Pacific Assets’ Doug Ledingham on why Asia ESG pioneer is set for bounceback

The joint manager of Pacific Assets investment trust talks to Cherry Reynard about the sustainable inv…

20th May 2020 17:13

by Cherry Reynard from interactive investor

The joint manager of Pacific Assets investment trust talks to Cherry Reynard about the sustainable investing philosophy that should see the trust continue to make solid gains.

Stewart Investors, which manages the Pacific Assets (PAC) trust, has long been a supporter of a little-known, Edinburgh-based charity called The Library of Mistakes. Its mission is that “by studying financial history we hope to improve financial understanding one mistake at a time”. This thinking also informs the trust’s investment style. Managers David Gait and Doug Ledingham believe that only by understanding the history of individual companies and their management teams can they avoid the pitfalls.

Key facts about Pacific Assets*

| Market cap | £285m |

| Total assets | £300m |

| Share price | 236p |

| Discount | -4.9% |

| Yield | 1.3% |

| NAV TR 1 year | -13.6% |

| NAV TR 3 yrs | -1.2% |

| NAV TR 5 yrs | 18.8% |

| Gearing | Nil |

| Ongoing charge | 1.21% |

Note: *As at 15 April 2020. NAV TR = net asset value total return. Source: AIC/Morningstar

Seeing off crises

Many of the companies in the portfolio have survived for decades, seeing off crises as diverse as world wars and financial meltdowns, dealing with interest rates from 0% to 10%. They are always thinking about what can go wrong, says Ledingham, rather than over-optimistically taking on debt to grow. The same is true on the macroeconomic side: “Asia has a long and chequered history. We have seen quite a few crises and corrupt governments. We are trying to look at history and understand it to get a better idea of what the future may hold.”

Looking at a company’s history is also important for the company’s sustainability mandate. While ESG (environmental, social and governance) considerations have started to permeate the investment management sector, they still remain only lightly adopted among Asian investment trusts, which marks Pacific Assets apart. However, the group’s approach is idiosyncratic, preferring more qualitative judgements on trust and past behaviour than a heavily statistics-driven approach.

Ledingham says: “We want to find people of integrity, so we look at the way they have treated shareholders historically. Have they short-changed minority shareholders, avoided taxes, dumped chemicals in an irresponsible way?” The team at Stewart Investors was among the pioneers of sustainable investment, with Gait helping launch the Asia Pacific Sustainability fund in 2005 with Angus Tulloch.

The trouble with wanting to quantify everything is that it neglects those elements that can’t be quantified, says Ledingham. It is relatively easy to look at independent directors, or female participation in the workplace, but a bald statistical approach may not capture the elements that are very important for a company’s long-term survival.

He gives the example of an Asian cigarette company that tends to receive fantastically high ESG scores because it has the right governance structure. “It can tick the box on independent directors and gets a high score for transparency, but it’s still selling cigarettes,” he says. “Equally, we see that other companies have a long track record of discriminating against minority shareholders, but this is not captured by the metrics.”

- Ethical fund choices in the Money Observer 2020 Rated Funds list

Instead the group relies on its collective experience to capture these elements. “We want to find those management teams that have shown integrity and competence historically. Our job is to protect capital before we can grow it,” he argues.

This leads them to a long-held preference for family-owned business. They can align themselves with the family, who usually have a lengthy time horizon and the long-term sustainability of the company at heart. This gives the portfolio a naturally conservative bias. The team tend to ignore those companies that have built up significant debt .

This ‘bottom-up’ ESG strategy is about effective long-term risk management, but is also, they argue, a driver of returns. They do not seek to make a moral judgement, but an investment one.

The group also has a targeted engagement strategy. They believe they ‘earn the right’ to engage with companies as long-term shareholders. Recent engagements have included areas such as recycling and packaging, and the sugar content of food. Ledingham says: “This is an integral part of managing client capital. This isn’t a private equity style ‘we think this is what you should be doing’, but is much more ‘we like your company, but there are risks you should be doing more to mitigate’.” They will bring in independent research to show how companies compare to their peers. This gives them greater power when they’re in front of the CEO.

