Quartix shares are in the 'buy zone'

19th October 2018 13:31

by Richard Beddard from interactive investor

It has always been a good company, but finally, Quartix shares may be available at a reasonable price, believes companies analyst Richard Beddard.

Normally I review companies I admire soon after they have published their annual reports, but when Quartix published its report in February the share price was so steep I skimmed the results rather than scoring the business, resigning myself to another year of not owning the shares.

This was a craven violation of my investing policy, which is to be proactive, not reactive, keeping up to date with research so I am ready to act.

Quartix's share price has tumbled nearly 40% in the last three months, and it is nearly 50% below the all-time high. The firm is trading on a multiple of about 20 times adjusted profit in 2017. That is still a hefty valuation, but, for the first time since I started following Quartix, it is not necessarily beyond reason.

Belatedly, therefore, I am scoring Quartix to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

Quartix manufactures vehicle telematics systems, tracking devices installed in vans that report back to a company on where its vehicles are and how safely and economically they are being driven. They allow fleet owners, typically fairly small businesses like local builders, plumbers and electricians, to curb moonlighting and time wasting, respond more quickly to customers, reduce fuel costs and accidents and protect their reputations from bad drivers. They also allow insurers to monitor newly qualified drivers, reducing accidents, claims and the cost of insurance.

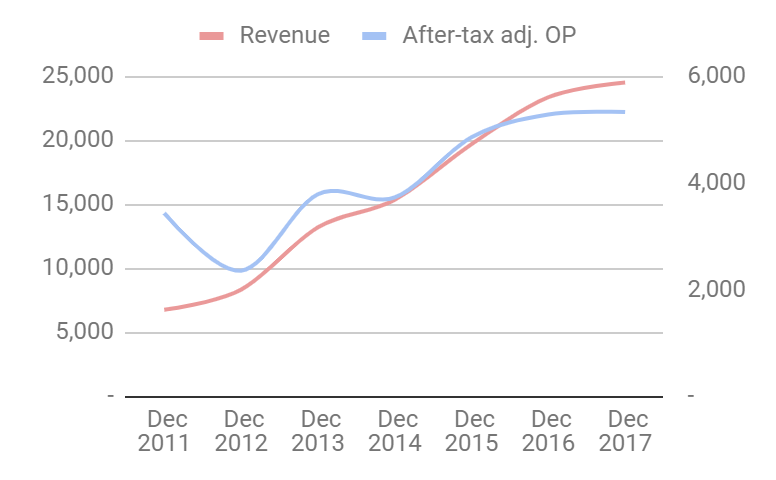

The company was founded by chief executive Andy Walters in 2001, and floated on the stockmarket in 2014. Fleet owners pay a monthly subscription, and the company has grown by adding many more subscribers than it loses every year.

The attrition rate is typically 10% compared to an industry average of 15%, although somewhat unnervingly in its most recent half-year (to June 2018), Quartix reported a 12% attrition rate compared to an industry average of 14%. Weak revenue growth and higher overheads resulted in flat profit in the year to December 2017, perhaps explaining why traders have got the willies, especially as Quartix's half-year performance was also muted.

Quartix has recruited senior managers over the course of the past year, resulting in higher staff costs, although a key member of the new team, chief operating officer, Ed Ralph is leaving at the end of the month after little more than a year. It has also subscribed to a new sales and marketing platform, which will be contributing to higher overheads as well.

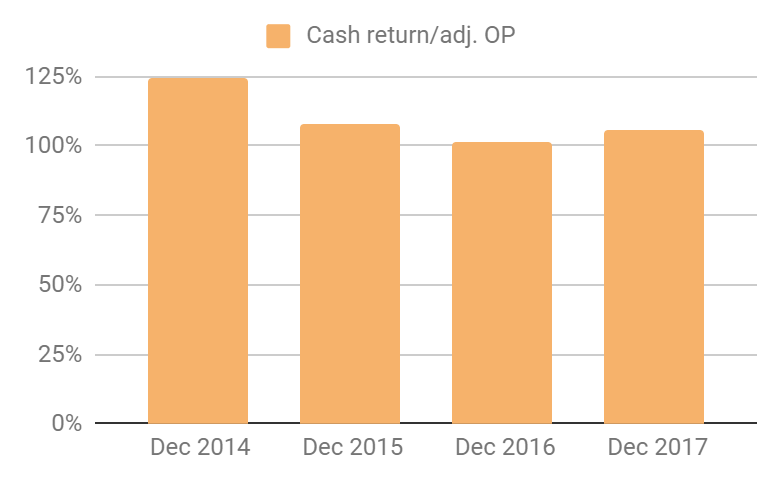

I haven't included a chart for return on capital because it is off the scale. The company has very little in the way of tangible assets (except cash, which I exclude from the calculation) so I don't think the figures are particularly meaningful. Suffice it to say Quartix is highly profitable both in accounting terms, and even more so in cash terms. Cash flow routinely exceeds adjusted profit:

