The oil major I'd buy

Following Chevron's bid for Anadarko, our international columnist and author names his top oil stock.

17th April 2019 11:40

by Rodney Hobson from interactive investor

Following Chevron's bid for Anadarko, our international columnist and author names his top oil stock.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

There's a popular belief among investors that in most takeovers it is better to hold shares in the target company rather than the one making the bid. The former get an instant reward that is worth more than the previous market price of their shares; the latter have at best a wait for the benefits to come through and at worst they find that value has been destroyed rather than enhanced.

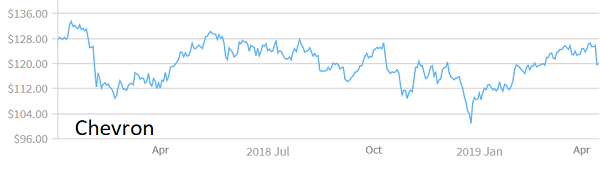

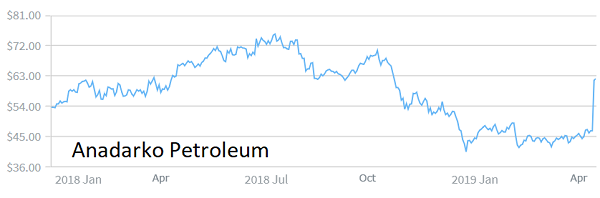

Thus shares in New York-listed oil giant Chevron (NYSE:CVX) fell 5% when it announced it was buying Anadarko Petroleum (NYSE:APC) for about $33 billion using a mixture of cash and shares. Anadarko shares, in contrast, promptly jumped from $46.80 to $61.78, a gain of 32%.

Source: interactive investor Past performance is not guide to future performance

The deal is 0.3869 Chevron shares and $16.25 cash for each Anadarko share. With Chevron now trading at around $120, that values Anadarko shares at $62.70, a premium of nearly 40% to the level immediately before the announcement. Adding in Anadarko’s $15 billion debt, which will pass to Chevron, the acquisition will cost about $50 billion, making it one of the largest ever in the oil industry.

Source: interactive investor Past performance is not guide to future performance

No wonder Chevron shareholders were a little nervous, especially as the company had been planning the sale of $15-20 billion of assets to reduce debt and return cash to shareholders.

However, the deal narrows the gap between Chevron, with a stock market valuation of $227 billion, and its larger rival Exxon Mobil (NYSE:XOM), valued at $333 billion. It means Chevron can stand tall as one of the big four oil majors alongside Exxon, Shell (LSE:RDSB) and BP (LSE:BP.).

Source: interactive investor Past performance is not guide to future performance

Chevron engages in exploration, production, and refining operations worldwide. Its oil refineries are spread across the United States, South Africa, and Asia with an approximate capacity of 2 million barrels of oil a day.

Anadarko is engaged in the exploration and production of oil and natural gas. Its assets include deep-water oil and gas projects in the Gulf of Mexico and Africa. In particular, it has fracking operations in the Permian Basin, straddling Texas and New Mexico, the most promising shale oil prospect in the world. These assets fit in well with Chevron's portfolio and add to its strengths.

Together they will produce about 3.6 million barrels of oil or the equivalent in gas per day, not far behind Exxon. However, Chevron’s fracking prospects would be way out in front at $100 billion.

Michael Wirth, Chevron chairman and chief executive, enthuses with some justification that "the combination of Anadarko's premier, high-quality assets with our portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities and will grow our liquefied natural gas business".

He expects the deal to improve Chevron's free cash flow and earnings per share 12 months after it goes through.

Even before the deal Chevron was expecting 3-4% annual production growth until 2013. Its latest financial figures, for the final quarter of 2018, showed earnings up from $3.11 billion to compared with the previous final quarter on revenue 13% ahead.

Chevron shares peaked at $134 early last year but had been recovering from a low of $101 at Christmas until the announcement of the deal stopped them in their tracks.

Anadarko shares peaked at $75 last July but have been as low as $40 since then, before levelling off around $45, so the bid is a welcome respite for its shareholders.

Hobson's choice: There's no point in buying into Anadarko now as a bidding war looks unlikely. However, if you are an existing shareholder stay in and accept the offer in due course. It wouldn't be wrong to take advantage of the fall in Chevron shares to make a purchase, but personally I would prefer Exxon, already up $6 since I recommended the shares on 6 February, around its current price of $81, where it offers a yield of 4% compared with Chevron's 3.8%.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.