Raise a glass to AI: here’s what it could mean for your long-term returns

23rd June 2023 10:25

by Stéphane Renevier from Finimize

It’s worth taking a closer look at what this technological revolution could mean for stock returns – and what the hangover from all the current hype could be like.

AI could supercharge labor productivity, revenue growth, and profit margins, potentially elevating the S&P 500's fair value by 5% to 15%, and possibly even by 30% under the sunniest scenarios.

But bear in mind that tech revolutions can be messy: you’ll want to pay attention to risks like macroeconomic fluctuations, policy shifts, profit-margin letdowns, and lofty valuations that already seem to anticipate AI's impact.

If you’re excited about the AI revolution, by all means, keep a slice of your portfolio for US and tech stocks. But don't underestimate the resilience you can get by diversifying across regions, styles, and asset classes.

AI has been the toast of the town all year, and driving a sparkling rally for the S&P 500. But, in case you’re thinking this intoxicating effect might soon lose its fizz, it’s worth taking a closer look at what this technological revolution could mean for stock returns – and what the hangover from all the current hype could be like.

How good might the AI bonanza be for the S&P 500?

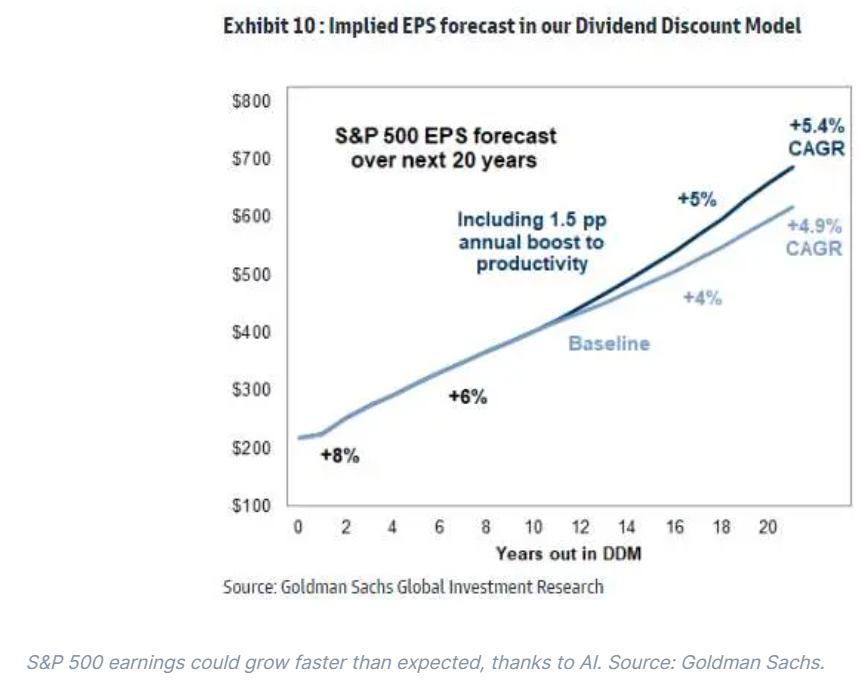

Goldman Sachs estimates that widespread use of generative AI could bolster US labor productivity growth by 1.5 percentage points across a decade. That might not sound like much, but it’d be enough to boost global GDP by 7% over the same period.

This economic rev-up implies that the S&P 500's earnings-per-share (EPS) could potentially accelerate half a percentage point, which would have them growing at 5.4% annually over the next 20 years – faster than the current 4.9% estimate.

Now, since current prices factor in future expected cash flows, we can calculate the index’s fair value – the price at which it should be trading if we take into account the AI boost. Goldman calculated that this AI boost on earnings raises the index’s fair value by about 6%, to 4,650. That tells you the S&P 500’s too cheap just now.

Running scenarios with different productivity growth rates varies the fair value estimate by only about 5 percentage points. Put more simply, if prices were to correctly reflect Goldman’s expected boost on earnings from AI, prices should be between 1% and 11% higher than they are today. And that additional upside would boost your expected return over the next decade by up to 1% per year.

It’s admittedly a bit disappointing, but it can get better. Goldman's calculations don’t factor in AI's possible impact on revenues and profit margins in the initial ten years, or after the 20-year mark. They argue that most of AI's value boost would occur between year ten (when it gains wider adoption) and year 20 (when growth plateaus).

