Profit margins have begun to sag. AI could have a fix.

1st June 2023 12:04

by Reda Farran from Finimize

Given the future promise of AI, I decided to dig into an insightful research piece from Goldman Sachs exploring the near-term and long-term outlook for the S&P 500’s profit margins in more detail. Here’s what I found.

Profit margins play a significant role in stock market returns: as they increase, they directly contribute to earnings growth, which is one of the major drivers of equity market returns.

Goldman Sachs doesn’t expect profit margins to expand anytime soon, given currently elevated inflation and wage growth, high interest rates, and bloated inventory levels. It notes that the biggest near-term downside risk to margins is that the economy falls into recession.

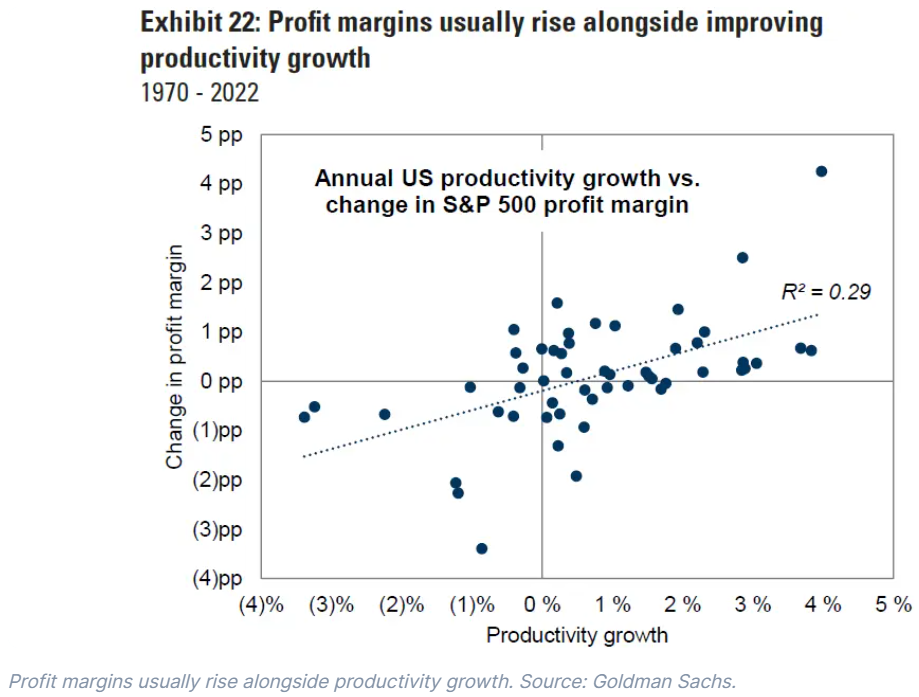

But on the brighter side: AI could potentially lift US productivity growth by roughly 1.5 percentage points per year over the next decade, which could boost S&P 500 profit margins by roughly four percentage points over that period.

Profit margins have a huge influence on earnings growth and, in turn, stock market returns – a fact that doesn't go unnoticed by investors. That’s why they pay such close attention to their direction. But today, we’re seeing some conflicting trends, which mostly come down to current levels of inflation and the future promise of AI. So, I decided to dig into an insightful research piece from Goldman Sachs that explores the near-term and long-term outlooks for the S&P 500’s profit margins in more detail. Here’s what I found.

But first, why are profit margins so important?

This is where the rubber meets the road on stock market returns. See, earnings growth, dividends, and changes in overall valuation levels are the three major drivers of equity returns. The first two are the most important in the long run, because the ebbs and flows of market sentiment – and therefore valuation levels – typically cancel each other out over time. And earnings growth can be decomposed into two main variables: revenue growth and changes in profit margins. When profit margins expand, that directly translates into earnings growth, which boosts stock market returns.

