Our new fund purchase even as markets fall

26th September 2022 14:13

by Douglas Chadwick from ii contributor

Saltydog Investor takes a stake in one of the best-performing stock markets this year.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor, we help private investors who want to invest in funds. We highlight which sectors of the market are doing well and which ones are underperforming. We then shortlist the leading funds. By investing in funds, you can avoid some of the risks associated with buying shares in individual companies, and are more likely to pick up on the general trends in the sectors.

Unfortunately, global markets have had a tough year and September is not providing any relief.

As of the end of last week, the FTSE 100 had fallen by 3.6% since the beginning of the month and the FTSE 250 was down 5.7%. The US indices have done even worse. The Nasdaq has fallen by 8.0%. The year-to-date figures also make uncomfortable reading.

| Stock Market Indices 2020 | ||||||

| Index | Jan, Feb, March | April, May, June | July | Aug | 1st Sept to 24th Sept | Year -to-date |

| FTSE 100 | 1.8% | -4.6% | 3.5% | -1.9% | -3.6% | -5.0% |

| FTSE 250 | -9.9% | -11.8% | 8.0% | -5.5% | -5.7% | -23.5% |

| Dow Jones Ind Ave | -4.6% | -11.3% | 6.7% | -4.1% | -6.1% | -18.6% |

| S&P 500 | -4.9% | -16.4% | 9.1% | -4.2% | -6.6% | -22.5% |

| NASDAQ | -9.1% | -22.4% | 12.3% | -4.6% | -8.0% | -30.5% |

| DAX | -9.3% | -11.3% | 5.5% | -4.8% | -4.3% | -22.7% |

| CAC40 | -6.9% | -11.1% | 8.9% | -5.0% | -5.6% | -19.1% |

| Nikkei 225 | -3.4% | -5.1% | 5.3% | 1.0% | -3.3% | -5.7% |

| Hang Seng | -6.0% | -0.6% | -7.8% | -1.0% | -10.1% | -23.4% |

| Shanghai Composite | -10.6% | 4.5% | -4.3% | -1.6% | -3.6% | -15.1% |

| Sensex | 0.5% | -9.5% | 8.6% | 3.4% | -2.4% | -0.3% |

| Ibovespa | 14.5% | -17.9% | 4.7% | 6.2% | 2.0% | 6.6% |

Data source: Morningstar

When economies all around the world are struggling, it is not surprising that most sectors are also having a difficult time and less than 5% of the funds that we monitor have gone up in the last four weeks.

The best-performing index in the table above is the Brazilian Ibovespa. It is the only one showing a gain in September and it is also up over the year. A couple of weeks ago, I published a table of the best-performing funds in August and at the top of the list were Liontrust Latin America, abrdn Latin American, and CT Latin America.

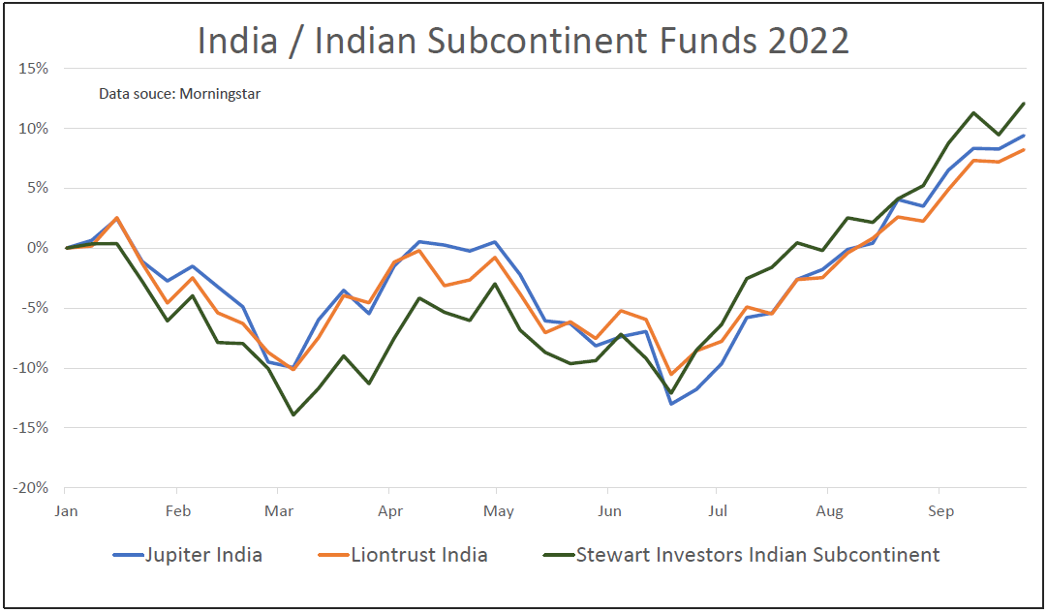

The next best index is the Indian Sensex, which is down over the year, but only by 0.3%. There were three funds from the India/Indian Subcontinent sector that also made it into our top 10 funds in August: Liontrust India, Stewart Investors India Subcontinent, and Jupiter India.

They had a poor start to the year, rallied during March and April, but then went back down again in May and the beginning of June. However, since mid-June they have performed well.

Past performance is not a guide to future performance.

In our Saltydog demonstration portfolios, we have been holding high levels of cash for most of the year. At the moment, it is nearly 90% in the Tugboat and 80% in the Ocean Liner.

We are obviously keen to avoid most funds, which are currently going down, but we are happy to invest small amounts into the few that appear to have some positive momentum. Earlier in the year, we had some success with funds investing in energy and other natural resources.

We have recently decided to invest in the Jupiter India fund and hope the upwards trend that started in June continues.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.