Our stock analyst's favourite Christmas Treatt

21st December 2018 15:05

by Richard Beddard from interactive investor

Richard Beddard is in a festive mood as he profiles one of his favourite shares. Flavour and fragrance manufacturer Treatt has just published its annual report. It is tasty.

However hard I try to look past Treatt's weak cash flows, I cannot get past the fact that currently it is only making good money in accounting terms. I do not believe that makes it a bad investment, but it takes the shine off what is in so many ways the perfect long-term investment.

"Bah Humbug!" to cash flow. It is important, but culture is king over the long-term...

As usual I am scoring Treatt to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

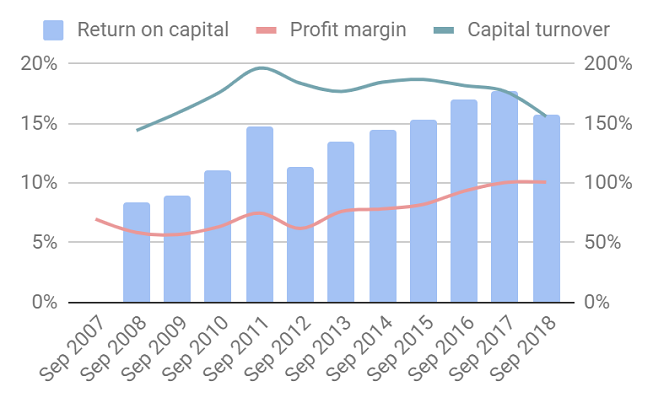

Treatt makes flavour and fragrance ingredients, often by distilling the natural essence of plants. For 140 years it has traded ingredients, particularly citrus oils, sourced around the World. Today it still trades ingredients and blends them to provide consistent flavour profiles, but an increasing emphasis on proprietary flavours in growth markets, principally iced tea and reduced sugar drinks, has lifted profitability in recent years:

Source: interactive investor Past performance is not a guide to future performance

For the first time since 2011, return on capital declined in the year to September 2018, mostly because Treatt's customers owed it more money, but also because it has invested to double the capacity of its US production facility, where Treatt manufactures flavours for ice tea and reduced sugar drinks. Increasingly health conscious consumers mean these niches are growing much faster than traditional fizzy pop.

Both working capital and investment are likely to continue dragging on profitability and cash flow as Treatt builds and equips a new headquarters in Bury St Edmunds and targets large multinational beverage companies (think Pepsi and Coca Cola) that take longer to pay. The company also stockpiles ingredients to take advantage of low prices and ensure it can meet customers' ad-hoc as well as contractual demands.

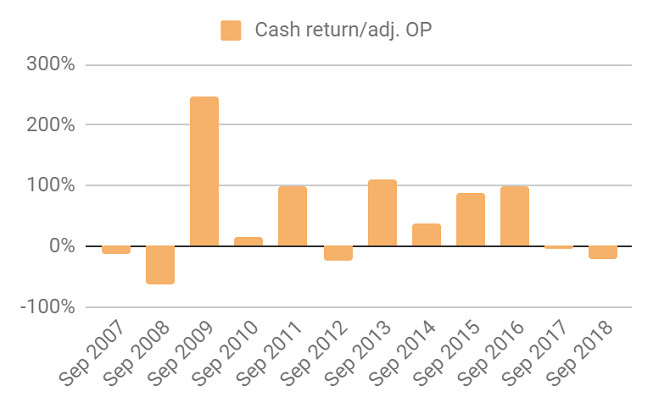

Shareholders in Treatt must be inured to inconsistent and sometimes negative operating cash flows, charted after deducting capital expenditure below:

Source: interactive investor Past performance is not a guide to future performance

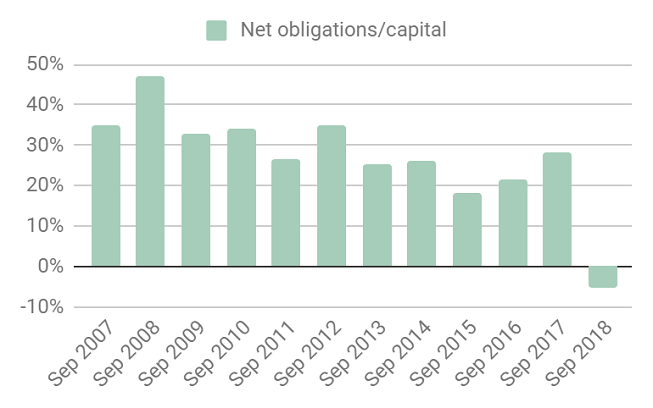

Despite losing money after investment in cash terms in 2018, Treatt's bank balance is unusually healthy. At the year end the cash balance exceeded all its financial obligations:

Source: interactive investor Past performance is not a guide to future performance

However, the improvement is entirely because Treatt raised money, selling a subsidiary, Earthoil, for £9 million and issuing shares worth £21 million during the year.

The cash surplus will not last. So far Treatt has only paid the £3.7 million cost of the site of new headquarters down the road from its existing one in Bury St Edmunds. According to the company's projections there is over £30 million to go, net of the sale of the existing site, and Treatt expects debt to peak in March 2020, a few months before it moves into the building.

