Only four of 32 fund sectors went up in March

Saltydog Investor looks at how funds performed last month, highlighting the biggest losers and the small number of fund sectors that bucked the trend.

8th April 2025 09:02

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor, our primary focus is on funds, but we also track the major stock market indices to get a feel for how the markets in general are performing.

This year started reasonably well, with nine of the 12 stock markets that we regularly monitor making gains in January. The European indices led the way, with the Frankfurt DAX posting a 9.2% one-month gain, while the Paris CAC 40 rose by 7.7%.

- Learn with ii: What is a Stocks and Shares ISA? | Cash ISA vs Shares ISA | Open a Stocks & Shares ISA

February was less encouraging - only five of these indices went up. The standout performer was the Hong Kong Hang Seng, which ended the month up 13.4%.

March was even worse. All eight of the developed markets that we track went down, with US indices suffering the largest losses. The Dow Jones Industrial Average dropped by 4.2%, the S&P 500 lost 5.8%, and the Nasdaq fell by an eye-watering 8.2%.

The emerging markets fared slightly better. The Shanghai Composite and Hong Kong Hang Seng managed relatively modest gains of 0.4% and 0.8%, while the Indian Sensex rose by 5.8%. The Brazilian Ibovespa beat them all with a one-month return of 6.1%.

Unfortunately, April has had a disastrous start as markets around the world react to the latest tariffs levied on US imports.

| Stock Market Indices | 2024 | 2025 | ||||||

| Index | Q1 | Q2 | Q3 | Q4 | Jan | Feb | March | 1 to 4 April |

| FTSE 100 | 2.8% | 2.7% | 0.9% | -0.8% | 6.1% | 1.6% | -2.6% | -6.1% |

| FTSE 250 | 1.0% | 2.0% | 3.8% | -2.0% | 1.6% | -3.0% | -4.2% | -5.7% |

| Dow Jones Ind Ave | 5.6% | -1.7% | 8.2% | 0.5% | 4.7% | -1.6% | -4.2% | -8.8% |

| S&P 500 | 10.2% | 3.9% | 5.5% | 2.1% | 2.7% | -1.4% | -5.8% | -9.6% |

| NASDAQ | 9.1% | 8.3% | 2.6% | 6.2% | 1.6% | -4.0% | -8.2% | -9.9% |

| DAX | 10.4% | -1.4% | 6.0% | 3.0% | 9.2% | 3.8% | -1.7% | -6.9% |

| CAC40 | 8.8% | -8.9% | 2.1% | -3.3% | 7.7% | 2.0% | -4.0% | -6.6% |

| Nikkei 225 | 20.6% | -1.9% | -4.2% | 5.2% | -0.8% | -6.1% | -4.1% | -5.2% |

| Hang Seng | -3.0% | 7.1% | 19.3% | -5.1% | 0.8% | 13.4% | 0.8% | -1.2% |

| Shanghai Composite | 2.2% | -2.4% | 12.4% | 0.5% | -3.0% | 2.2% | 0.4% | 0.2% |

| Sensex | 2.0% | 7.3% | 6.7% | -7.3% | -0.8% | -5.6% | 5.8% | -2.6% |

| Ibovespa | -4.5% | -3.3% | 6.4% | -8.7% | 4.9% | -2.6% | 6.1% | -2.3% |

Data source: Morningstar. Past performance is not a guide to future performance.

