A ‘perfect’ time to invest in trusts?

The investment trust sector has been hit hard, but Kepler Trust Intelligence argues that now that corporate activity is picking up, there are discount opportunities aplenty for bold investors

27th October 2023 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

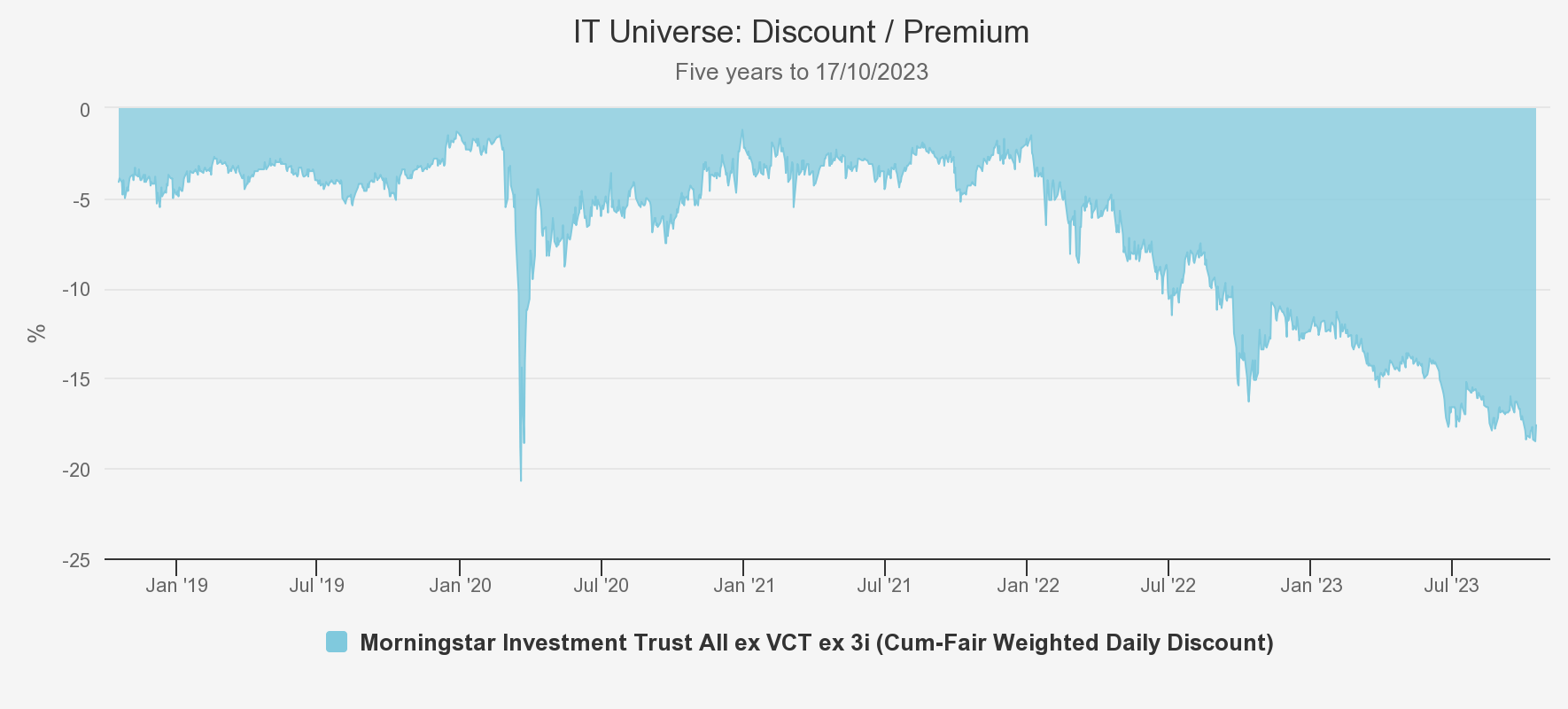

It’s an exciting time for investors in the investment trust sector, even if it might not feel like that right now. The chart below is striking, and if you listen carefully you can hear the sucking sound as billions of pounds disappear off the London Stock Exchange. It is the average discount in the investment trust sector (ex VCTs, ex 3i). What it shows is a stampede for the exits, as investors finally capitulate in 2023 after a couple of difficult years.

- Invest with ii: Trade Investment Trusts | Cashback Offers | Open a Trading Account

The average discount in 2021 was 3.1%, and this widened to 8.8% in 2022. Over 2023, it has been 14.9% for the year to date, reaching 17.6% at the time of writing. The sector is almost as out of favour as it was in March 2020 when the nation was wondering whether it would have to use stadia as temporary morgues and Matt Hancock was planning his TV career.

SECTOR DISCOUNT

Source: Morningstar

The last few weeks seem to have seen the mood shift in the sector — although, of course, what we are hearing is the fruits of earlier discussions and decisions. A growing number of boards are outlining concrete steps to address the discount of their share price to NAV. We are strong believers that there is good potential in the NAVs of most sectors right now after significant sell-offs in public markets have left assets looking cheap, while technical reasons — i.e. a dash for cash — have left trusts holding high-quality real assets, in many cases with inflation-linkage, trading at wide discounts.

In that light, we note that JPMorgan published their Long-Term Capital Market Assumptions last week, in which they forecast returns for various asset classes over the next decade. The sell-off in real estate and other real assets, where the investment trust sector is strong, has led to a significant mark-up in expected long-term returns. Similarly, equity markets are undoubtedly more attractive than they were 18 months ago after such a significant sell-off — if one has a sufficiently long-term investment horizon. However, we think it is fair to observe that few people are interested in those long-term potential returns right now. With cash or cash-like investments offering 5%-plus, investors are shifting their portfolios there and using liquid investments such as investment trusts as sources of capital. Understandably, managers and boards may find this frustrating, and seek to focus on the long-term potential of the NAV for as long as possible, but ultimately they serve shareholders and so they must react to shareholders’ shorter-term focus.