Thanks to the sums Treatt has raised, I do not believe Treatt will end up more in the red than the reasonable levels of debt it has carried in the past.

Adaptable: How will it make more money?

Score: 2

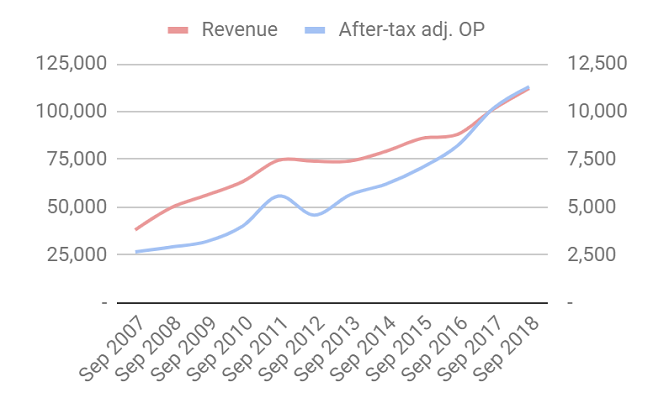

Growth in revenue and profit has come from the company's focus on citrus oils, tea flavours and sugar reduction, which combined earned Treatt almost 70% of revenue in 2018.

Source: interactive investor Past performance is not a guide to future performance

It is promising more of the same. In 2016, North Americans were drinking 40% more ready-to-drink teas like ice tea by value than they were five years earlier, so Treatt's natural tannin and caffeine free tea flavours, like its sugar reduction solutions, position it in growth markets.

The new headquarters, which will consolidate six drab buildings into one "science-led" facility, should allow employees to collaborate more easily with each other and customers to design bespoke ingredients earning Treatt more consistent revenue and higher profit margins. By selling these higher value products directly to beverage manufacturers it is by-passing the flavour houses and capturing more of the profit.

Treatt's biggest market is North America but it believes China and India have great potential. In addition to the production facilities in Suffolk and Florida, it operates a sales office and research and development centre in Shanghai.

Resilient: What could go wrong?

Score: 2

Treatt's total investment in the new headquarters is enormous, roughly a third of annual revenue, or three times annual profit. The company has already delayed the move by six months because finalising the design took longer than expected, but it says it is happy with 7.5% contingency in the plan and is sticking with its cost estimates. One source of comfort for nervous shareholders is the $14 million US expansion, near completion and coming in on budget.

The investment might not generate a satisfactory return. I do not believe there is an urgent need to increase Treatt's capacity in the UK, although that time should come and the modular design of the new site will allow it to expand easily. The more immediate benefits are somewhat less tangible, it will remove the requirement for forklift drivers to whizz between buildings, sometimes on public roads, and members of staff moving in its corridors will no longer have to flatten themselves against the wall to let others pass.

I believe the strategy, to add more value by developing technically innovative flavours and sell them directly to beverage manufacturers, addresses the key risk in the businesses, which is that trading basic ingredients is not very profitable and becoming less so as manufacturers source them directly from growers. Now that Treatt has proved it can add value to basic ingredients it needs a building that will encourage staff to collaborate with each other and their counterparts from the companies it supplies, even though it comes at considerable cost.

Equitable: Will we all benefit?

Score: 2

I have visited Treatt three times. It is impossible not to bump into the people that work there, the corridors are that narrow. I always come away impressed. Appearances can be deceptive, so can the overwhelmingly positive reviews posted by staff on recruitment websites, statistics on absenteeism and length of service, and corporate rhetoric, but when they all give the same impression there is probably truth in it.

Treatt says it has an "enabling culture", and one of the reasons it is growing more profitable "is the amount of discretionary effort made by our people." It "seeks to secure an emotional attachment to the business", so they stay and the average length of service of all 360 employees is just shy of 10 years. Like the previous year, all staff were awarded free shares in 2018. They have the option to buy more and receive matching shares, and contribute to a third share scheme. Innovation, Treatt says, is the responsibility of every department and it boasts of "sustainable fair and rewarding outcomes for growers and processors".

There is little doubt the company's two executives have fostered this happy environment. Daemmon Reeve has been chief executive since 2012 and his tenure roughly corresponds to a dramatic improvement in Treatt's performance that was already underway, partly because he had led the transformation of the US business. Reeve has worked at Treatt since joining as a technician in 1991 and Richard Hope has been finance director since 2003.

They're both very well paid. Reeve's maximum salary is about £1 million split equally between basic pay, performance related bonus, and performance related share options valued at the date of grant and Hope's is £700,000. Though I wish companies didn’t feel the need to pay executives these sums, at least Treatt's spreading the love.

Cheap: Is the firm's valuation modest?

Score: 0

Treatt shares cost about 22 times profit in the year to September 2018 on a debt adjusted basis.

Although I use rounded numbers here, Treatt's valuation score is slightly less than zero (a multiple of 20 would score zero) so the total score is 6.7.

Treatt is everything a company should aspire to, investing, innovating, and looking after customers, suppliers, employees and shareholders, but it pains me to say the score is a shade under seven, the arbitrary level for an outright recommendation. Fair value then, not obviously cheap. Hold.

Bah! Humbug!

Richard owns shares in Treatt.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.