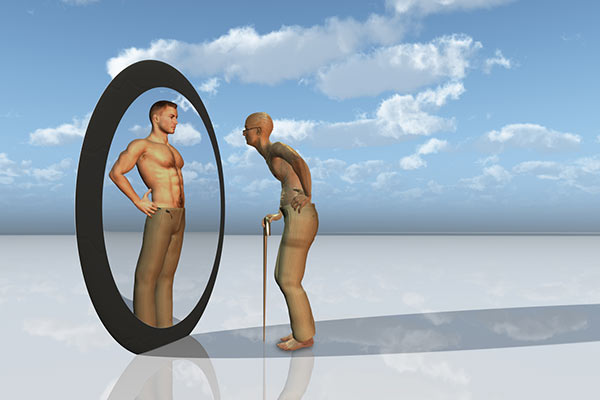

Pros and cons of opting for youth or experience with fund managers

When it comes to fund manager experience does this result in a safer pair of hands? In this article Kyle Caldwell examines the cases for both experience and youth.

7th August 2023 11:32

by Kyle Caldwell from interactive investor

Over the past couple of months a number of high-profile fund managers have announced plans to hang up their boots, including UK fund managers Richard Buxton and Simon Brazier, as well as European stockpicker Richard Pease. Prior to that, in 2022 both abrdn’s Harry Nimmo and Scottish Mortgage’s James Anderson called it a day.

Those five professionals had long careers in the increasingly short-term nature of fund management. If performance is not up to scratch, fund firms are more inclined these days to ring the changes rather than afford more time in the hope for a change in fortunes.

- Invest with ii: Invest in Investment Trusts | Top UK Shares| Interactive investor Offers

When it comes to managerial experience does this result in a safer pair of hands? In this article we examine the pros and cons for both experience and youth.

Price cannot be put on experience

Fund managers that have been around the block a couple of times and witnessed a number of market cycles will be able to draw on their experience, including learning from any past mistakes.

Indeed, those fund managers in the early stages of their career (and those who started 15 years ago) will for the first time in their careers be investing against a backdrop of rising interest rates, which has caused a re-pricing of all risk assets.

Moreover, fund managers that have racked up the longest track records are likely to have done so in large part because good performance has kept them there.

Darius McDermott, managing director of fund ratings agency FundCalibre, points out: “The main pro of investing with a veteran fund manager is that you know what you are getting - the investment style and how you might expect a fund to perform in different conditions.”

The longest serving fund manager is Peter Spiller, who has overseen the management of Capital Gearing (LSE:CGT) since 1982.

- How to separate fund manager luck for skill

- Why these investment trust discounts are too cheap to ignore

But there’s some drawbacks to be aware of….

However, the past is not always prologue. In particular, veteran fund managers can have the best years of performance at the start of their careers, prior to having an avalanche of money entering the fund as they gain a reputation for beating the wider market and peers.

As we’ve seen time and time again when funds become too big, the fund manager struggles to repeat his or her past success. This is because, as a fund grows in size, the investment universe becomes smaller, with fund managers not able to have positions in smaller companies.

For some funds, such as those investing in large global companies, fund size is less of an issue. But for other funds, such as those investing in UK smaller companies, the fund size could cause the fund manager to have, effectively, a hand tied behind his or her back as they can only invest in companies of a certain size. In turn, this can cause a fund to stray from its investment approach or style.

James Penny, chief investment officer at TAM Asset Management, points out: “Large funds often have asset pools so large the management team have to distort their original investment mandate to accommodate a much larger asset base. In some instances, this distortion over time becomes at odds with the investment mandate on the fund and one starts to see style drift creeping into the numbers.”

In addition, there’s the risk of complacency creeping in with an experienced fund manager. McDermott points out: “The cons of investing with a veteran fund manager are they could potentially become more risk averse - especially if their own money is invested in the fund - as they get older and they could retire at any time. They could also become complacent. So you can't just invest and forget - you still need to review how veterans are doing from time to time."

- Hunting for the best value opportunities among 'cheap' UK shares

- Why 'get rich slow' dividend investing is back in fashion

New kids on the block

However, with the future fund manager stars there’s arguably greater risks due to having less experience under their belts. McDermott notes: “With newer managers you are taking potentially higher risks as they are unknown and the range of outcomes therefore much wider. In order to back a newer manager, I really like to see a strong investment case for the asset class and have the comfort that they are backed by a wider and experienced team.”

In most cases younger fund managers have built up several years of experience as an analyst, prior to making the step up to running money.

In addition, there’s much more of a team approach nowadays, with the star fund manager culture much less prevalent.

Although, as John Monaghan, a research director at Square Mile, points out it is important that “there still needs to be a key decision maker”.

He says: “For the younger generation of fund managers coming through there is often a couple of named managers on each fund. However, there still needs to be credibility and accountability.”

Simon Evan Cook, a fund-of-funds manager at Downing Fund Managers, agrees that having a figurehead is important. He notes this helps investors to “judge what the fund is about, what it's going to do and you can have a little bit of faith that from one human being to another human being, that you can trust this person to invest in the way that they said they're going to invest.”

- Cash rates are rising but lag inflation: here's where to invest instead

- Fund Battle: Vanguard LifeStrategy versus BlackRock MyMap

New fund launches – should investors back them?

In terms of new fund launches investors face a similar dilemma – do they back them from the outset or stick with more established funds with longer-term track records.

In financial adviser circles a three-year track record is viewed as a necessary requirement prior to considering whether or not to invest. The thinking is that this is a good amount of time to assess how performance has fared.

However, Penny points out this rule can be broken, particularly when it is a fund management team that has jumped ship to join a rival fund firm.

He says: “One downside of backing a fund at launch is the lack of a track record from the vehicle itself and the management team behind it. However, while there is no denying experience counts for a lot in this market, many managers launching new funds are not new to the exercise and have cut their teeth under another investment houses before launching.”

This view is echoed by Monaghan, who says he with new funds he likes to see “a tried and tested process” from a “comparable strategy”.

Penny adds despite the challenge of limited track records, new funds offer the potentialfor innovation and unique investment edges.

On the other hand, he points out that “veteran funds bring the advantages of long-standing stability and ample data for analysis, but may face issues related to size.”

Two examples of newer fund managers McDermott has backed in the past include Alex Savvides of JOHCM UK Dynamic and Stuart Rhodes, M&G Global Dividend.

He adds: “Both have had their ups and downs, but the ups have been more plentiful. When we met them both had confidence in the way they presented the case for the asset class, the fund and their process and they both had good teams behind them.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.