One of the few sectors that still looks cheap

Many industries have seen valuations rise sharply since March, but there is still value here.

16th December 2020 09:54

by Rodney Hobson from interactive investor

Many industries have seen valuations rise sharply since March, but there is still value here.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

With share price indices in the United States hitting new highs, it is hard to spot worthy sectors that have been left behind in the recovery from the Spring stock market slump. One possibility is to look at energy stocks such as Duke Energy (NYSE:DUK) and Dominion Energy (NYSE:D).

It is possible to argue that Covid-19 has taken a toll on the US economy and that, with the epidemic still raging across many states, there will continue to be an impact on production and employment well into the New Year. This would inevitably reduce demand for gas and electricity and thus hit the profitability of energy companies, which tend to have substantial fixed costs.

However, the same argument would apply across a range of sectors, yet investors have not baulked at pushing the Dow Jones Average above 30,000 for the first time. By all accounts, energy shares are looking comparatively cheap.

And energy is one area where new President Joe Biden has distinct views, ones that will be put into effect from day one of his term of office. He proposes a greener energy policy. That will be a distinct bonus for companies with facilities for renewable energy.

- Finding value among US power generators

- What Bill Ackman thinks will happen to stocks in 2021

- Want to buy and sell international shares? It’s easy to do. Here’s how

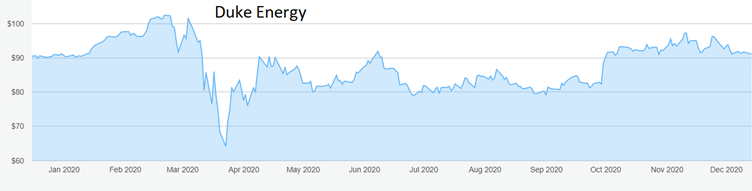

Duke is one of the largest US utilities, selling electricity and gas to customers in North and South Carolina, Indiana, Florida, Ohio and Kentucky. It also owns energy infrastructure.

Duke is at last marginally ahead of the $90 at which it began the year, having been as low as $64. It did briefly top $100 before the Covid-19 crisis set in and should do again next year, hopefully for a longer period of time.

Source: interactive investor. Past performance is not a guide to future performance.

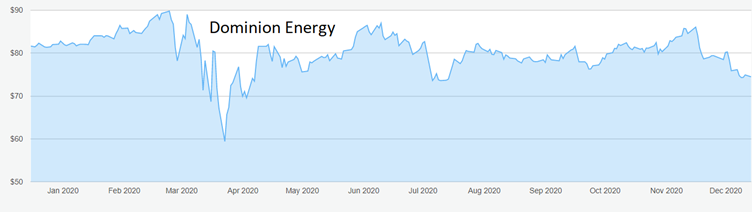

Dominion, based in Virginia, is an electricity generator that also owns power lines. It has a liquefied gas facility in Maryland and is building a wind farm off the Virginia coast that will be the largest in the US.

Dominion began the year at $82 and peaked at $90 before plunging to $60. The recovery has twice petered out at $87 and the stock is currently at $76, where the yield is 4.6%, a particularly attractive level for an American quoted company.

Source: interactive investor. Past performance is not a guide to future performance.

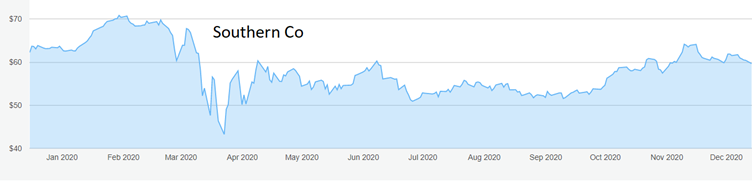

Another possibility in the sector is Southern Co (NYSE:SO), which like Duke is one of the largest utilities in the US. It has generating capacity and also sells electricity and natural gas in nine states. Its wind farms are spread across a number of states in addition to its core market.

Its wholly-owned subsidiary Southern Power generates from mostly renewable energy sources and is the conduit through which the group stands to gain most from Biden’s green agenda.

- Investing in the US stock market: a beginner’s guide

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

I recommended the shares at $56 in May last year and all was looking well when they topped $70 in January this year. They have taken a bigger hit than either Duke or Dominion since, slumping to $46 in March and performing disappointingly since. They currently stand just above $60, mercifully back ahead of my tip price, where the yield is 4.3%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: When I wrote about this sector in January, I pointed out that Duke had underperformed Dominion during 2019, with the gap widening in the final three months. I described this phenomenon as “quite unjustified” and rated Duke the better value at around $90.

Both companies currently look underpriced. I repeat my January advice to buy Duke up to $93. Its yield of 4.2% is only fractionally lower than at Dominion. I have, however, switched my preference to Dominion, which is worth considering at up to $80, with the downside probably limited to the recent low of $73.50. Southern also looks good at up to the recent peak of $63.70.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.