As 75% of Goldman’s model valuation hinges on its terminal value (projected earnings growth from year 20 onward – which hasn’t factored in AI), a more enduring boost to economic growth could take the fair value even higher.

Goldman's calculation also reveals that a 1% margin expansion driven by AI in the initial years could lift the S&P 500's fair value by another 6%, contingent on the time frame. By extension, you could assume that if margins amplify by 4% in the upcoming decade (which would be consistent with the historical relationship between productivity growth and corporate profitability), we might witness an extra 20% upside. That means, in the best-case scenario (which, admittedly, is not Goldman’s), the S&P 500's fair value might be up to 30% higher than it is today. In that best-case scenario, that’s an extra 3% per year for ten years.

What could throw these predictions out of whack?

While it’s easy to get excited about the upside created by AI, it’s also important to remember that technological revolutions are messy and that reality doesn’t always live up to the hype. Here are some of the main risks to the above:

First, there are macroeconomic risks. Short-term economic downswings might dent earnings across the board – yes, even in the tech sector. In the longer run, interest rates stabilizing at higher levels would raise the rate used to discount future cash flows, offsetting some of the positive effects of AI.

Second, there are important policy risks. As economist Carlota Perez has explained, tech revolutions typically involve a “reset” period, brought about by a shift in political and societal factors. For instance, politicians might feel the pressure to raise corporate taxes or implement measures that directly protect workers threatened by AI. Goldman calculated that an 8 percentage point increase in the tax rate would fully offset the benefits of AI.

Third, there’s the risk that profit margins disappoint. If US stocks have performed well historically, it’s largely because they managed to grow their margins at an impressive rate. The issue is, more than 70% of the expansion in margins can be attributed to the falling costs of goods sold, taxes, and interest rates. And these handy helpers may not be as generous in their contributions in the future. And with margins already very elevated – across all sectors, and not just in absolute terms but more importantly also as a share of GDP – the bar for earnings to keep growing at their high historical rate is pretty high.

Fourth, there are valuation risks, with current stock prices already reflecting some of the expected benefits from AI. The S&P 500 is barely a 6% leap away from Goldman’s AI-enhanced base case scenario. Moreover, companies with the most to gain from AI already boast valuations that are bubbling with optimism. As history warns us (hello, 2000), even if the tech lives up to its promise, meeting investors' short-term expectations can be a tough hill to climb, and the journey up is hardly ever a smooth one. Remember, stocks promising robust growth might command high valuations, but beware: they can face harsh penalties at the slightest hint of unsustainable growth rates.

So what’s the opportunity?

You’ll get no argument from me: AI is gearing up to be a major driver of S&P 500 returns in the years ahead. And if I were to revisit my ten-year expected returns projections for the S&P 500, I’d likely add a percentage point or two per year to factor in the potential AI-led boost in margins and revenue growth. That strengthens the case for owning the S&P 500 in your long-term portfolio.

But I wouldn’t go all-in: the AI effect, while undoubtedly positive, might not be as colossal as some narratives would have us believe. Goldman's sunny projections indicate a total upside of only 5% to 15% to current prices on the overall index, after all. And given how elevated valuations, margins, and profits are right now – and these really are the three most important drivers of long-term returns – there’s not much margin of safety if AI doesn’t live up to expectations.

And, sure, a good narrative can push prices way beyond fair value – meaning your returns could be way higher than the fair value analysis above suggests. But as the dotcom boom and bust taught us: that’s a high-stakes game that can backfire, because a rapid shift in sentiment can easily send prices crashing – even if the tech eventually lives up to the hype. Put more simply, buying based on sentiment rather than fundamentals is a dangerous game.

At the end of the day, successful investing isn’t just about being right: it’s also about making sure your portfolio does well if you’re wrong. So keep a serving of US – and particularly tech sector – stocks in your portfolio, but don't turn your back on the comforting embrace of diversification. Spread your investment eggs into a few regional baskets (consider Europe, Japan, China, and the broader emerging markets), across different styles (for example, value stocks and small-cap stocks), and among asset classes (you might want to add some gold, bitcoin, and long-term Treasury bonds to your mix). This approach could navigate your portfolio toward a healthier path of risk-adjusted returns.

And remember to hold onto some cash reserves. Because if the prices do correct and the entry point gets more attractive, then your long-term returns may look really attractive

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.