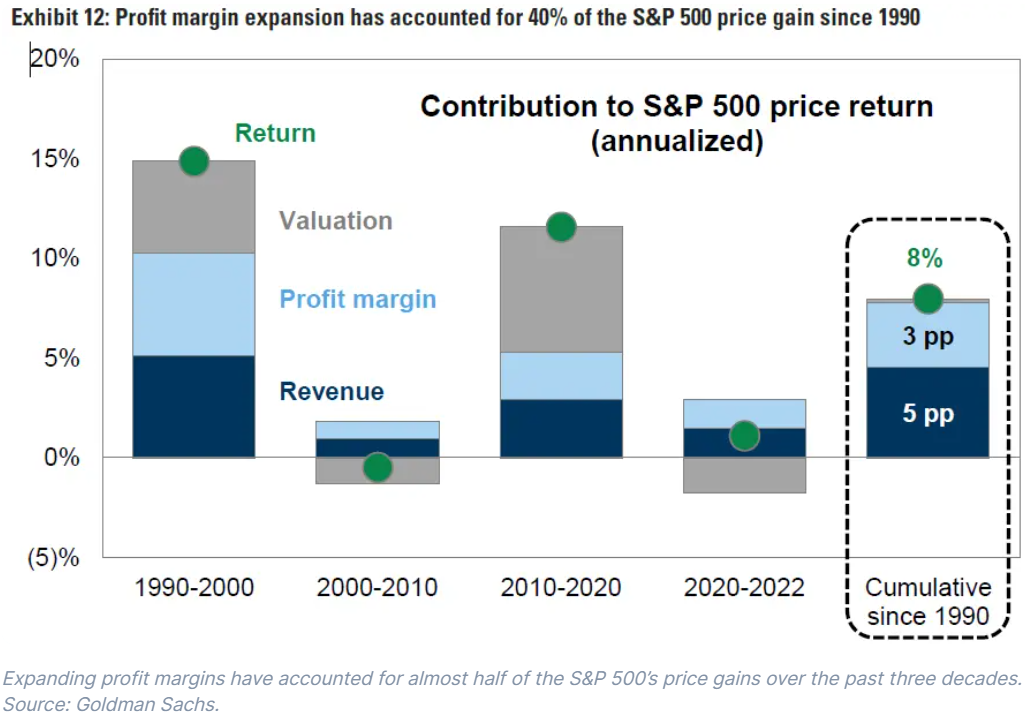

To see this more clearly, consider that since 1990, profit margins have risen by seven percentage points, accounting for 40% of the S&P 500’s 1,100% price gain over that period. Put differently, expanding profit margins are responsible for almost half of the US stock market’s price appreciation over the past three decades. Note that here (and in the rest of this article), I specifically mean net profit margin – that is, net income as a percentage of revenue.

How have profit margins fared recently?

