Pension withdrawal values lower than average during Q1 lockdown

Total value of withdrawals from pension pots rose at the start of 2021, but the average is lower.

30th April 2021 11:11

by Rebecca O'Connor from interactive investor

Total value of withdrawals from pension pots rose in the first three months of 2021, but the average is lower.

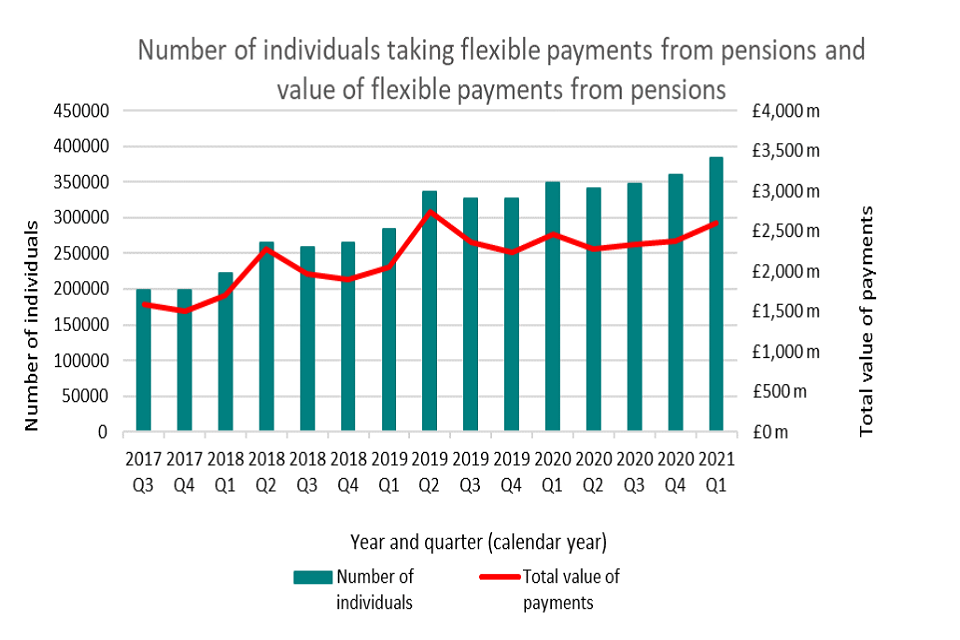

HMRC’s flexible pension payment statistics for the first quarter of 2021, published this morning, show a 6% rise in the total value of withdrawals from pension pots in the first three months of 2021.

More individuals withdrew from their pensions in the first quarter of this year, at 383,000 compared with 348,000 in the same period in 2020 – a 10% rise, and 6% higher than the previous quarter.

However, the value of the average withdrawal fell by 4% from £7,100 in Q1 2020 to £6,800 in the same period this year.

Source: HMRC data

HMRC said that withdrawal data was becoming less volatile over time. It added that withdrawals tend to be higher in the first three months of the year.

interactive investor data from its own SIPP customers over the age of 55 shows an average drawdown withdrawal amount of £4,467 in Q1 2021, up from £3,468 in the same period a year earlier and an increase of 29%.

Among ii customers, there was a 38% rise in the average withdrawal among 55 to 64-year olds in Q1 2021 compared with Q1 2020, from £3,740 to £5,163.

The rise in average withdrawal among the 65+ age group, who are more likely to be fully retired, was lower, with SIPP customers in this age group withdrawing on average 18% more in Q1 2021 compared to Q1 2020, at £3,772 compared to £3,196.

Becky O’Connor, Head of Pensions and Savings, interactive investor, said: “Lower spending needs in lockdown could be behind the slight drop in the average withdrawal from pensions in the first three months of this year.

“However it’s a mixed bag, with our own data from SIPP customers showing some older workers and retirees choosing to take more from their pensions.

“We know that some older people have lost income during the pandemic and this could mean a need to tap into pension pots earlier. But this is a decision that shouldn’t be taken lightly.

“Pension freedoms have given people a lot more choice over how to plan their retirement, but with this freedom comes responsibility to make your own money last.

“It can mean some difficult choices along the way. There are many steps people can take to make their pension pot go the distance, including keeping as much as possible invested in the stock market for growth, for as long as possible.”

Notes to editors

- HMRC Flexible Pension Payment statistics https://www.gov.uk/government/statistics/flexible-payments-from-pensions/flexible-payments-from-pensions

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.