A £50bn stock to own in a crisis

This solid, profitable company should emerge relatively unscathed from the Covid-19 pandemic.

6th May 2020 10:06

by Rodney Hobson from interactive investor

Our overseas investing expert finds a solid, profitable company that should emerge relatively unscathed from the Covid-19 pandemic.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

With European Union countries taking a hefty hit from the coronavirus crisis, particular care needs to be exercised in picking companies to invest in. The Purchasing Managers’ Index, one of the most reliable economic indicators, plunged in March for manufacturing and for services. France and Italy are in recession and Germany is set to follow.

One example of a solid, profitable company that should emerge relatively unscathed is Bayer (XETRA:BAYN).

Bayer is a German healthcare and agriculture group with sales split pretty evenly. Healthcare includes drugs and vitamins plus animal health products; agriculture, which expanded with the acquisition of Monsanto two years ago, covers seeds, pesticides, herbicides and fungicides.

All was going well at the start of this year. In April Bayer reported higher sales and earnings for the first quarter, with particularly strong growth in consumer health products. Sales overall grew 4.8% while net income soared by 20% to nearly €1.5 billion.

This followed an equally encouraging surge in 2019, especially in agriculture. For the full year, sales grew 19% while net income more than doubled to over €4 billion. Bayer’s initial guidance was for sales to grow 3-4% this year.

Chair Werner Baumann said that in health and nutrition “we have shown our ability to successfully continue our business operations in a challenging environment and deliver a positive contribution even during a time of crisis".

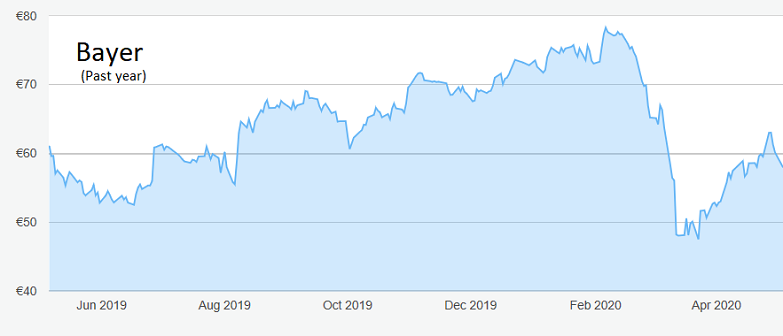

Source: interactive investor. Past performance is not a guide to future performance

However, all that has been thrown into the melting pot by Covid-19. The focus has been to implement extensive measures at its sites to prevent the spread of Covid-19 while keeping up supplies to patients, farmers and consumers, especially for life-saving medicines.

There is, though, no getting away from the fact that there will be a considerable impact during the rest of the year.

It will not help, either, that US agriculture specialist Corteva (NYSE:CTVA), spun out of the DowDuPont conglomerate last year, plans to attack Bayer’s dominance in the $4 billion a year US soybean seed market, beginning this year.

- One of the major recovery stocks, even before crisis ends

- Want to buy and sell international shares? It’s easy to do. Here’s how

One cloud that has been lightened is the threat of expensive legal action in the United States, where litigants claimed that the weedkiller Roundup caused non-Hodgkin’s lymphoma, a form of cancer.

Roundup became Bayer’s liability with the $63 billion acquisition of Monsanto two years ago and the claims centre on glyphosate, the key ingredient in Roundup, which had been one of Monsanto’s best sellers.

In January, the US Environmental Protection Agency reaffirmed its view that glyphosate is safe to use, based on a 10-year review period. It stuck to its ruling that Bayer did not have to put a warning on the product.

Nonetheless, US juries have consistently found against Bayer where cases have come to court and, although judges have, on appeal, reduced the excessive compensation awards that American juries are notorious for awarding, Bayer is likely to agree to pay $8 billion to close existing cases and set aside $2 billion for future claims.

There were previously fears that the cost could be double that.

It has to be admitted that Bayer shares were on the decline well before the coronavirus crisis, sliding from €135 in July 2015 to €53 four years later, but they were staging a mini-recovery before the virus struck and sent them as low as €48.

They currently stand at around €58. Based on last year’s dividend payment of €2.80, that would give a yield of 4.8%, although this year’s payout will obviously depend heavily on how long the coronavirus shutdowns last in various countries and how great the economic impact is.

Hobson’s choice: Buy Bayer below the April peak of €63. The floor is probably around €56. I recommended Corteva at the severely depressed price of $23.50 on 1st April and the stock has since picked up to around $26. Clearly, the best chance to buy has passed, but I stick with my guidance that the stock will recover to the $29 at which it started trading last year.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.