A puppy for Christmas? Better invest in dog food

24th November 2021 14:55

by Moira O'Neill from interactive investor

Owners increase the care lavished on pets, creating opportunities for suppliers

Moira O’Neill’s puppy Dido is proving an expensive addition to the family

People have always been willing to spend on pets at Christmas, even fake ones. Advertising executive Gary Dahl once sold more than 1m Pet Rocks, marketed like live pets, in custom cardboard boxes with “breathing holes”. And remember the Tamagotchi virtual pet? Twenty five years ago, It was one of the biggest toy fads.

But now I’m one of the estimated 59% of UK adults with a real-life pet. And six months into puppy ownership, I’m fast learning that a dog is for a lifetime of spending, and not just at Christmas.

With insurance bought and vet bills already paid, we’ve trialled expensive foods and treats (she was a fussy eater), and we’ve purchased special toys and bedding.

- Watch our Christmas and New Year share tips here and subscribe to the ii YouTube channel for free

- Read more articles by Moira O'Neill here

As Christmas approaches, the teen and tween in my family will want to buy even more puppy toys and treats. Money Expert, a price comparison website, found that UK dog owners spend an average of over £236 a month on essentials, plus £91.70 a year on gifts and toys, adding up to almost £3,000 a year.

This makes me sick as a dog, so instead I’m going to research the prospects of pet-related companies with a view of buying the shares. To perhaps get some of my money back, as it were.

Junior ISA management is coming up fast for my soon-to-be 16-year-old and this could be a valuable lesson.

Consistent spending on pet essentials makes for a resilient sector. Over a decade ago, fund manager Terry Smith memorably explained why he likes investing in pet food: “Research shows that consumers will cut down their expenditure on feeding their children before they will cut down on feeding their pets.”

Does our puppy get better snacks than they do? It’s a topic we may discuss. But the important takeaway is brand loyalty – once we’ve found a food that our puppy will eat, we’re likely to stick with it. In our case, it’s Eukanuba, owned by Mars, which is a private company so we can’t invest in it.

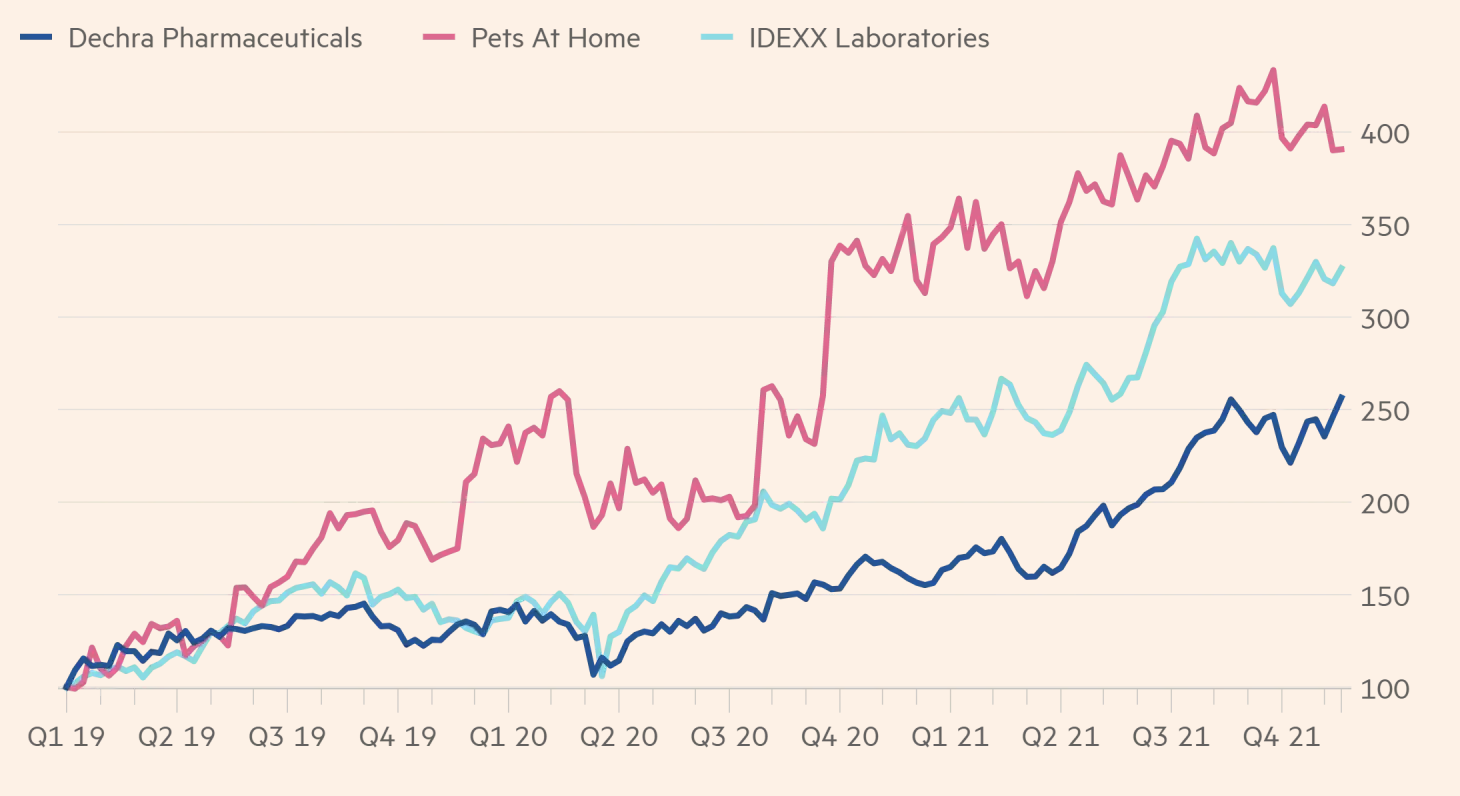

Growing pets brands

Share prices in £ (rebased to 100)

Source: Factset. Past performance is not a guide to future performance.

