Rate cuts edge closer as inflation cools to 2.5-year low

The Bank of England will have some big decisions to make over the coming months with the UK’s 2% inflation target now in sight.

20th March 2024 10:16

by Craig Rickman from interactive investor

UK inflation has fallen to its lowest level since September 2021, bringing the prospect of interest rate cuts into even sharper focus.

Today it was confirmed that the Consumer Prices Index (CPI), the UK’s main measure of inflation, eased to 3.4% in February, coming in 0.1 percentage points below economists’ forecasts. That’s as low as it’s been since the 3.1% seen in September 2021.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

According to the Office for National Statistics (ONS), slowing food prices proved the main driver, with prices easing to 5% in the year to February versus 7% the month before. This means that our shopping bills are still rising but at a slower pace.

Today’s news will provide some green shoots for households whose finances have taken a pasting over the past two and a bit years. Inflation hit 11.1% in October 2022 - a 41-year high - and remained stubborn for the first half of 2023, before cooling significantly as the year drew to a close.

In a further sign that things are on the right track, core inflation - which strips out things like food and energy - slowed from 5.1% in January to 4.5% last month.

In response, Chancellor Jeremy Hunt said this shows the plan to bring down inflation is working and repeated his desire to make further cuts to national insurance contributions (NICs).

“This sets the scene for better economic conditions which could allow further progress on our ambition to boost growth and make work pay by bringing down national insurance as we work towards abolishing the double tax on work - but only if we can do so without increasing borrowing or cutting funding for public services,” the chancellor commented.

- Spring Budget 2024: what it means for you?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

During his Spring Budget speech, Hunt said that inflation is set to fall below the UK’s 2% target in the next few months. Today’s development will add further weight to the chancellor’s claim.

Will this speed up interest rate cuts?

All eyes now turn to the Bank of England’s Monetary Policy Committee (MPC), who meet tomorrow for the second time this year to decide what to do with interest rates. However, anything other than a fifth consecutive hold at 5.25% seems highly unlikely.

Many commentators believe that cuts will arrive in June at the earliest, with August seeming more likely. Some, however, believe that February’s better-than-expected inflation data may accelerate the arrival of rate cuts.

George Lagarias, chief economist at Mazars, said: “An economy in technical recession is more than balancing out building price pressures from external supply chains. While a pick-up in producer output prices may give Andrew Bailey (pictured below) some pause, we believe that the overall figure brings the first rate cut closer.”

Central banks on both sides of the pond are continuing to tread carefully regarding inflation. The US Federal Reserve (Fed) will announce its interest rate decision later today but is widely expected to keep its benchmark rate at a range of 5.25% to 5.5%.

- How to make the most of your pension allowances before April

- Budget 2024: new ‘British ISA’ with extra £5,000 allowance

On these shores, at the Bank’s Monetary Policy Report press conference, held on 1 February, Bailey said that policymakers need to be confident that inflation will not only fall to the 2% target, but stay there.

“Any decision to change Bank Rate will depend on how the evidence evolves,” Bailey said last month, adding: “By the time we get to March, we think inflation will be around 3%. In April, May and June we expect inflation to be close to the 2% target before increasing somewhat over the second half of the year,” Bailey said.

We may find out tomorrow whether February’s inflation data has moved the needle here.

Others feel that the Bank’s monetary policy tactics have been too cautious, claiming that rate cuts are already long overdue. Benjamin Nabarro, chief UK economist at Citi, an investment bank, told the Telegraph yesterday that “the Monetary Policy Committee has in all likelihood already left it too late”.

Citi estimates suggest that rates are 2 percentage points above where they should be based on the current economic conditions.

Why is inflation expected to ease significantly over the coming months?

As noted above, inflation is expected to fall below the Bank’s 2% target by the summer, far earlier than previously forecast. However, this may prove transient, with price rises predicted to nudge back up as the year plays out.

One of the main elements behind cooling inflation is that global inflationary shocks have assuaged.

A paper by the World Bank, published in December 2023, noted: “Oil price shocks were the main drivers of variation in global inflation with a contribution of over 38%, followed by global demand shocks with a contribution of about 28% over the past five decades, and much smaller contributions of global supply shocks and interest rate shocks.”

- ISA Inspiration: practical tips for your portfolio

- Bond Watch: two takeaways from how bond markets barely moved after Budget 2024

Bank governor Bailey said last month that the decision to raise interest rates was not to prevent these global shocks from happening, but rather to prevent “second-round effects on domestic prices from taking hold”.

Bailey went further: “Our restrictive monetary policy stance is working to reduce domestic inflationary pressures. Services price inflation, which is closely linked to domestic costs, has started to ease and somewhat more than we had expected.”