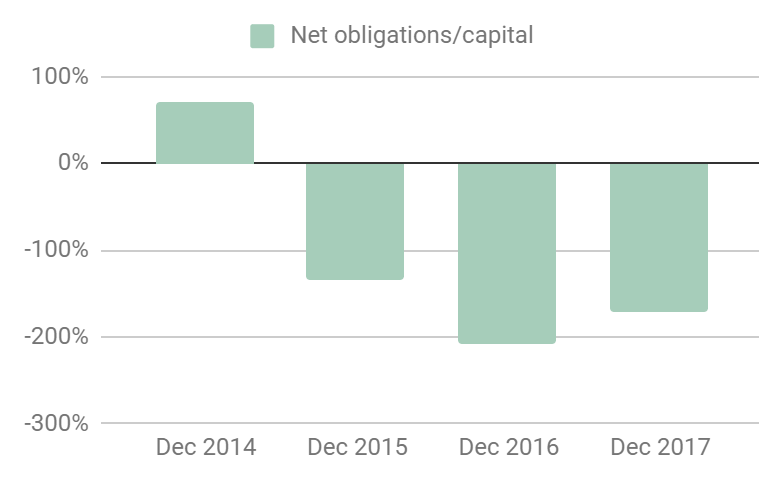

And all that cash flow means no debt and lots of cash, despite the payment of a special dividend in 2017:

Judging by the numbers, Quartix is a good business, but something is putting the skids on growth...

Adaptable: How will it make more money?

Score: 2

Beneath the bonnet things are a little more complicated. Quartix earns 70% of revenue from fleets, and the rest from insurance companies, but the insurance business is acting as a brake on revenue growth and profitability. Quartix has one major insurance customer, Wunelli, which resells telematics systems to insurers and brokers. It drives a hard bargain, which means lower profit margins, and, since Quartix will not supply if it can't make a decent profit, revenue from insurance declined in 2017 and remained flat in the first half of 2018.

At the half year, Quartix had a subscription base of over 112,500 vehicles, mostly belonging to small fleets of, say, a dozen or so vehicles. The small business market is big, in excess of 1. 5 million vehicles in the UK.

In 2016, Andy Walters told me about a third of these vehicles have telematics devices installed, about 11% of them supplied by Quartix. The company also has smaller but faster growing French and US subsidiaries, but these too are dragging on profitability. The youthful US sales office made a loss of £0.3 million in 2017, down from £0.8 million in 2016.

Unlike large fleet owners who often have bespoke requirements, small business want a cheap easy to install and use gadget, which Quartix supplies at low cost.

The technology is fairly basic, the components are shipped in from China, assembled in Cambridgeshire and sold by a direct sales team based in Newtown in Wales using Quartix's own database, and through resellers and price comparison sites. Since the early days the company has used software to automate the sales process, culminating this year in a new marketing platform and integrations with its websites.

Quartix only ties customers in to subscriptions for the first year. After that they pay monthly and can cancel at any time, yet relatively few cancel, which is surely an endorsement of the product. The small commitment makes it easier for businesses to sign up, particularly when times are hard.

Resilient: What could go wrong?

Score: 1

Seventeen years of optimisation of the device and marketing systems, as well as a large installed base of satisfied customers are probably Quartix's strongest defences against competitors.

Its biggest growth opportunity is in the USA, a huge market where proportionately fewer vehicles have telematics systems than in the UK, but Quartix has only been operating there for a few years.

The USA is, to state the obvious, a different country. Installers have to cover wider areas, salespeople are probably paid more, and Quartix must use more expensive 3G technology in the US (it uses 2G in the UK) so it remains to be seen how low Quartix can drive costs. The more it sells the greater the economies of scale, and since losses have reduced almost to break even, we can, perhaps, hope profit is not too far away.

While insurance contributes only 30% of revenue and a smaller (undisclosed) proportion of profit, if Quartix were to lose Wunelli's custom the impact on the company's performance might be greater than the loss of revenue because the additional insurance business gives the company economies of scale in the UK, reducing the cost of data services, components, production and installation.

Quartix is attempting to diversify and earn higher margins by going to brokers directly with its "Powered by Quartix" platform. It says four brokers and one insurer already use the service, but while I applaud this self sufficiency competing with a major customer may jeopardise the relationship.

While the company's strategy addresses competitive risks, it does not face up to the possibility the technology will be redundant if self-driving vehicles take over from piloted ones.

Due to the legal and technical complexities of navigating towns and cities, where most of Quartix's customers operate, this may be a long way off but I find it impossible to discount the risk since Quartix is essentially a one product company (well, two. It has a wired in system that must be installed and a plug in system that can be installed by the customer).

Equitable: Will we all benefit?

Score: 2

Andy Walters owns 37% of the shares in Quartix, so he could pretty much pay himself what he likes. In 2017, his salary was £85,000, less than four times the median UK salary. That surely makes him one of the UK's most underpaid chief executives.

Dividends paid and proposed for the full year, including a special supplementary dividend of 6.8p, totalled 11.1p so Walters, who owns nearly 18 million shares, would have received nearly £2 million on top of his salary. I think the health of the company is more important to him than extracting money from it.

Employees participate in share option schemes and the company's blog contains a lots of interviews with happy staff members. Staff reviews on Glassdoor, a recruitment site, are very mixed but also few, so potentially skewed by disaffected employees.

Cheap: Is the firm's valuation modest?

Score: 0

No, at about 20 times adjusted profit in 2017, the firm's valuation is not modest. But it is no longer blatantly immodest.

A score of 7/10 means Quartix scrapes into the 'buy zone'', but I am not as confident in that verdict as I hoped to be. The increase in attrition rates andreduction in the still healthy rate of growth in the UK subscription base concerns me,and the departure of digital marketing guru and chief operating officer Ed Ralph is also puzzling.

Normally, I would look beyond these likely short-lived uncertainties to the reassuring vision of where Quartix's well executed business model should take it in 10 years time, but my 10 year horizon is foggy too because of technological developments I am ill qualified to assess.

Contact Richard Beddard by email:richard@beddard.netor on Twitter:@RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.