Is Portmeirion in the 'buy' zone?

27th April 2018 16:21

by Richard Beddard from interactive investor

At first blush, homeware designer had a great 2017. Revenue increased 11% and adjusted profit 15% in the year to December. Impressive cashflow meant the company had more cash than debt at the year end, even though it splurged £16.7 million on candlemaker Wax Lyrical the previous year. Business has been brisk so far this year, but as usual Thanksgiving and Christmas will be make or break.

Though the company headlines its annual report with "Ninth successive year of record revenue", it's not perhaps the vintage year the headline implies. The previous year included only an eight month contribution from Wax Lyrical, and the company also benefited from kind exchange rates. On a like-for-like basis it grew revenue about 4%.

Beyond the financial headlines, Portmeirion launched a new range of tableware, it continued to lose sales in South Korea (once a major growth market), and more than made up for it with a surge in exports to other overseas markets.

I'll add these developments to what I already know about Portmeirion, and score its business model (how it makes money), strategy (how it will make more), risk management (what could go wrong), management culture (how it treats shareholders, staff, customers and suppliers) and market valuation. Each category is scored out of two, to give a total out of ten.

Brand power = profit

Portmeirion has good brands. It's a profitable businesses [Business model: 2/2]

Portmeirion develops and promotes brands.

The biggest is the eponymous Portmeirion brand, owner of Portmeirion Botanic Garden. Portmeirion Botanic Garden reliably chalks up over £30 million in annual revenue, approaching half of all the revenue Portmeirion earns from ceramics. It's probably the most popular tableware pattern of them all, and the brand has staying power, it was launched in 1972.

Portmeirion bought fellow Staffordshire potters Spode and Royal Worcester out of administration during the financial crisis. Spode Christmas Tree amply illustrates their revival. It earned Portmeirion about £10 million in revenue in 2016. Pimpernel, an earlier acquisition, is, I think, a bit of a sideshow, it makes trays, placemats, and other paraphernalia.

Wax Lyrical is a significant departure for a business hitherto focused on tableware, because it took Portmeirion out of the dining room and beyond branded products. Wax Lyrical makes candles and reed diffusers (collectively home fragrances), and it also supplies them to supermarkets who market them under their own brands.

The acquisition is a step towards Portmeirion's ambition to be a leading supplier of great British homeware brands around the world. "Made in Britain", Portmeirion believes, has a cachet in certain overseas markets.

The other key aspect of the business model is financing. Even after shoehorning capitalised operating leases and Portmeirion's pension deficit into my definition of debt, the company's operations were only 22% bankrolled by external finance at the year end.

That's important because Portmeirion borrows during the year to finance the Thanksgiving/Christmas rush, and because a relatively small decline in revenue can lead to a dramatic decline in profit when lower volumes are going through its factories in Stoke on Trent and the Lake District.

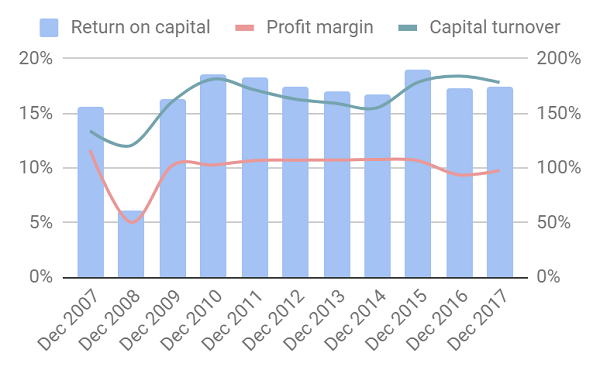

Fortunately, this is not a frequent, or long-lived occurrence. Generally, Portmeirion has been highly profitable:

Source: interactive investor Past performance is not a guide to future performance

Extending old brands and developing new ones

The strategy is coherent, but perhaps too reliant on old brands [Strategy: 1/2]

Portmeirion plans to grow by developing and acquiring products to sell through its distribution network, directly in the UK and the USA, and through agents and distributors in the rest of the World.

2017 was a busy year for product development. The company launched 1,175 new products, double what it achieves in a typical year. It launched a new range, Sara Miller London, and 200 new home fragrance products made by Wax Lyrical but sold under the existing Portmeirion brands. It also extended various ranges, including Botanic Garden.

The Sara Miller London collection was developed in collaboration with the designer, Sara Miller. Ideal Home says it's "simply stunning" and "a feast for the eyes" and judging by the pictures it is (though I'm not much of a judge).

With the new collection, Portmeirion is probably trying to emulate, or perhaps surpass, the success of another designer-led collection, Sophie Conran for Portmeirion, which in 2016 earned about £6 million revenue.

There are other important elements of Portmeirion's strategy: it promotes the brands, obviously, it's wedded to operational and financial efficiency, and it defends its intellectual property from copycats. It all starts with new designs though.

