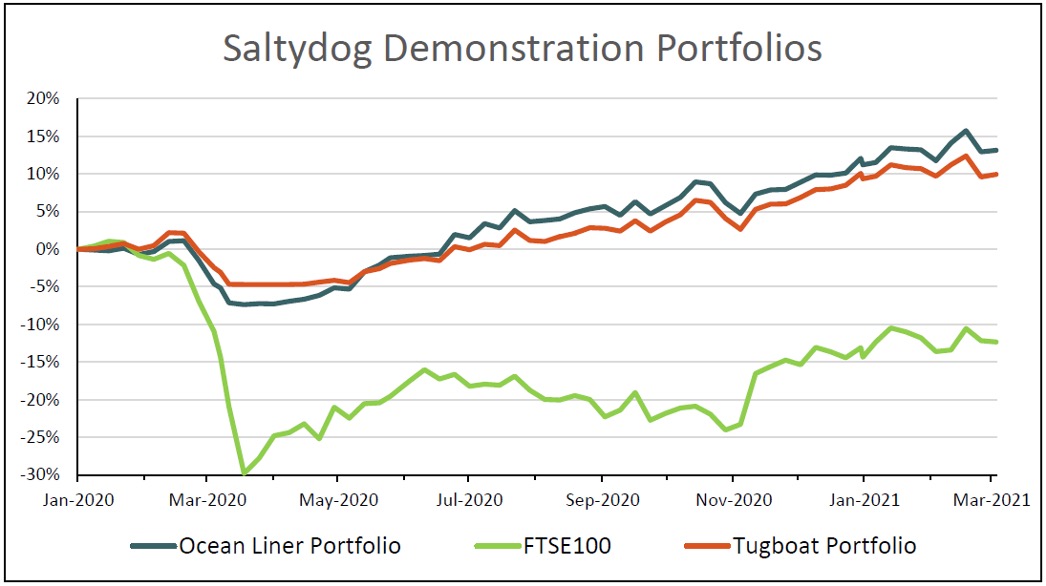

One year on from crash, our portfolios have set new all-time highs

Saltydog Investor reflects on last year’s sell-off, and explains why its China fund exposure could be cut

8th March 2021 14:53

by Douglas Chadwick from ii contributor

Saltydog Investor reflects on last year’s sell-off, and explains why its China fund exposure could be cut.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

This time last year, global stock markets had already started to fall as it became clear that the outbreak of the coronavirus in China at the end of 2019 could not be contained.

The World Health Organization had declared it an international public health emergency at the end of January. All the unrest weighed heavily on global equity markets and most stock market indices ended the first month of 2020 below where they had started.

During February, there was a brief rally. The Dow Jones Industrial Average closed at an all-time high on the 12 February and the S&P 500 and the Nasdaq followed a week later.

At the time, the UK’s FTSE 100 index was showing a gain of over 2% since the beginning of the month and trading just above 7,450.

- How Saltydog invests: a guide to its momentum approach

- Best and worst fund sectors a year on from the Covid-19 sell-off

Towards the end of February, markets began to fall and in March 2020 they collapsed. On 9 March, the S&P 500 fell by 226 points, which at that stage was its largest one-day drop ever. The record did not last long. A few days later, on 12 March, it went down by 261 points and then on 16 March it lost nearly 325 points. It had fallen by 24% in less than a month. It was a similar story all around the world. The FTSE 100 was briefly down by more than 30% from its February high.

On the 23 March 2020, Boris Johnson announced that the UK was going into lockdown. Few people would have thought that a year later restrictions would still be in place.

Fortunately, markets started to pick up in April. Our demonstration portfolios, which had moved into cash during the 2020 crash, started to reinvest and have gone on to set new all-time highs.

Past performance is not a guide to future performance

However, they have dropped over the last couple of weeks.

Every Wednesday, we provide our members with a number of reports showing the recent performance of the various Investment Association sectors and highlight the best-performing funds.

When we reviewed the data last week, nearly all of the sectors were showing losses over the previous week. The only exception was ‘Property’, which had gone up by 0.4%.

- Why investors are heavily selling out of this fund sector

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

For our analysis, we combine the sectors into our own Saltydog Groups, based on their historic volatility. The sectors in our ‘Full Steam Ahead – Emerging’ group tend to be the most volatile; they can do fantastically well when conditions are favourable, but often get hit the hardest when things take a turn for the worse.

They certainly had a tough time in the last week of February.

Past performance is not a guide to future performance.

The funds that we monitor in the China/Greater China sector went down by 8.9%, having gone down by 2.4% the week before.

It is hard to believe that China/Greater China was the best-performing sector in January. As a result, our demonstration portfolios are holding two funds from this sector: New Capital China Equity and Baillie Gifford China.

We do not usually reduce a fund just because it has had a couple of poor weeks, and so when we reviewed the portfolios last week, they avoided the cut. I am not sure that they will be so lucky this week.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.