Pensions and IHT: 54% of UK adults to adjust plans before 2027 changes

New interactive investor poll sheds light on plans to adjust their retirement or estate planning before impending changes.

17th February 2025 13:46

by Myron Jobson from interactive investor

- From April 2027, pensions will no longer be exempt from inheritance tax

- A majority (52%) of respondents in a poll of over 1,000 UK adults said their pension is a key component of their estate planning, while 23% said it plays a role to a lesser extent

- When asked about confidence in the pensions system, the largest proportion (44%) of respondents said they had none, with a further 17% unsure.

More than half (54%) of UK adults are planning to adjust their retirement or estate planning in response to inheritance tax (IHT) changes on pensions, which come into effect in just over two years, according to a new snap poll by interactive investor, the UK’s second-largest DIY investment platform.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

In the October Budget, the chancellor announced plans to include unused pension savings and certain pension death benefits in the value of estates for IHT purposes from 6 April 2027.

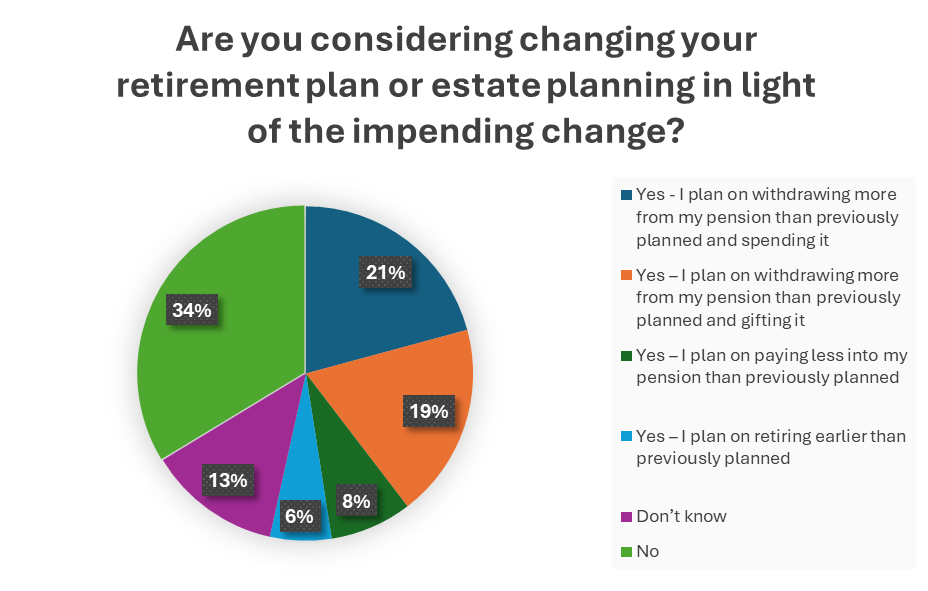

While the final details of how IHT on pensions will be implemented remain unclear, the survey, conducted among 1,064 visitors to the interactive investor website between 6 and 7 February 2025, revealed that 21% of respondents plan to withdraw more money from their pension than originally intended and spend it.

Another 19% plan to withdraw more and gift it, 8% intend to reduce their pension contributions, and 6% plan to retire earlier than originally expected due to the impending change.

Meanwhile, 13% remain undecided, while 34% have not considered altering their current retirement or estate planning strategy.

The role of pensions in estate planning

When asked about the role of pensions in estate planning, 52% of respondents said their pension forms a key component of their strategy. A further 23% said they consider pensions as part of their plan to limit IHT but not in detail, while 25% said they have not factored pensions into their estate planning at all.

Confidence in the pensions system

The poll also found that 44% of respondents have no confidence in the pensions system, with an additional 17% unsure. However, some 39% of the sample said they had confidence in the pensions system.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “Our survey shows that, despite uncertainty over how IHT on pensions will be implemented, many people are already considering pre-emptive steps to reduce their future tax burden.

“It’s interesting to see that more people are considering drawing down larger sums from their pensions in response to these changes. At first glance, this might seem like a savvy move - accessing funds now to spend or gift before new tax rules come into effect.

“But there are important trade-offs to consider. Withdrawing more than necessary could push retirees into higher tax brackets, resulting in an unnecessarily large tax bill. There’s also the risk of depleting pension savings too quickly, leaving less for later life. While gifting money can be a tax-efficient strategy, careful planning is essential to avoid unintended financial pitfalls.

“A U-turn on this policy seems unlikely, given the government’s need to bolster public finances. The Office for Budget Responsibility (OBR) expects these changes, alongside the extended freeze on nil-rate bands until 2029-30, to generate an additional £2.5 billion in tax receipts by 2029-30.

“Significant changes to the pensions system risk undermining confidence in it. Pensions are long-term investments, and frequent rule changes can leave savers uncertain about the future. It’s little wonder that 44% of respondents in our survey say they have no confidence in the system.

“Stability and clarity are essential to ensuring people feel secure in their retirement planning. Without them, there’s a danger that more individuals may disengage from pensions altogether—potentially leaving them worse off in later life.”

Rising IHT burden by 2030

- A Freedom of Information request by interactive investor to the Office for Budget Responsibility (OBR) revealed that almost 153,000 estates will face new or additional IHT liability by 2030

- According to OBR data, 31,200 additional estates will become liable for IHT by the end of the 2029-30 tax year if the proposed changes are enacted, with a further 121,500 estates facing increased IHT liability

- The proportion of estates subject to IHT is projected to rise from 5.2% in 2023-24 to 9.5% in 2029-30, while the average tax bill per estate is expected to remain broadly unchanged

- In the 2027-28 tax year, the average IHT liability is projected to be £169,000—increasing by approximately £34,000 when pension assets are included in the value of the estate, according to OBR estimates.

Source: interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.