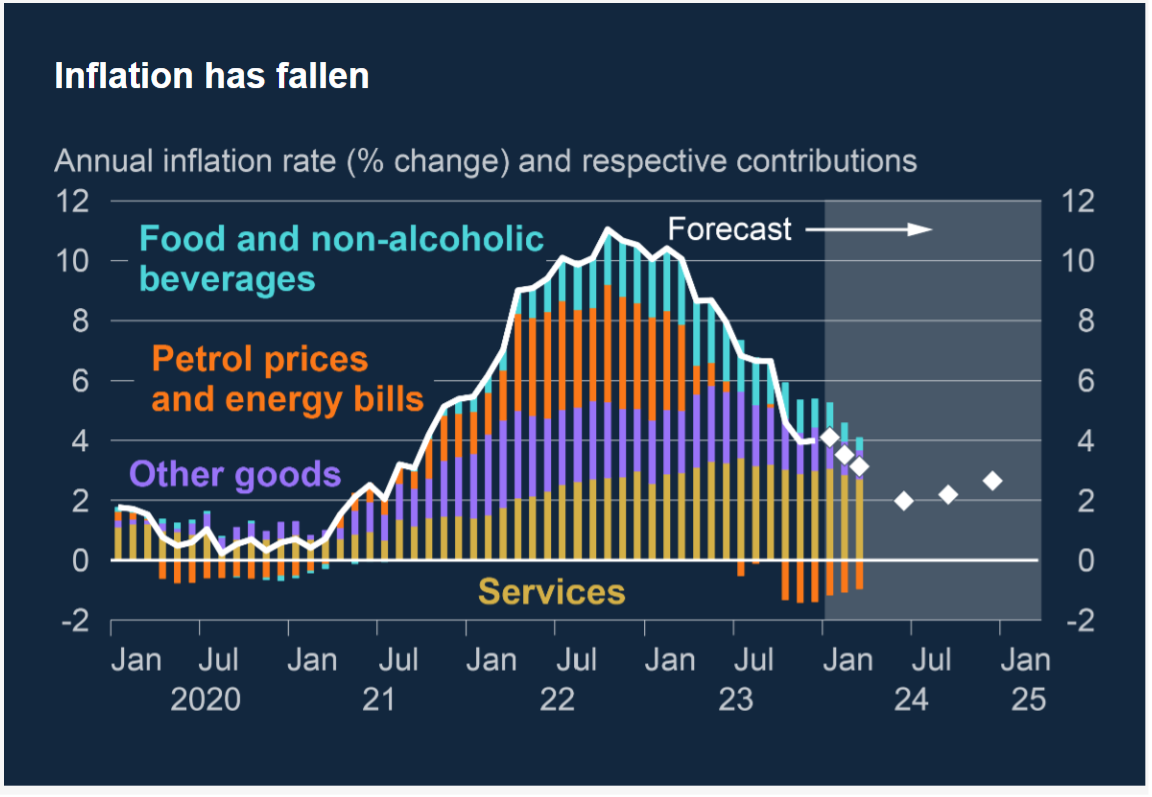

It’s worth reminding ourselves that the headline inflation rate comprises several parts. Price movements of food, petrol, services, and other goods tend to move at different speeds, and sometimes in different directions. The chart below shows how each component has contributed to overall inflation since January 2020.

Source: Bank of England Monetary Policy Report - February 2024.

As the chart illustrates, easing food and other goods increases are no longer shunting overall inflation up at the same tempo.

Elsewhere, every UK family has felt the force of spiralling energy prices, which kicked off at the start of 2021.

The chart shows how energy costs have impacted CPI over this period, but utility prices will fall 12% over the coming months, providing a welcome boost to households.

The energy price cap – the maximum suppliers can charge you per unit of energy - will fall to £1,690 per year for a typical household between 1 April to 30 June. This will shave £238 off the average annual energy bill.

Where do future inflationary pressures lie?

While things are certainly improving, it’s too early to get complacent, as the Bank frequently reminds us.

And further threats to the future path of inflation continue to lurk.

One of the biggest factors is annual wage increases. These have cooled from the 8.5% registered in the middle of last year, although one-off bonus payments to civil servants and NHS staff puffed up this figure.

Pay increases had eased to 6.1% in the three months to January. While things have slowed significantly, wages are still outstripping current inflation – and now by an even wider margin.

This is good news for workers as it means salaries are more than keeping pace with the rising cost of living. But Bailey recently reiterated his urge for constraint here, due to the impact this could have on keeping inflation elevated.

With the UK now in a “technical” recession, which is often characterised by high unemployment and slower wage growth, pay increases may continue to ease over the coming months. However, the ongoing battle for talent, with recruiting firms having to pay more to attract the best workers, could act as a counterweight to this trend.

Further potential pressures to inflation arrive in April when the national hourly minimum wage will rise from £10.42 to £11.44. In addition, some of the NIC cuts announced at the last two set-piece fiscal events also take effect, boosting the spending power of both employed and self-employed workers.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.