The power of flat fees vs percentage charges on large pots

22nd February 2023 10:42

by Jemma Jackson from interactive investor

Large pot cost comparisons show how flat fees come into their own, says interactive investor.

- Large pot cost comparisons show how flat fees come into their own

- High charges can suffocate investors’ ability to meet goals and remain financially resilient

In the lead up to the traditional ISA season, interactive investor, the UK’s second-largest investment platform for private investors and leading flat-fee provider, is highlighting the power of flat fees versus percentage charges on larger investments with some astonishing cost comparisons.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

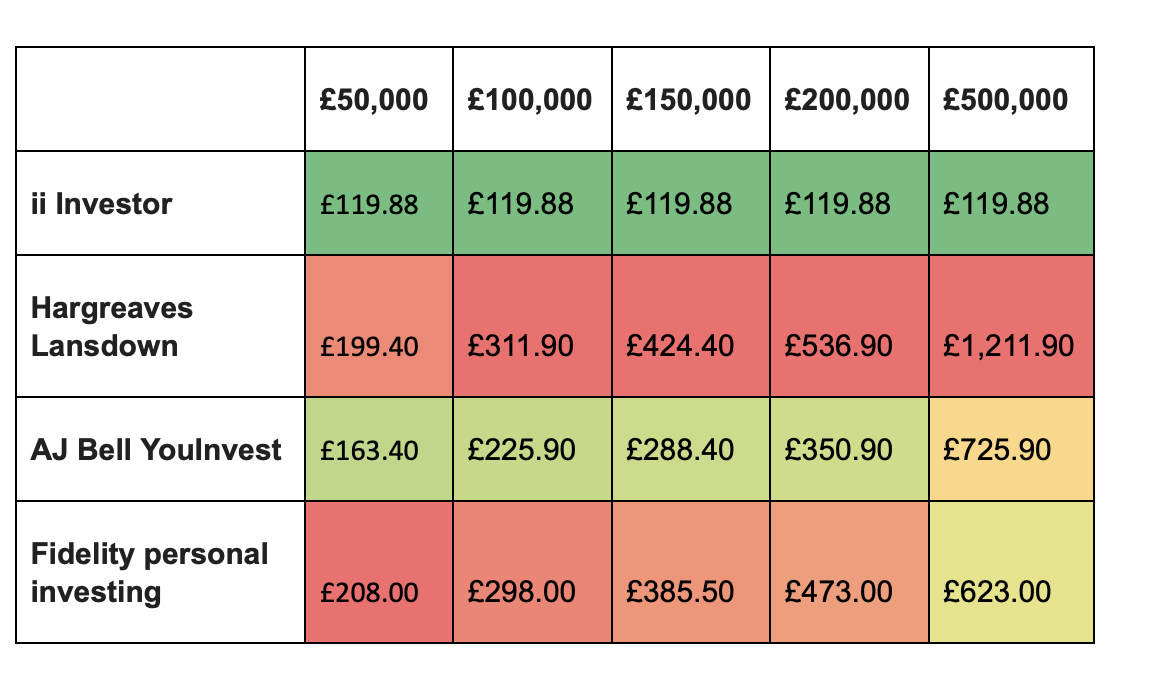

Annual charge comparisons with ii’s largest competitor reveal differences of more than two and a half times on pots of £100,000, and 10 times more than its closest competitor on pots of £500,000.

ii is the UK’s leading flat-fee investment platform for private investors with its most popular Investor account costing £9.99 per month. That’s regardless of whether it contains £31,000 or more than £1 million – the fixed fee stays the same.

Why flat fees rule for larger pots

Investors’ ability to meet their financial objectives, or to cope in the event of a sudden fall in income – known as financial resilience – is often connected to their investment returns, and wealth in turn is interlaced with any fees they pay for their investments.

Percentage-based charging means the amount you pay depends on how much you have in your account. The more you have invested, the greater the charge. On the other hand, a flat fee is just that: flat and predictable.

For larger amounts, the difference between flat fees and percentage charges can be jaw-dropping.

interactive investor vs the competition – we’ve run the numbers

How does interactive investor shape up against the competition? We asked platform consultancy the lang cat to compare annual charges on our flagship Investor account with those levied by our largest competitors.

The illustration below is based on an ISA portfolio that is 50% shares, 50% funds.

It assumes two fund trades in a year and two equity trades. It also assumes regular investing into one fund per month, and one direct equity (UK share or investment trust) per month.

Annual cost comparison

The largest disparity – between an annual cost of £119.88 and £1,211.90 at the £500,000 level – is more than 10 times.

At the £100,000 level, ii’s largest competitor is more than two and a half times more expensive.

Richard Wilson, CEO, interactive investor, says: “These numbers are stark, and yet they only look at platform costs over one year. Over a lifetime of investing, the differences between providers can add up to tens of thousands of pounds.

“Investor awareness of charges, and their impact on wealth creation, is growing. The realisation that more than necessary has gone to the platform provider can be incredibly frustrating.

“The results are clear: once you get beyond a certain threshold, you could be overpaying. And the more your pot grows – the more successful you are as an investor – the worse the percentage charges can bite.

“Ultimately, investors’ ability to achieve their goals, and to be resilient if they are faced with unexpected or unavoidable financial difficulty, is directly linked with the charges they pay. We encourage all investors to consider the impact of charges on their investments, and to carry out their own cost comparisons – alongside their other value for money considerations – when considering which investment platform is right for them.”

Investor Essentials

This month, interactive investor also launched Investor Essentials, a new entry-level addition to ii’s subscription service, broadening its award winning, great value price plans to an even broader range of budgets, without compromising on choice.

The new price plan was significant, because ii’s flat fee subscription model has traditionally been more cost effective for people with larger investment pots.

Customers can now invest up to £30,000 with ii for just £4.99 a month. They will benefit from free regular investing and competitive trading fees of £5.99 for funds, investment trusts and UK/US shares – all with the same choice of investments.

Beyond the £30,000 threshold, they’ll automatically graduate to ii’s most popular Investor price plan, which is £9.99 per month. That’s regardless of whether they have over £30,000 or over £1 million – the fixed fee then stays the same.

In keeping with ii’s other ultra-low price plan, Pension Builder, Investor Essentials does not come with a free monthly trade, and nor does it come with free Junior ISAs – features that are standard with ii’s Investor and Super Investor price plans.

Richard Wilson, chief executive, interactive investor, said at launch: “Investor Essentials is a pivotal moment. No longer do you need to reach for the calculator to work out at which point in time fixed fees become an obvious cost-saving choice for your investments. ii now takes care of that with a simple, transparent service to meet a range of needs and budgets – and the added benefit of free regular investing.”

More details on Investor Essentials can be found here.

Notes to editors

Source on financial resilience: https://www.fincap.org.uk/en/articles/resilience-task-force

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.