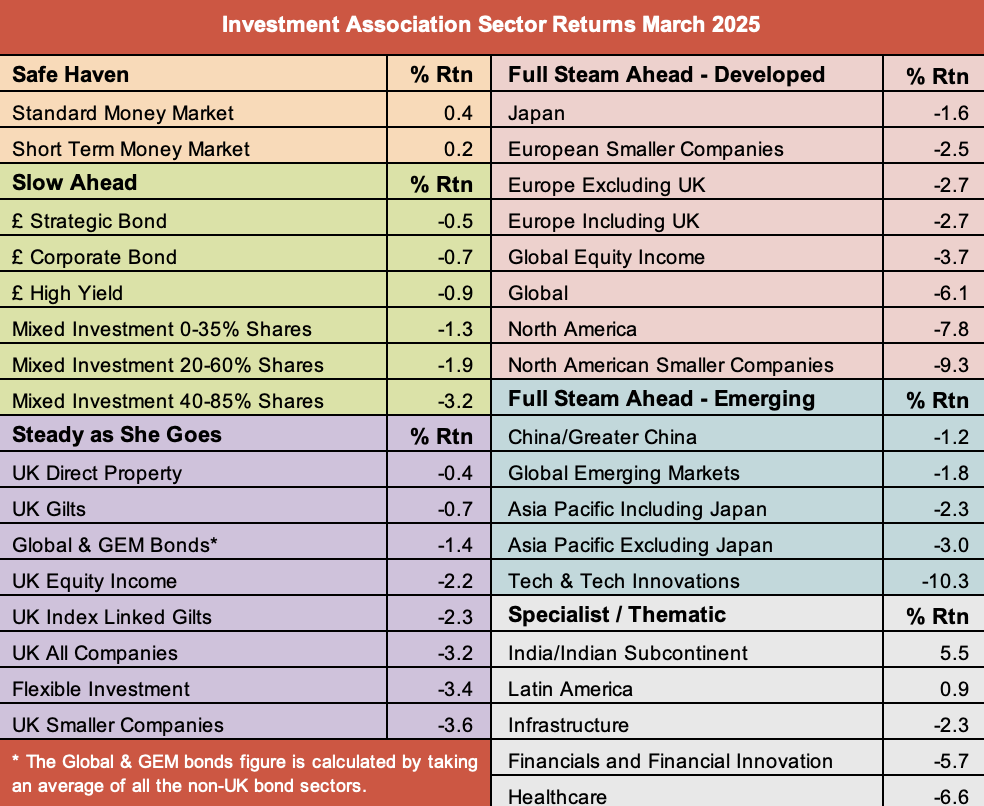

The general decline during the first quarter of this year is reflected in the performance of the Investment Association (IA) sectors.

Past performance is not a guide to future performance.

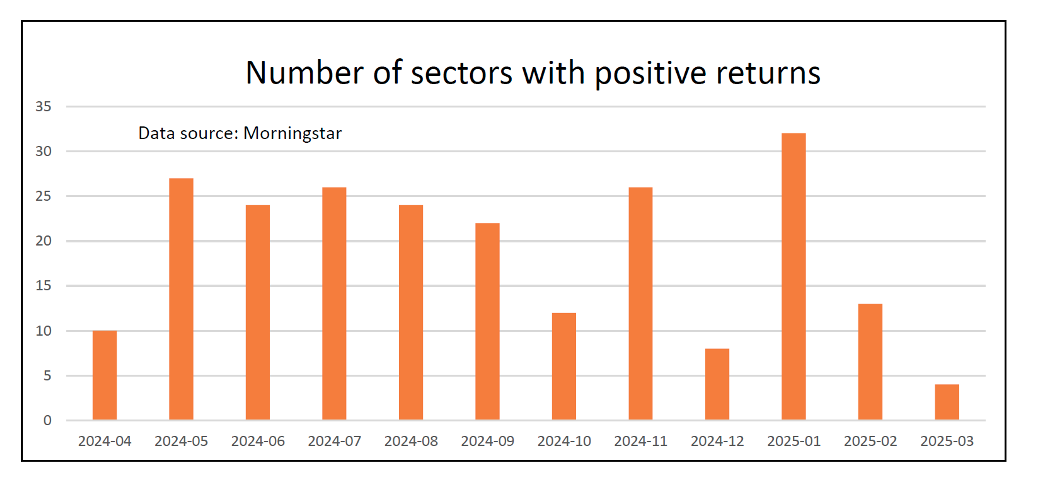

Only four out of the 34 sectors that we monitor each week went up in March. That is down from 13 in February and 32 in January. It is the fewest that we have seen for over a year.

The largest losses were in the Technology & Technology Innovations sector, down 10.3%, the North American Smaller Companies sector, down 9.3%, and the North American sector, down 7.8%.

Other developed markets also struggled. The UK All Companies Sector ended the month down, 3.2%, the European including and excluding UK sectors both went down by 2.7%, and Japan lost 1.6%.

Data source: Morningstar. Past performance is not a guide to future performance.

The performance of the emerging market sectors was more mixed. The Asia-Pacific sectors saw the largest falls, with the Asia Pacific excluding Japan sector dropping by 3.0%. However, the Global Emerging Markets sector fell only by 1.8%, and China/Greater China fared slightly better, although it still went down by 1.2%.

The Latin America sector bucked the trend, gaining 0.9%, while the India/Indian Subcontinent sector stole the show with a 5.5% one-month return.