However, Smith was talking about Del Monte’s pet foods business, which became Big Heart Pet Brands and is now part of the JM Smucker Co (NYSE:SJM), a packaged food company listed on the New York Stock Exchange. One of the subsidiary brands today is Nature’s Recipe, which didn’t find puppy love in our house, but is the dog’s dinner of choice for many of our friends.

In his latest book, Investing for Growth published October 2020, Smith named pets as one of his 10 Covid-19 beneficiaries. And most children will be aware that during lockdown 2020, the UK faced a puppy shortage.

In May 2020, investment analysts at Robeco reported: “The global pet care market offers moderate but stable growth prospects, helped by a rise in pet ownership around the world and a consistent increase in spending per pet.”

They highlighted the sector’s resilience even in the 2008 financial crisis and the recession that followed. They concluded “the recent surge in ownership in some countries, driven by an increase in adoption and fostering by people confined to their homes, could even soon turn into a tailwind for the industry”.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- How to invest…to pay your child’s private school fees

How strong the pandemic pet boom has been is a matter of some debate. There’s plenty of anecdotal evidence about people buying pets and vets besieged by new clients.

But the 2021 PDSA Animal Wellbeing Report (also known as The PAW Report), says there has not actually been a statistically significant increase in the estimated population size of the UK’s pet dogs, cats and rabbits since the onset of the pandemic in March 2020.

The Pet Food Manufacturers’ Association, which compiles its own historical pet population numbers, changed the data collection methodology from 2020 to 2021, so it’s hard to make a comparison.

Still investing in this theme is not just about ownership numbers but about how much we are prepared to lavish on our animals.

The Pet Care ETF in the US, delightfully called PAWZ, that launched in 2018 has delivered 39% growth over the year to October 31. While UK-based savers can’t invest in this fund, its investment case applies around the developed world — it’s focused on how people, particularly millennials, are increasingly spending on pets like family members. And British investors can invest in the underlying shares in other ways.

PAWZ does cite growth in pet ownership — 67% of US households have pets today compared to 56% in 1988 — but says the big difference is how we’re “humanising” our pets and “premiumising” pet care.

Its top holding is Zoetis (NYSE:ZTS), the world’s largest producer of medicine and vaccinations for pets and livestock, listed on the New York Stock Exchange. Chief executive Kristin Peck says the company is on track for a “record-setting year” and sees positive market trends continuing into 2022.

Other top holdings in PAWZ include IDEXX (NASDAQ:IDXX), Dechra (LSE:DPH) and Chewy (NYSE:CHWY). The Nasdaq-listed IDEXX Laboratories is engaged in the development, manufacture, and distribution of products and services for the companion animal veterinary. It reported 12% revenue growth in the third quarter of 2021 with the group enjoying a boost in sales in its Companion Animal Group unit. But with a price/earnings ratio of 73 it looks expensive.

- Low-cost investments to help get you started – all chosen by our experts

- Six things you must do before buying any share

Dechra Pharmaceuticals is a major UK-based drug manufacturing company, with a focus on veterinary pharmaceutical products. It narrowly missed out on promotion to the FTSE 250 in September and with a current market cap of £5.2 billion. Its PE ratio is a lot more reasonable than IDEXX’s at 47.9.

Chewy, a US online seller of pet food and grooming supplies, fell short of Wall Street forecasts but chief executive Sumit Singh has said he remains “really bullish” about the business even as some Covid tailwinds fade. But trading on a stratospheric PE ratio of 3738, you may feel this is biting off more than you want.

If you prefer a diversified professionally managed fund, the Fundsmith Sustainable Equity fund managed by Terry Smith has Zoetis in its top 10 holdings, while Fundsmith Equity fund has IDEXX as its third largest holding. Or Robeco Global Consumer Trends Equities fund has pets’ well-being among the key themes in the portfolio, investing in Zoetis and Chewy.

After the 66% in the US, the PAWZ ETF has its biggest exposure to the UK at 16%. Pets at Home (LSE:PETS), a store we visit occasionally at the local retail park on a damp Saturday, ranks 11th in its top holdings.

Shares in the pet supplies retailer, a constituent of the FTSE 250 index, have fared well since the pandemic lows in the first quarter of 2020. In its latest set of figures for the half year released on Tuesday, the company noted the “robust” UK pet care market and said “sustained growth in pet ownership” significantly increased its market opportunity.

- Want to learn more about the world of investing? Visit our Knowledge Centre

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

With Pets at Home’s revenue growing 18% to £677.6 million in the first six months of 2021, there is little sign that this sense of momentum is slowing. There’s been a bit of uncertainty weighing on the shares with the recently announced departure of its chief executive next year ,but if the company can appoint a good successor then it looks like one to stash in our doggy bag.

So that opens up some things to discuss with the kids. If they can’t decide, we’ll find a way for puppy to choose, taking inspiration from the five cows which beat the Norwegian stock market by relieving themselves on a grass grid.

Moira O’Neill is head of personal finance at interactive investor, the author of Finance at 40 and a former winner of the Wincott Personal Finance Journalist of the Year.

This article was written for the Financial Times and published there on 24 November 2021.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.