New products keep established brands relevant and are the basis of new ranges. A bumper year like 2017 should be a harbinger of growth, if the new products stick. That's Portmeirion's business model and strategy in a nutshell. I like it, but for the business to really take off it could do with another blockbuster like Botanic Garden. Trouble is, it's a rare thing.

What's Portmeirion not telling us?

Under the surface, much is changing, not all of it fully explained [Risks: 1/2]

The great thing about Botanic Garden, apart from it being so big, is that it belongs to Portmeirion. Newer ranges like Sara Miller, Sophie Conran, and Royal Worcester's Wrendale Designs have been developed under licence. Wrendale Designs is, incidentally, very twee, it "brings a splash of British Countryside to the home" and is popular in the USA.

The advantage of working with partners is they already have a following, but it also means profit is shared and the partners' views must be accommodated, so I don't know if the new design-led contemporary ranges are as profitable or as sustainable as Botanic Garden and Spode Christmas Tree.

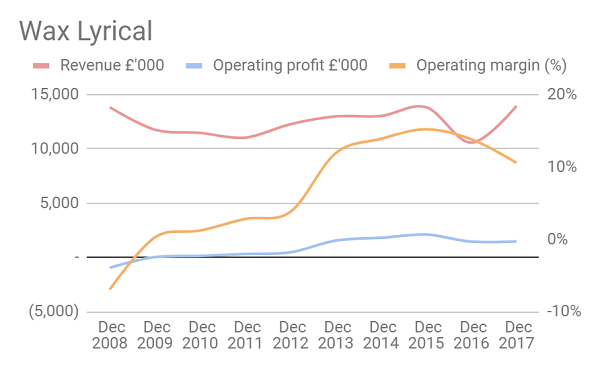

Portmeirion generally doesn't disclose how much it's ceramic brands earn, but it does provide data for Wax Lyrical. I've bolted it onto the numbers from Wax Lyrical's accounts before it was taken over to produce this chart:

Source: interactive investor Past performance is not a guide to future performance

The dip in 2016 is a glitch because Portmeirion only owned Wax Lyrical for eight months of the year. The chart shows Wax Lyrical has yet to experience a significant increase in revenue (red line) as a result of being part of Portmeirion, and profit margins (yellow line) have fallen. It's early days yet, but this is a test case for Portmeirion's acquisition strategy, so we need to see the synergies coming through in the numbers.

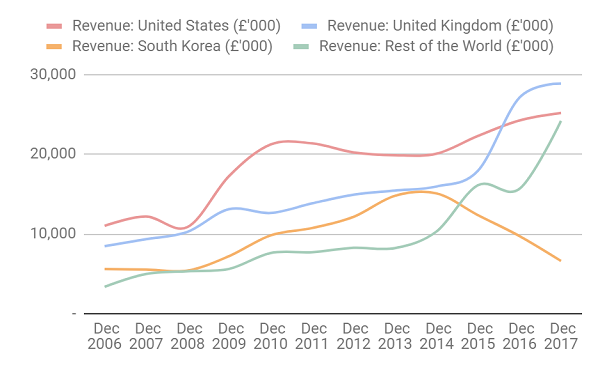

South Korea is also a big mystery. Revenue there declined 32% (yellow line, below). The annual report simply says Portmeirion is working with its exclusive distributor to sell a wider variety of products and find new customers.

Source: interactive investor Past performance is not a guide to future performance

But Portmeirion has never given a convincing explanation for the loss of about £3m in revenue in each of three consecutive years. It coincides with the dramatic surge in sales to the Rest of the World (green line), India initially. I understand that unbeknown to Portmeirion, its Indian distributor was selling into the already well developed South Korean market, which inflated the Indian figures and deflated the South Korean ones. There's no mention of India in this year's annual report though, Portmeirion says it grew sales into Europe and some Asian markets such as Hong Kong and Taiwan.

You may ask why it matters, as long as the revenue comes from somewhere. Botanic Garden is Portmeirion's big seller in South Korea, and its demise makes me wonder whether outside the Anglo-Saxon world 'Made in Britain" has staying power.

Don't be fooled, by the way, the surge in UK revenue (blue line), that's mostly revenue added by Wax Lyrical.

Experienced, well paid managers

On culture, it's a split decision [Culture: 1/2]

The company says it's responsive to private shareholders and employee engagement surveys report high satisfaction rates (94% at Portmeirion say they are happy, 87% at Wax Lyrical).

Chief executive Laurence Bryan is also President of Portmeirion Inc., the US subsidiary. That and the fact that he's led a successful business since 2001, may explain his highly salary (£476,000 in 2017), before bonus and share options.

While I don't see much evidence of wage restraint in the boardroom, Bryan does have some skin in the game. His shareholding is worth over £1.5 million.

Probably good value

The shares aren't obviously expensive [1/2]

A total score of 6 out of 10 puts Portmeirion just outside of my 'buy' zone. That feels a bit harsh. It's almost certainly a good company at a reasonable price (£11.40), but there's just a little too much I don't know to fully endorse it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.