Rallying blue-chips and an AIM share that just doubled

A bunch of well-known names are behind today’s stock market rally. These are the big stories.

7th May 2020 13:09

by Graeme Evans from interactive investor

A bunch of well-known names are behind today’s stock market rally. These are the big stories.

Investors got crumbs of comfort from unlikely sources today, with AA (LSE:AA.), Superdry (LSE:SDRY) and even an enterprising deep fat fryer management firm providing distraction from the BT (LSE:BT.A) dividend blow.

Shares rose by double-digit percentages in the case of AA and Superdry, while More Than owner RSA Insurance (LSE:RSA) added 6% and blue-chip hotels group InterContinental Hotels Group (LSE:IHG) lifted 3%, despite its warning that global revenues per room were likely to be down by 80% in April.

The FTSE 100 also continued to hold on to April's spectacular gains, with the promise of ongoing support from central banks enough to withstand the awful global outlook. Today, the Bank of England warned that UK GDP was on track to shrink by a record 14% this year.

- Bank of England warns of economic crash and unemployment spike

- BT shares: should investors still own them after dividend scrapped?

- FTSE 100: the route to 6,000 on 7 May 2020

Other stocks doing well in the top-flight included Flutter Entertainment (LSE:FLTR), whose shares have rebounded by 80% since the crisis thanks to a surge in online gaming in the lockdown.

And as we have seen recently at testing firms Novacyt (LSE:NCYT) and Genedrive (LSE:GDR), those stocks able to exploit opportunities linked to Covid-19 are providing investors with some spectacular returns.