As a result, we have seen corporate activity pick up in recent months, and we expect this to accelerate. This creates opportunities for investors in the sector, both individuals and those with fund-picking mandates. One potential straw in the wind is the decision by the board of private equity investor Symphony to realise assets and wind up the company. AVI Global Trust Ord (LSE:AGT)has been an investor in this business for some time, and is set to benefit as any realisations are likely to provide a significant return on the 46% discount at which the shares were previously trading — Symphony’s shares were up 21% in September.

In fact, AGT’s strategy of buying companies at a discount to their fair value, in particular investment trusts, put it in a strong position in such an environment. The manager, AVI, has recently weighed in on the situation at Hipgnosis Songs Ord (LSE:SONG), having been buying shares at a deep discount to SONG’s NAV. The situation is complex, but with the shares on a wide discount, the board and shareholders are negotiating the next steps forward, which could see radical action to unlock value and potentially deliver high returns which are not dependent on the health of the economy or the direction in the market.

Private equity is an area where discounts are wide, and we have been vocal in highlighting the value we see in these trusts. Symphony’s realisation is one action in this space, another is Pantheon International Ord (LSE:PIN)’s decision to conduct a £200 million buyback of its shares. Companies in the sector have been loath to do this, but PIN’s success may encourage others to change course. According to the company’s calculations, the programme so far has added circa 3.4% to the 31/08/2023 NAV, a risk-free return that to us looks very attractive over a period in which the FTSE All-Share is marginally down.

In fact, PIN’s shares are up circa 8.6% since that August NAV, the discount having come in from circa 40% to circa 33%. We think this is a pretty attractive return in the current market environment. We will shortly be initiating research on PIN, click here to be notified. Boards who are wavering on the decision may do well to consider the words of Warren Buffet in his latest shareholder letter: “The math [sic] isn’t complicated: When the share count goes down, your interest in our many businesses goes up. Every small bit helps if repurchases are made at value-accretive prices...Gains from value-accretive repurchases, it should be emphasised, benefit all owners — in every respect.”

Alongside AGT, another trust which is well-placed to benefit from a pick-up in corporate activity is MIGO Opportunities Trust (LSE:MIGO), which is heading to AVI under its old manager Nick Greenwood and will be renamed AVI Global Opportunities in time. Nick has spoken publicly about the huge opportunity he was seeing across the board this summer, and when we met with him last week he reaffirmed how excited he was about the number and scale of the opportunities in front of him. Nick tells us he is particularly excited about discounted trusts in the Vietnam and India sectors at the moment, but he has been finding opportunities all over the place. "We are likely to look back to the autumn of 2023 as the perfect time to invest in investment trusts," he tells us. We will be publishing an updated note on MIGO in the coming weeks with all the details, you can add the trust to yourwatchlist here to receive a notification.

One way boards can seek to address significant discounts is to make a performance-conditional tender offer. In our view, this is an attractive feature of the investment trust sector in which boards can heavily incentivise managers to perform well in a way which clearly benefits shareholders. One such example was the recent decision of the board of European Opportunities Trust (LSE:EOT)to declare it would make a tender offer for 25% of the shares if the trust underperformed its benchmark over the next three years. In our view, this further tilts the risk/reward calculation in investors’ favour. One important element is the presence on the shareholder register of activist investor Saba Capital, whose founder Boaz Weinstein has been vocal about the opportunity to generate risk-free returns from corporate activity in the investment trust sector. Saba published an open letter to the board of EOT last week urging it to go further than a 25% tender offer, and it would not be surprising to see it undertake further such actions in the coming months.

Conclusion

The year started with large issuance from BH Macro GBP Ord (LSE:BHMG) and 3i Infrastructure Ord (LSE:3IN) in February, but since then the AIC statistics show a net outflow of £303 million from the sector due to tenders and other corporate activity — and this doesn’t include the effect of regular buyback programmes. There are still a few mergers and combinations going through the approval process which could lead to more capital departing — for example the combination of Asia Dragon (LSE:DGN)and abrdn New Dawn (ABD), which should create a much larger and liquid vehicle with the potential to be held by a broader range of professional investors. It looks likely that this £303 million will rise by the end of the year. Whether this is in the long-term interest of shareholders is hard to say — as discussed above, with asset prices having taken a significant knock, the long-term outlook should be good.

We think investment trusts are a superior structure for long-term investment thanks to the ability to take liquidity risk and the ability to take on debt. However, facing facts, the short-term outlook is miserable for economies, making investors keen to draw in their horns, while high interest rates make low-risk investments much more attractive — even if high inflation means this is in part an illusion. In this environment, boards have levers to pull to satisfy these considerations. Above we have touched on just some of the examples of such corporate activity, but frankly, there are too many to cover in this space, with every day seeing new announcements. In our view, it should be comforting to investors to see boards taking their responsibilities seriously to generate value and listen to shareholders’ concerns.

Occasionally we meet with managers who are embarrassed that their trust sits on a discount, but from a potential shareholder’s point of view this is fundamentally an attractive thing: where else can you get publicly traded assets for pennies in the pound? The worry is always whether that discount will persist indefinitely. But with an active board, this is not a realistic fear, and the evidence is that boards are ramping up their activities on behalf of shareholders. This offers the potential for investors to generate returns which are not dependent on the direction of the market and which in some cases can be significant and swiftly realised.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.