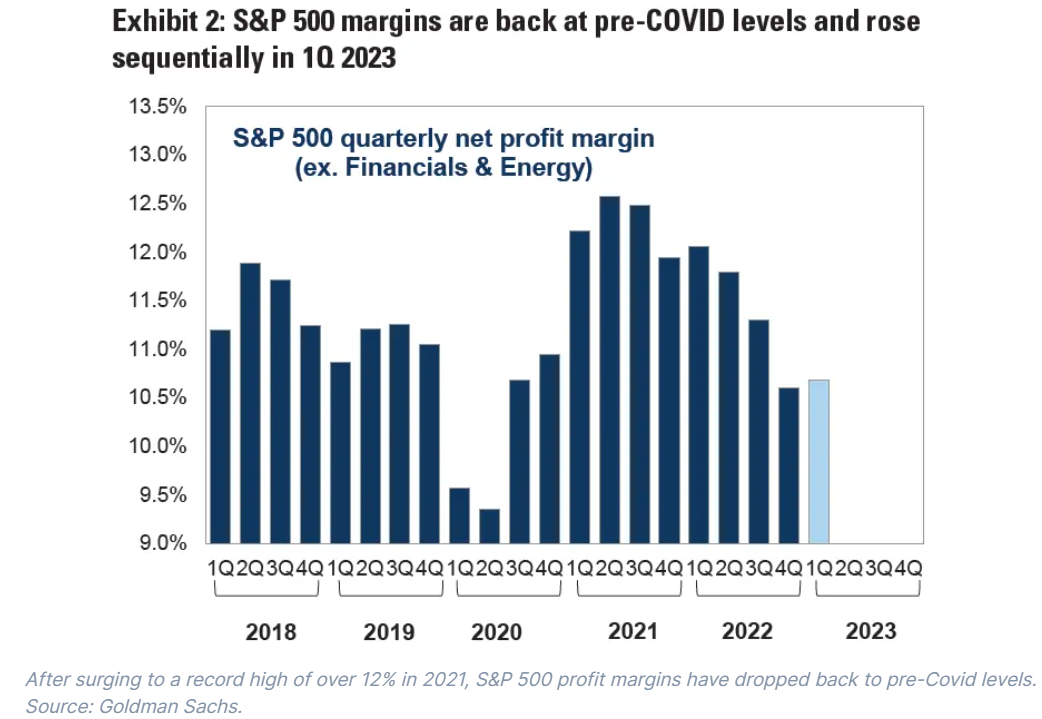

After surging to a record high of over 12% in 2021, S&P 500 profit margins have plunged. They’ve fallen by more than 1 percentage point in recent quarters as soaring inflation led to higher input costs that firms couldn’t completely pass on to their customers. That drop in profit margins drove an 8% decline in S&P 500 earnings per share (EPS), even despite robust sales growth. This year, however, things have improved. In the first quarter of 2023, companies reported margins of 10.9%, which was in line with pre-Covid levels and above both consensus estimates and profit margins reported in the previous quarter.

What’s the short-term outlook for profit margins?

Inflation and wage growth forecasts by Goldman’s economists suggest that input costs are starting to mellow out for companies in the S&P 500. That, combined with still-strong revenue growth and a weaker US dollar (which increases the value of money made abroad), should support profit margins in the short run. Put differently, the investment bank says the worst of the profit margin “reset” is likely behind us.

That said, Goldman doesn’t see profit margins expanding anytime soon. And there are a few reasons for that. First, while inflation and wage growth have cooled, they’re both still elevated. Second, higher interest rates are expected to slowly increase companies’ expenses as they refinance their debt. Third, many firms are currently contending with bloated inventory levels. That can shrink profit margins by increasing storage and maintenance costs, tying up cash that could be used elsewhere, and potentially leading to price reductions or write-downs if items don't sell quickly enough.

But the biggest near-term downside risk to profit margins is that the economy falls into recession. Goldman’s data shows that in the eight recessions since 1970, S&P 500 profit margins declined by an average of 1.4 percentage points, ranging from a 0.72-percentage-point drop in the 1981 recession to a 1.79-percentage-point plunge in 1990.

What’s the long-term outlook, then?