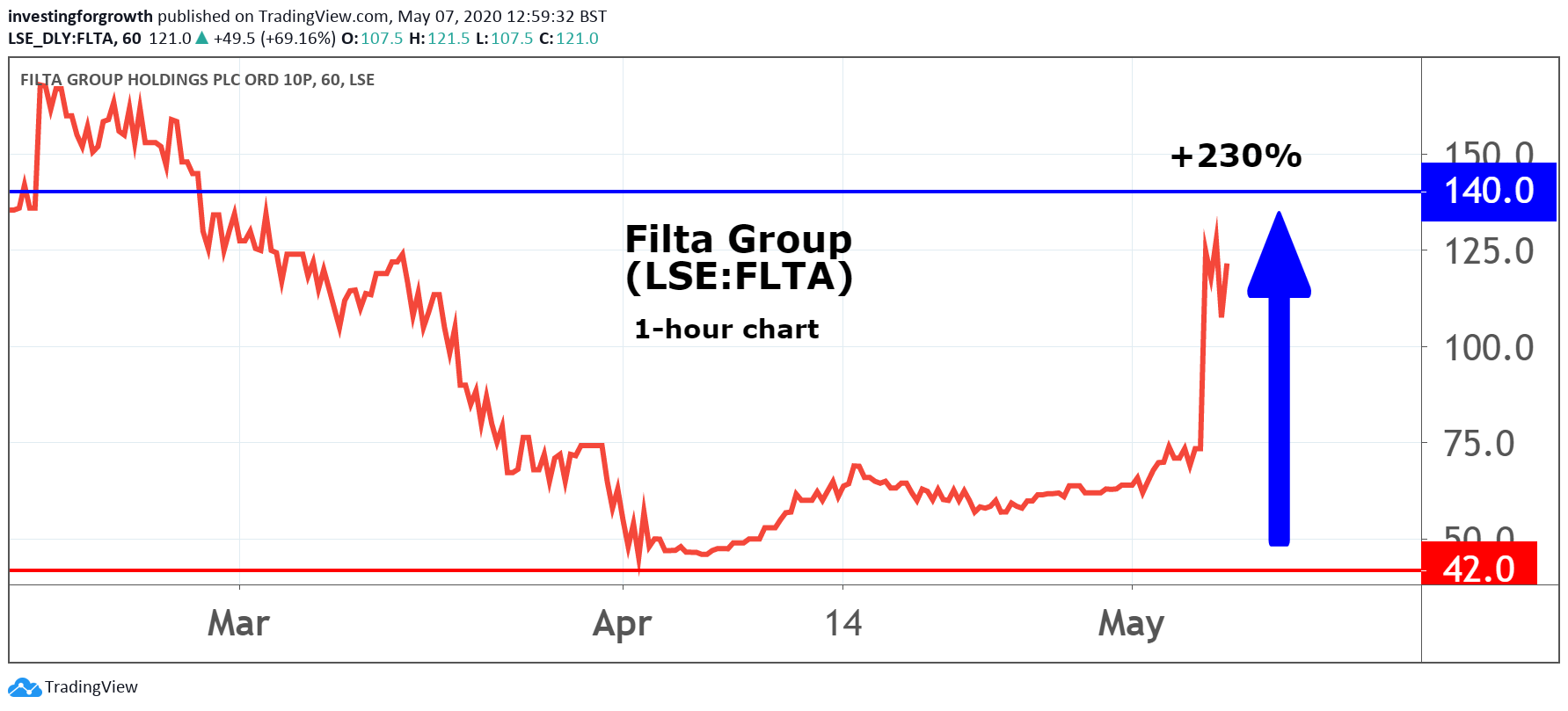

The latest of these came today from deep fat fryer management and kitchen services firm Filta (LSE:FLTA), whose latest venture is a laboratory-tested sanitising solution for use in restaurants, bars, shops, offices as well as healthcare facilities. It not only kills all viruses in minutes, it leaves behind a mono-molecular layer that bonds to the surface and protects for up to 30 days.

As well as the UK launch of FiltaShield, the Rugby-based company is also supplying and managing temperature screening devices so that its customers can screen up to 30 people per second for a fever. The devices are installed at the entrances of buildings.

Having seen shares tumble in recent weeks due to the closure of restaurants and bars in the UK and North America, today's update fired up the AIM-listed stock in spectacular fashion. Shares, which traded at 159p in February, doubled in the opening minutes of trade today and are around 60% higher at 115p this lunchtime, recouping a chunk of its coronavirus losses. They had changed hands for as much as 140p earlier.

Source: TradingView. Past performance is not a guide to future performance.

There was also a further recovery for AA shares, which jumped 15% to over 30p after the roadside assistance firm forecast that results for the year to January 2021 should only be only slightly below the full-year figures reported early today.

This reflects the recurring nature of its income, as well as the cost reduction programmes it has undertaken to reflect changed activity levels due to the lockdown.

The 2019/20 results, which showed a 3% rise in underlying earnings to £350 million, were released a few weeks after the company suspended its final dividend. This markedly reduced what had been one of the few clear attractions of the stock, namely the dividend yield.

- Stockwatch: two insurance shares I'd buy

- The Ian Cowie portfolio: a healthy return on this investment

- ii Winter Portfolios 2019-20: beating the market in a crash

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Superdry also pulled the plug on its dividend today after reporting that fourth-quarter sales were down by 37% due to the closure of all stores and most franchise locations since the end of March.

The closures have been offset by a shift in sales to online, with CEO Julian Dunkerton pleased that women's ranges are accounting for around half sales for the first time ever.

Superdry has £39.8 million of cash on its balance sheet, which it has sought to protect through measures such as the furloughing of 88% of staff and with boardroom pay cuts.

The company's lenders have also agreed to waive its April fixed charge covenant test, with discussions ongoing with potential new financing providers. Shares, which crashed 80% during February and March to just 70p, rebounded 10% to 130p today.

In the FTSE 100 index, RSA Insurance was a big riser after it reassured investors over the company's exposure to Covid-19 impacts.

It is still early days, but RSA estimates that it received 25,000 related claims in March and April, most of which were to do with travel.

This will come at an estimated cost of £25 million, with the great majority of business interruption claims not expected to be eligible under coverage terms for Covid-19.

CEO Stephen Hester added: “RSA is resilient and determined to sustain strong and appropriate support for our customers in these testing times.” He said that the company would look to restart dividend payments when it was prudent to do so.

Its Solvency II ratio was estimated at 153% at the end of April, which is a slightly better than the 151% seen in March after Covid-19 driven market impacts and planned pension contributions caused the figure to slide from 168% at the end of 2019.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.