Outlook for renewable energy sector in 2025

Several headwinds have hurt valuations across the sector, but what will the next 12 months bring? Alex Watts shares his view on renewable energy and names an interesting way to play a recovery.

4th December 2024 11:43

by Alex Watts from interactive investor

Political

With the arrival of a new Labour government with the stated intentions of making Britain a “clean energy superpower”, in tandem with the tailwind of the first cuts to UK bank rates, prospects for renewables in the UK may be looking up. The UK and Europe appear to still be looking to follow the path of the green transition – requiring immense investment and policy support.

However, the picture in the US is less clear following victory for Trump, whose rhetoric has included plans to repeal the Inflation Reduction Act (IRA) - meaning tax credits for renewable generation (and other aspects of the IRA) may be under threat. Post-election, this negativity manifested in falls in the share prices of listed clean energy companies, versus rallying prices across oil & gas companies.

Still, we might not be looking at a total rescinding of unspent IRA funds. Certain aspects of the IRA have bipartisan support, and the threat must be weighed against the potential damage to US manufacturing, and the benefits the IRA brings for domestic job creation across blue and red states.

Macro

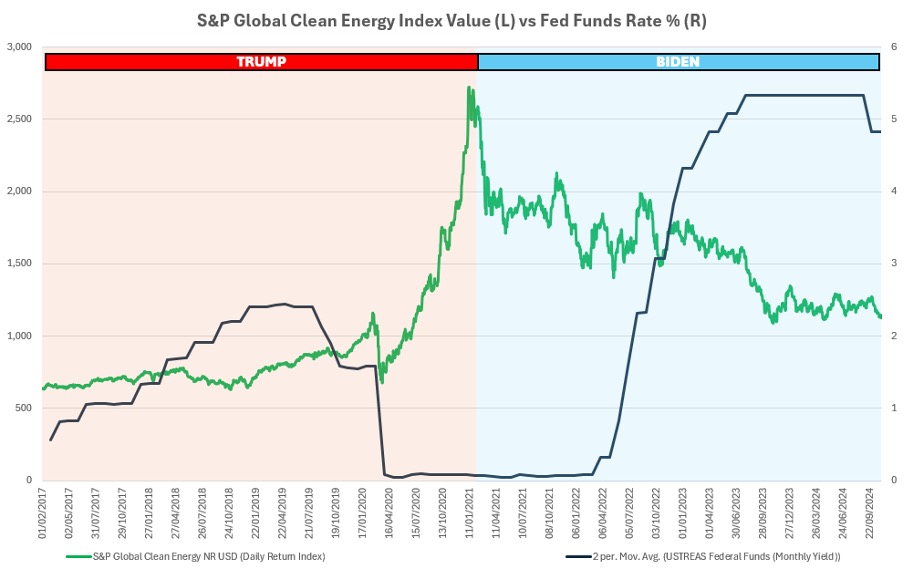

While policy is important at a global level, market performance of renewables has been much more sensitive to changes in interest rates than policy. During Trump’s first presidency, the S&P Global Clean energy index returned over 260% as Fed rate was cut near the end of his tenure (see chart). Irrespective of Biden’s more accommodative stance, underperformance for renewable energy companies in the ensuing three-plus years was chronic, while central banks raised interest rates rapidly.

Source: Morningstar Market Index Closing Price (L) Base and Current Yield % (R). Index rebalanced in April 2021. President terms are based on inauguration.

Since a peak in early 2021, valuations of listed-clean energy companies have fallen significantly. For Renewable Infrastructure sector investment trusts in the UK, which invest in unlisted assets, negative sentiment also manifested in widening discounts to net asset value (NAV). Across the renewable infrastructure sector, trusts have fallen from trading on average at a premium in 2020-21, to each constituent trading at a notable discount in November 2024.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Fund Spotlight: this fund taps into a powerful long-term trend

So, while the sector has struggled recently, partly owing to the higher interest rate environment, the compelling environmental and societal reasons for investing in renewable infrastructure never went away.

While the unwinding of quantitative tightening that so hurt valuations of these companies may be slower than initially anticipated in the UK and US, as interest rates come down, those hardest-hit sectors (such as renewables) on the way up could be well placed for some recovery.

VT Gravis Clean Energy Income Fund – ACE 40

One way to invest in renewable energy, including in renewable energy investment trusts, is via the VT Gravis Clean Energy Income Fund. While this is a fund (not a trust), it holds a mix of shares of both companies and investment trusts – with most of its holdings within the Renewable Energy Infrastructure investment trust sector, such as Greencoat UK Wind (LSE:UKW) and Renewables Infrastructure Grp (LSE:TRIG).

Managed by William Argent, Gravis Clean Energy Income Fund aims to generate income, and to preserve and grow capital through investing in alternative energy. The fund invests globally in businesses deriving revenue from the operation, funding, generation and supply of clean energy, with 43% in wind, 31% in solar and 8% in hyrdroelectric adjacent investments. Due to the bias to UK-listed trusts, the portfolio appears very UK-heavy. However, the sources of revenue across the portfolio are far more international in nature.

While the fund didn’t capture the same degree of upside as the more globally focused benchmark in the clean energy rally of 2020, it has held up far better than the S&P global clean energy benchmark in the three years since and year to date.

The fund is unique among peers due to its less growth-focused profile versus both clean energy peers and benchmark – a product of its focus on income. Accordingly, its yield of over 6% is one of the very strongest of its wider Infrastructure peer group.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.