's and will watch from the side-lines for, perhaps, a better re-entry point, perhaps buy-one-get-one-free! - couldn't help myself.

Leigh Himsworth is a portfolio manager at Fidelity UK Opportunities Fund.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.