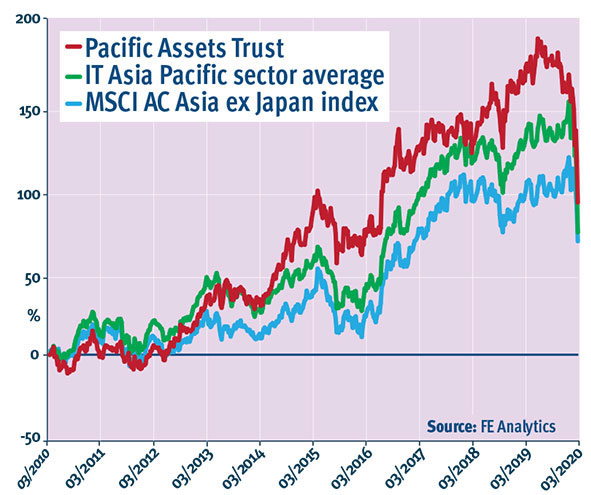

Recent performance of the trust has been difficult, but not necessarily for the obvious reasons. Certainly, the group has lost some experienced hands: Angus Tulloch to retirement in 2017, and Tom Allen last year. However, the biggest problem for the trust has been the discount rather than underlying performance. Net asset value (NAV) performance for the trust has recently been uninspiring relative to its peers, with the trust down 1.2% over three years, compared to a rise of 6% for its peer group, and the shares down 3.3% as at 15 April.

Market rout disguises a decade of outperformance

Portfolio motoring on

The trust’s shares had been sitting at around par for much of 2019, even reaching a 5% premium to NAV at one point during the year, fuelled by good NAV performance and the appeal of its sustainability mandate. However, the mid-March rout in markets hit disproportionately hard, with the trust moving out to an 18% discount by 20 March, slightly lower than the wider sector (Invesco Asia, for example, was trading at a 22% discount), but this represents a steeper fall from its previous levels.

Nonetheless, the underlying portfolio keeps motoring on and has even proved relatively defensive in the recent rout for Asian markets. The group’s approach tends to be cautious, even where there appears to be strong structural growth for a particular area.

Ledingham gives the examples of manufacturing of electric vehicles. While there is a fast-growing market for electric cars, he believes that it is difficult to make attractive returns. The group prefers to invest in the ‘picks and shovels’ companies so has targeted those companies that supply the testing equipment for batteries. These benefit from the structural growth but have a better return profile.

Another long-term holding is Vitasoy, a Hong Kong manufacturer of soy milk products. Family-owned, the founder Lo Kwee-seong was switched on to the virtues of the soybean as early as 1936, when he heard a speech by the US commercial attaché to China.

- What about an ethical ranking for investment trusts?

Ledingham says the company has an “amazing” track record of treating shareholders well. It has recently taken steps to reduce the sugar content of its products and is well-placed to grow sustainably. Soya milk has a high nutritional value and is less resource-intensive to produce than other sources of protein.

How are the managers handling today’s tough markets? They had already been nervous about markets when the coronavirus hit and were positioned cautiously. So far, this hasn’t helped: “Markets have sold off significantly, but there has been little differentiation between high-quality companies with sustainable development prospects and poor-quality companies,” says Ledingham. However, he believes quality may become more important as the dust settles.

He says the rout has pushed valuations to extreme levels. They are currently waiting on the sidelines, looking out for opportunities. “In times of stress, companies we own tend to outperform. We haven’t seen that yet and it will be interesting to see whether it happens in the next few weeks and the market starts to take notice of those companies that are very indebted. Good companies should be rewarded for their strength.”

In the meantime, this long-term top performer has recently traded at an all-time wide discount. Investors who fancy dipping a toe back in Asia in these troubled times should watch out for similar opportunities to secure a rare bargain.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.