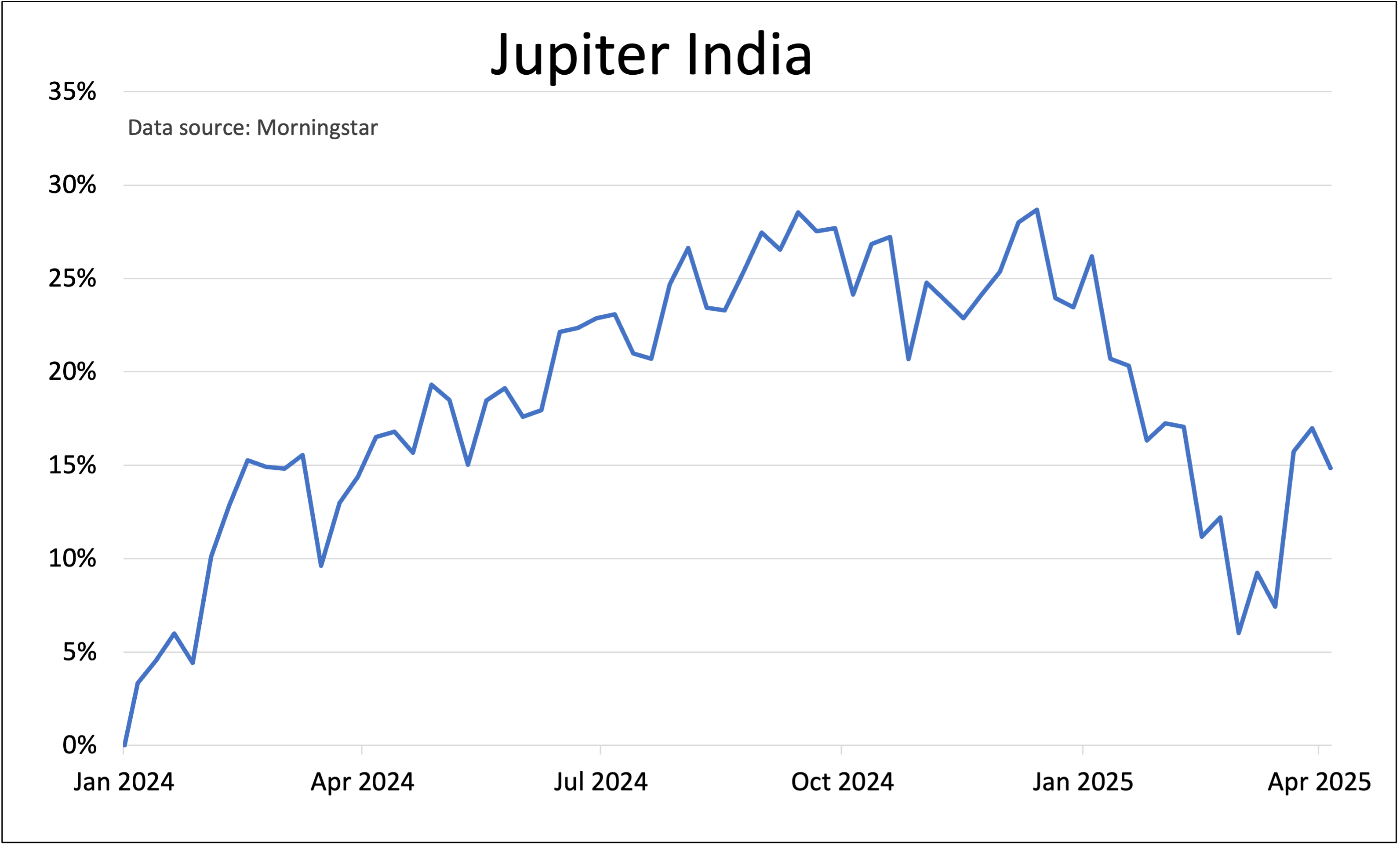

Jupiter India I Acc was the best-performing fund in its sector last month posting a 10.3% return. This fund went up by 24.1% last year, and we held it in both our demonstration portfolios until the end of October.

It then fell sharply from mid-December until the end of February, but bounced back in March. April has not started well, and with global stock markets in freefall it looks unlikely to be getting better any time soon.

Past performance is not a guide to future performance.

Only two sectors went up in February and also in March, Standard Money Markets and Short Term Money Markets. The funds in these sectors may not be very exciting, but at least they are giving steady returns when most funds are going down.

The funds that have benefited the most from the current maelstrom are the gold funds from the Specialist sector which we highlighted last week.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.