Pressure grows as Nvidia raises the bar again

Priced for perfection, Nvidia is finding it harder to deliver the shock-and-awe results of the past. As the AI boom continues, what will it take to reignite momentum?

27th February 2025 13:41

by Graeme Evans from interactive investor

Nvidia figures, not quite as jaw-dropping as previous quarters, today got a muted reaction as sky-high expectations make it harder for shares to deliver the explosive gains of the past.

The semiconductor giant’s fourth-quarter revenues of $39.3 billion (£31 billion) rose 78% on a year earlier and comfortably exceeded its entire annual revenues figure from just two years ago.

Fuelled by an “amazing” level of demand for NVIDIA Corp (NASDAQ:NVDA)’s new Blackwell platform, the group also forecast current quarter revenues $1 billion above Wall Street’s expectations at $43 billion.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The latest revenues beat was offset by a slight miss on the margin outlook front, contributing to expectations for shares to post a robust if unspectacular session near to $135.

Nvidia is still up 500% in the past two years, with a valuation of $3.2 trillion meaning that growth of another 10% would equate to twice the size of competitor Advanced Micro Devices Inc (NASDAQ:AMD).

Saxo’s global head of investment strategy Jacob Falkencrone said: “Nvidia is still a phenomenal company, and AI is still an incredible growth driver.

“But at its size, Nvidia can’t triple revenue forever, and the stock will likely behave more like a mega-cap tech stock than a high-flying disruptor from here on out.”

He said that doesn’t mean that the AI trade is dead - it just means that the market may be entering a more measured phase where valuations need to catch up to fundamentals.

- Still time to buy this American tech stock and AI leader

- How my core/satellite fund ISA portfolio fared, and changes in 2025

Last night’s earnings confirmed that companies are still racing to build AI-powered services and that Nvidia remains the undisputed leader behind the revolution.

One key concern is Nvidia’s heavy reliance on hyperscalers — big tech firms such as Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT) and Google, which make up a large portion of its sales. If these giants cut back on AI spending, Nvidia would feel the impact immediately.

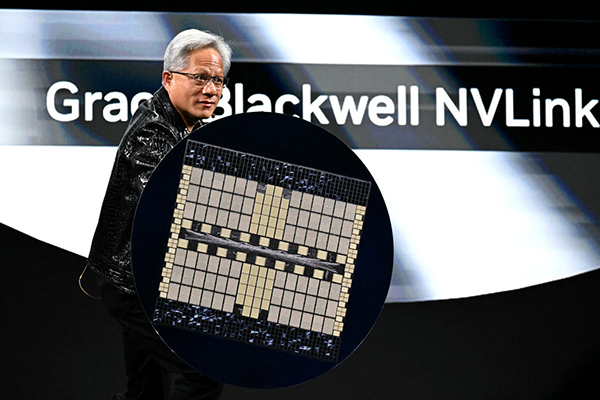

Falkencrone added: “So far, there’s little evidence of that happening. Microsoft and Amazon continue to invest billions in AI infrastructure, and chief executive Jensen Huang (pictured above) insists that demand remains “insane”.

“However, history suggests that tech spending moves in cycles. If we enter a phase where companies focus more on monetising AI rather than just building capacity, spending could slow, and Nvidia’s revenue growth could follow suit.”

Wall Street recently seized upon China’s lower-cost DeepSeek AI model and speculation that a single customer has paused land buying for a data centre as reasons for caution.

While sentiment has cooled, Morgan Stanley still expects a strong Blackwell ramp up in the second half of 2025 and predicts enthusiasm will return in the next six to nine months.

The bank has maintained its target multiple of 32 times forecast earnings, but an increased bottom-line estimate of $5.07 a share boosts its price target by $10 to $162.

It added: “AI spending is in our view not a bubble but it is likely to be cyclical, and is unlikely to slow gracefully when that cycle ends. If we could identify a cyclical pause we would likely become more cautious.”

Nvidia’s above-consensus revenues and strong guidance for the April quarter is consistent with the higher capital spending plans announced by big tech companies in recent weeks.

UBS has forecast that 2025 capital expenditure by the big four US tech firms will grow by 35% to $302 billion and estimates total AI spending to be close to $500 billion in 2026.

It adds that big tech companies have recently flagged capacity constraints as the main impediment to their cloud revenue growth instead of insufficient demand.

- A solid long-term investment plus my view on Palantir Technologies

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

With data suggesting ongoing improvement in AI adoption, the bank’s global wealth management team shares the view of Alphabet Inc Class A (NASDAQ:GOOGL) CEO Sundar Pichai that the AI opportunity is “as big as it comes”.

The bank added: “While we continue to highlight volatility in the near term amid US-China tensions, tariffs, and geopolitical developments, we believe the broader AI trend remains intact.

“Given still-strong spending intentions and improving monetisation ahead, we continue to like AI semiconductors and leading cloud platforms.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.