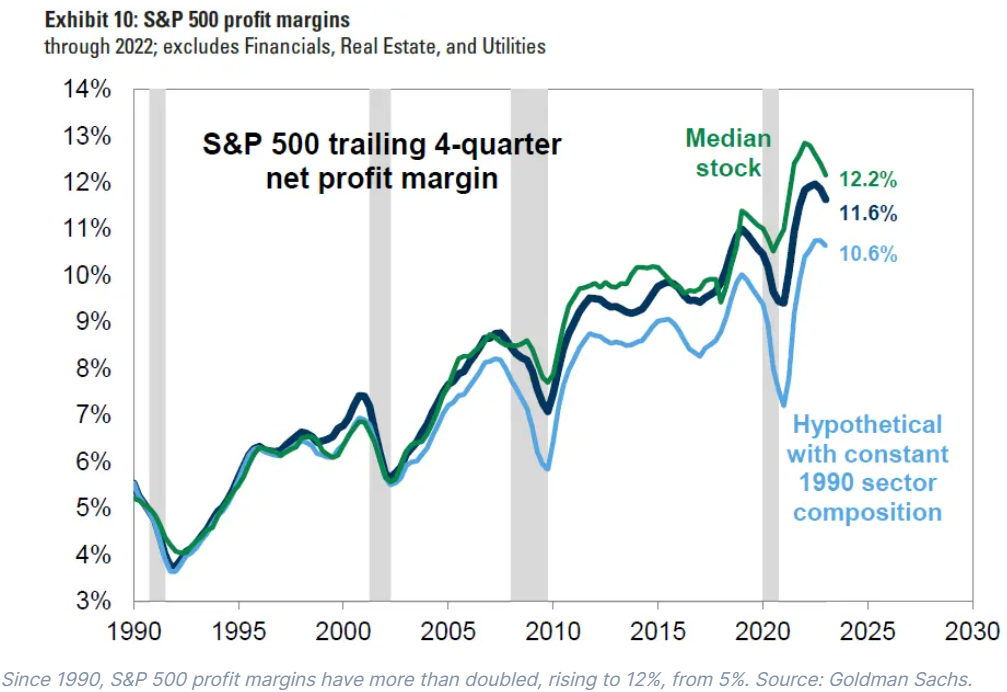

Putting aside the most recent quarters, S&P 500 profit margins have expanded dramatically during the past 30 years. Between 1970 and 1990, profit margins compressed from 6% to 5%. But since 1990, they’ve more than doubled, rising to 12%. And, no, this isn’t simply a function of a few large stocks dominating the index or the increased weight of the highly profitable tech sector. The same trend can be seen by looking at the profit margin of the median index constituent and also when controlling for sector composition (see the chart below). In fact, every S&P 500 sector currently enjoys a profit margin that’s at the upper end of its historical distribution.

But the major margin tailwinds of the past three decades aren’t likely to repeat over the coming years. Recall that since 1990, profit margins have risen by seven percentage points. Then consider that the cost of goods sold (COGS) has declined from 71% of S&P 500 revenues in 1990 to just 64% of revenues last year, accounting for 70% of the S&P 500 profit margin expansion over that period, with falling interest rates and lower effective taxes contributing to the rest. But each of these drivers threatens to reverse in the years ahead.

COGS has declined as a percentage of revenue partly because of the development of global supply chains and just-in-time inventory management. However, Goldman’s view is that recent supply shocks have generated a new corporate focus – one that prioritizes operational resilience, even when it costs more. We already know that interest rates have headed higher, and as for corporate tax rates, they’re not likely to fall again in the near future – especially not when policymakers from many countries are now calling for a minimum global tax rate.

What’s AI got to do with all of this?

Quite a lot, actually. According to Goldman, AI has the biggest potential to support long-term profit margin expansion. Its economists estimate that generative AI could potentially lift US productivity growth by roughly 1.5 percentage points per year over the next ten years. And based on the historical relationship between productivity growth and corporate profitability, this boost could lift S&P 500 profit margins by roughly four percentage points over the next decade, everything else being equal. But, as always, you’ll want to take these estimates with a grain of salt. After all, uncertainty around both the eventual economic impact of AI and the regulatory response it may evoke is very high.

What does this mean for you?

Margin expansion has allowed S&P 500 EPS to grow in line with the long-term historical trend despite slowing revenue and GDP growth. Going forward, unless margin expansion continues, revenue growth reaccelerates, or equity valuations soar to new record highs, the trajectory of stock market returns will fall below the trend of the past 150 years.

The good news is that AI can support long-term profit margins and uphold equity market returns. A four-percentage-point uplift from AI would take S&P 500 profit margins from around 12% today to 16% in a decade – an increase of a third. On an annualized basis, that would represent a 3% boost to earnings growth, which could push up stock market returns by a similar amount (everything else being equal).

Reda Farran is a senior analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.