One in eight in the dark over number of old workplace pensions

interactive investor poll reveals many people do not know how many old workplace pensions they have.

6th January 2021 12:49

by Rebecca O'Connor from interactive investor

interactive investor poll reveals many people do not know how many old workplace pensions they have.

One in eight people do not know how many old workplace pension pots they have, according to a poll by interactive investor.

Among customers of the UK’s second-biggest investment platform, with an average age of 55, a total of 13% said they did not know how many old workplace pensions they have.

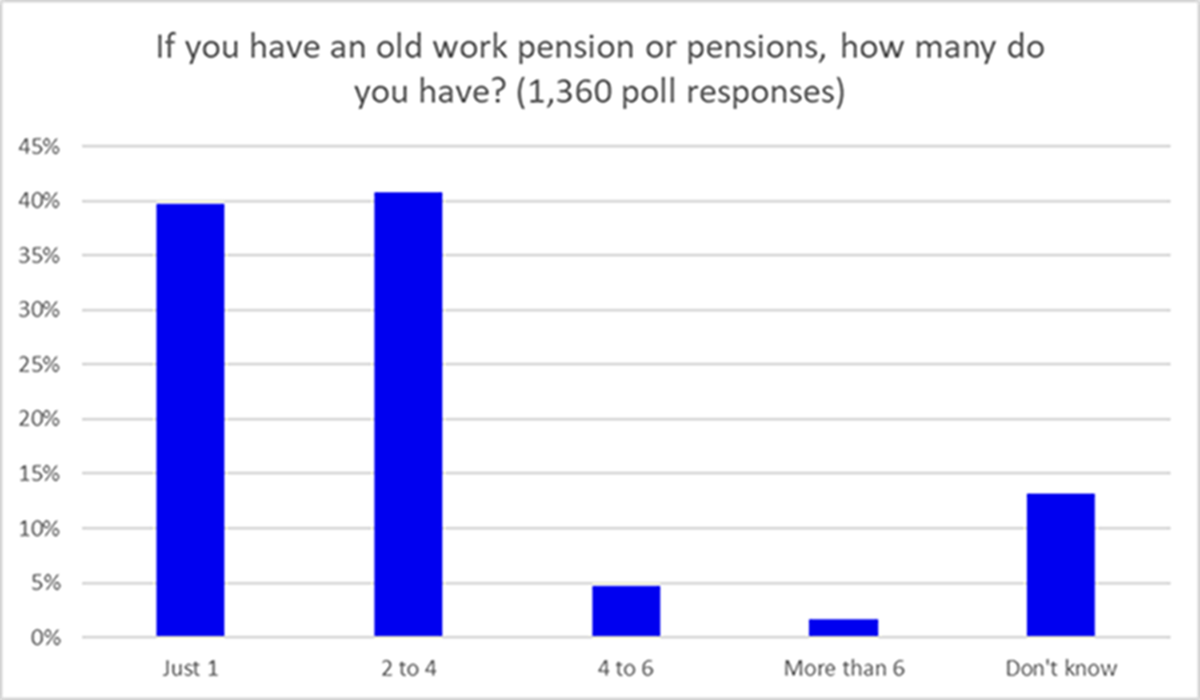

The number of old workplace pensions held by most respondents was two to four, according to the poll, with 41% of investors saying they had this number of old schemes.

The next highest response was “just one”, with 39% of responses. Only 5% had four to six old work pensions, while 2% had more than six.

The poll underscores a growing need for the Pensions Dashboard, an initiative that has been subject to a number of delays.

Becky O’Connor, Head of Pensions and Savings at interactive investor, said: “Ignorance is not bliss when it comes to keeping on top of old workplace schemes.

“The mystery of missing pensions is one you definitely want to solve as over the years, investment growth – even for pots you haven’t been contributing to – can add up to thousands of pounds. That is money few of us can afford to ignore in retirement.

“You wouldn’t just leave a cheque for a few thousand pounds uncashed. So why do we leave old pensions to turn to dust?

“As well as just finding out how much your total pension wealth is worth, another reason to identify old pensions is that you might be paying too much in charges on them.

“High percentage charges, particularly on old pots, can end up stripping thousands of pounds from your retirement wealth without you even realising. Fee erosion is a particular problem for smaller pots that are not generating much investment growth.

“The good news is that if you want to bring all your pensions together in one place, there are ways to locate old schemes and consolidate them into one place, if that is in your best interests.

“The number of old workplace pensions is expected to grow during the decades following auto-enrolment, with more people than ever signed up to a pension through their employer and changes in the labour market resulting in people having more jobs – and therefore more pensions – throughout their working lives.

“The government may be producing a Pensions Dashboard, allowing us all to see all our pensions in one place. But until that is developed, there are ‘DIY dashboard’ options, such as Self-Invested Personal Pensions, available.”

Tips for checking in on old pots:

- Find out where your old pensions are. Go through your old files or emails and if this fails, contact the HR departments of old employers. They should be able to tell you the name of the pension provider they use or used at the time

- Use the government’s pension contact service – you will need the name of previous employers to use this https://www.gov.uk/find-pension-contact-details. NB. There are other pension tracing services out there that are run by adviser firms rather than the government and may charge a fee for follow-up help

- Find out how much is in each pension and what type of pension it is. If you plan to move all your pensions to one place, like a Self-Invested Personal Pension, you will only be able to do this with old defined contribution (money purchase) schemes, rather than defined benefit (final salary) schemes, as the latter comes with the valuable guarantee of income throughout your retirement

- Look at the charges you are paying on your old pensions. Depending on the balance and the percentage you are being charged, you could save a substantial amount of money by switching to a flat fee or lower percentage fee pension. If you are not sure from your pension statements how much you are paying in fees, contact the provider and ask them for a breakdown

- Prevention is better than cure: if you move house in future, always inform your pension providers past and present of your new address, so you don’t forget about them.

Reasons to consolidate:

- Research suggests that people are likely to have 11 jobs throughout their working lives*. That’s a lot of pensions – and a lot of your money - to potentially forget about

- You can see all your investments in one place, making it easier to control risk and asset allocation

- You may be able to access a wider range of investments

- You can save money on fees

- You can ask employers to pay into SIPPs, so you don’t lose your employer contributions if you choose this path

- With SIPPs, you also get more investment choice than with workplace schemes

- Consolidating into a SIPP means you might be able to do an ‘in specie’ transfer, which means moving your investments directly from the funds they are currently held in to the same funds on the new platform.

Reasons against:

- The potential cost of exit charges to move away from old providers. While few pension providers still charge exit fees, a few do and they can be so hefty that it’s not worth moving them (even if you dislike the provider even more for charging them).

- If your pension is defined benefit, it almost never makes financial sense to move it. If it’s fully defined benefit or a ‘hybrid’ (part defined benefit, part defined contribution) and worth more than £30,000, then you will need an adviser to move it. Very few advisers will even offer advice on defined benefit pensions now, after many people were given bad advice to do so and lost money.

- You can have up to three small pots that don’t count towards your pension lifetime allowance of £1,073 million. So for pension investors who reach this limit, it can be tax efficient to keep these smaller pots where they are.

Notes to editors

- The poll was conducted in mid-November 2020 on the interactive investor platform and received 1,360 responses

- *From the Pension Policy Institute “Generation Vexed” report https://www.pensionspolicyinstitute.org.uk/media/3332/20191106-generation-vexed-report-final.pdf

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.